Investors can remain long on the benchmark equity index as large-cap stocks are witnessing good buying interest, according to Ruchit Jain, lead research analyst at 5Paisa Ltd.

"It's better to stay long. Although the broader market has seen some profit-booking, large-cap stocks are witnessing good buying interest," he said. "The sector rotation is happening in index heavyweights. If you're long on the index, it's better to continue."

He noted a build-up of a good risk-reward ratio in select information technology companies, and should banking and finance stocks take a breather from their ongoing rally, IT can take the lead.

For the Nifty 50, the 23,900–24,000 range is where no initial resistance exists based on retracements, he said.

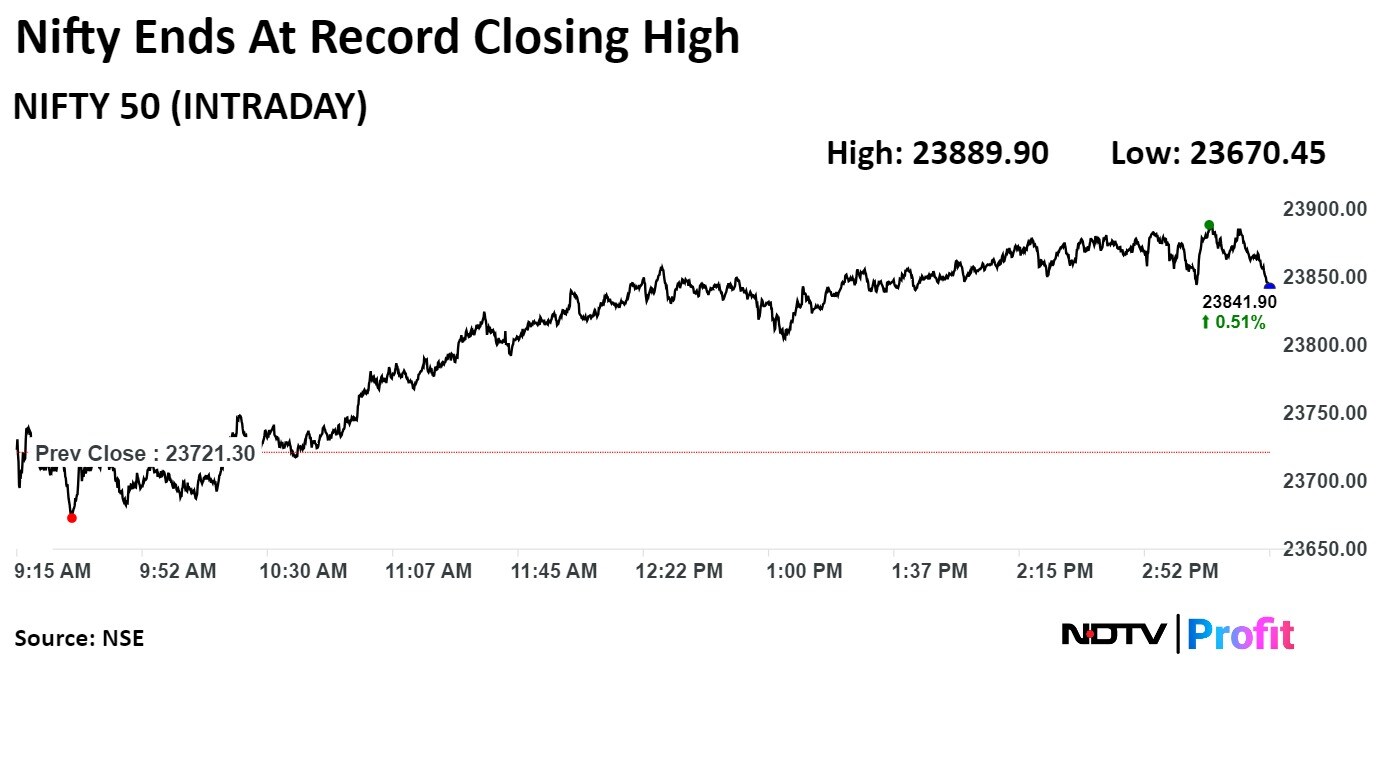

The benchmark equity indices extended their record run for the second consecutive day on Wednesday, ahead of the expiry of their monthly derivative contracts. The Nifty Bank, whose monthly contracts also expired in the day, recorded its highest close as well.

The NSE Nifty 50 closed 147.50 points, or 0.62%, higher at 23,868.80 points, while the S&P BSE Sensex ended 620.73 points up, or 0.8%, at 78,674.25.

Even as telecom stocks saw significant gains on expectations of tariff hikes, Avinash Gorakshakar, director of research at Profitmart Securities, said business remains difficult on structural issues like capital-intensive nature and low average revenue per user.

"Any revision (in tariffs) will be good for all telecom players. Reliance has gained because Jio is part of it, and Bharti Airtel is also benefiting. For Vodafone Idea, unless I see a parity in revenue and debt, I would not recommend it," he said.

On the other hand, the upward trend in most defence stocks like shipbuilders will stay intact as trading volume remains high, lending support to a jump in share prices, Jain said. "Even (in) the recent correction during election time, some of these stocks did not break the 20-day exponential moving average, which are very short-term supports."

Watch the full conversation here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.