Morgan Stanley expects Indian equities and earnings to rise in 2024, aided by political stability even as global volatility is likely to persist.

The research firm expects the the S&P BSE Sensex to rise 14% by December 2024, assuming political continuity and majority mandate resulting in stable policy.

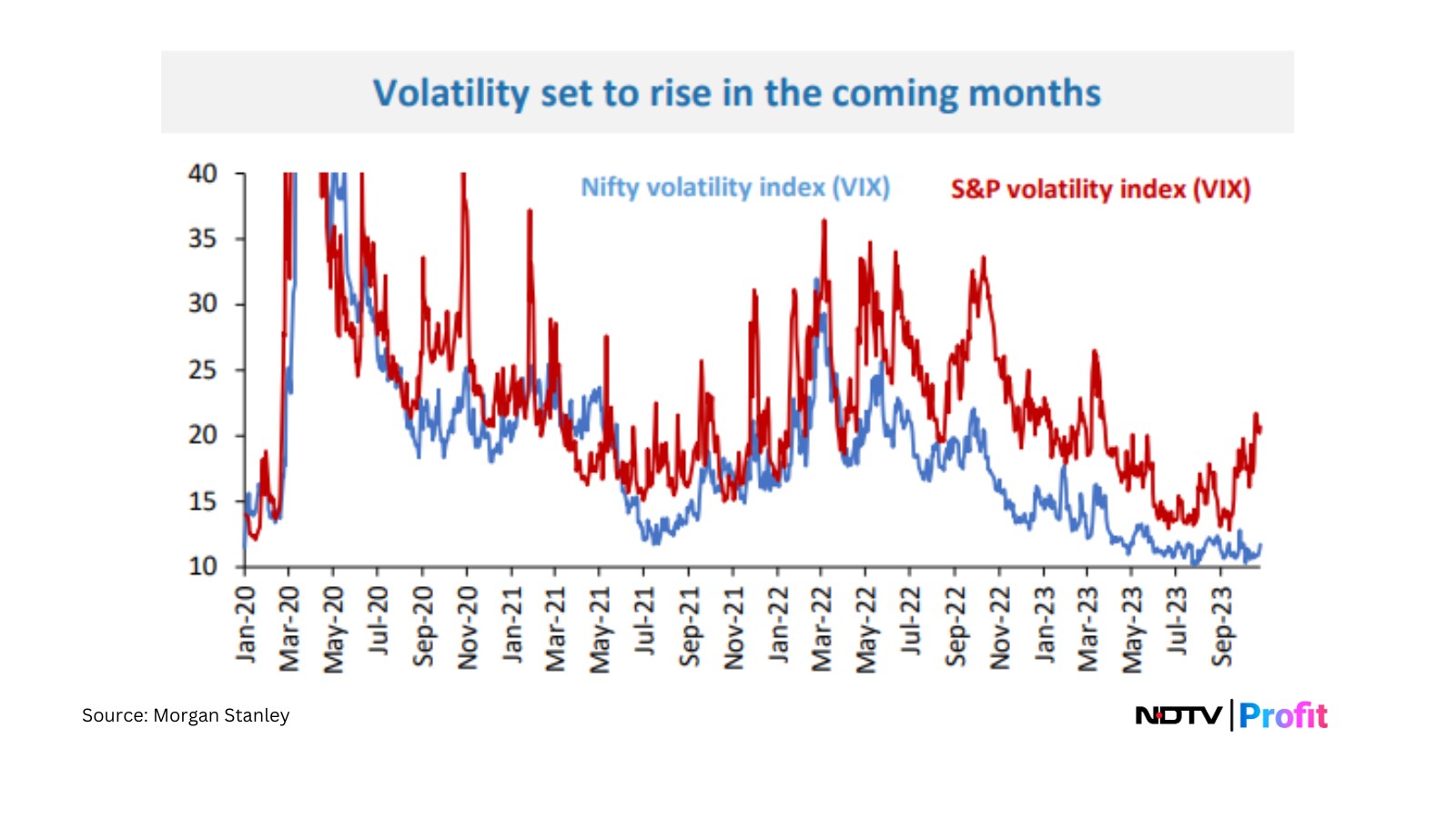

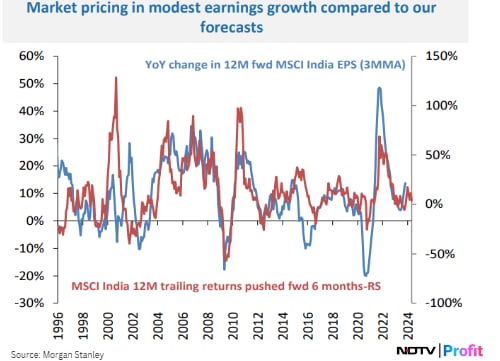

"We forecast BSE Sensex earnings to compound 21.5% annually through F2026E," it said in a note on Tuesday. "However, the base case masks the potential for volatility in 2024, which is evident in the spread of our bull-bear scenarios."

What's In Store For 2024?

The fundamentals are underpinned by a strong macro stability as a result of improving terms of trade, flexible inflation targeting and stable non-portfolio foreign flows.

It forecasts earnings growth of about 20% annually over the next four to five years, led by an emerging private capex cycle, re-leveraging of corporate balance sheets, unfolding of a structural rise in discretionary consumption and a reliable source of domestic risk capital.

"These factors have reduced correlations and volatility of Indian stocks relative to EM," the research firm said. "India's beta to EM is <0.4 and India's rate spread with the US has also declined, explaining India's rich headline multiple."

Catalysts For 2024

Politics: Morgan Stanley expects the market to trade higher in the run-up to the Lok Sabha election. Historically, the market has favoured continuity and a majority government as this implies limited policy shifts after polls.

"In the event, if the results go against the market's preferred outcome, we see the possibility for a drawdown of 30%," it said.

Earnings: It expects earnings in the current and the next fiscals to be strong, with an improvement in margins due to a durable rise in capital spending and benign material prices. Rising capital expenditure is good for corporate-profit margin until the capex becomes unproductive.

The bear case for earnings is a big slowdown in global growth, rising commodity prices and an election outcome that significantly alters corporate-investment sentiment.

Global markets: India's correlation of returns with global equities continues to decline. The country is a large stock market in terms of capitalisation in a global context and cannot completely deviate from global equity-market trends.

Softer global markets could cap absolute returns, while a strong global bull market could coincide with relative underperformance for low-beta markets like India.

Short Rates: If oil prices drop, it may create room for lower domestic fuel prices and may lead to the headline CPI moving into the RBI's comfort zone of circa 4%. On the flip side, strong domestic growth could create a floor on core inflation.

While it expects the RBI to cut rates in the middle of 2024, the rate cycle is likely to be a shallow one given the domestic growth impulses.

Fund Flows: Domestic flows are likely to stay strong in 2024 but an adverse general-election outcome poses some risk.

Bond Flows: In June, India will join the global bond index, prompting $30 billion in inflows into its G-sec market. The country will join the index with 1% and this weight will increase by 1% each month until it reaches 10% in April 2025. "We expect investors to pre-position themselves before the index inclusion."

Oil Prices: While India remains less affected by these than the past, further rises in the oil price, especially above $110, will present headwinds to the macro. Oil affects India in both the current account and inflation, and therefore, interest rates, currency and growth.

Key Portfolio Themes

Morgan Stanley is overweight on consumer discretionary, industrials, financials and technology and underweight all other sectors.

Buy Domestic Cyclicals: Domestic growth is likely to stay strong with benign inflation, which historically has been a perfect combination for domestic cyclicals. Growth is likely to be capex driven and accompanied by improving credit availability. Rates have peaked, albeit may not come down significantly given growth impulses. This sets the stage for outperformance for financials, consumer and industrial cyclicals.

Avoid defensives And Global Cyclicals: Unless election outcomes prove unfavourable for markets, defensives, including consumer staples, utilities, healthcare and telecoms, are likely to underperform.

Slow global growth likely keeps a lid on the performance of global cyclicals, including energy and materials.

Large Caps Likely To Outperform: Morgan Stanley continues to pursue ideas around clean-energy spending, defence indigenisation, a new residential property market, auto and air-travel cycle, a multiyear credit cycle for financials and life insurance, digital transformation and market-share concentration, plus horizontal growth for discretionary and staple consumption and electric vehicles as key themes for 2023.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.