11_07_24.jpg?downsize=773:435)

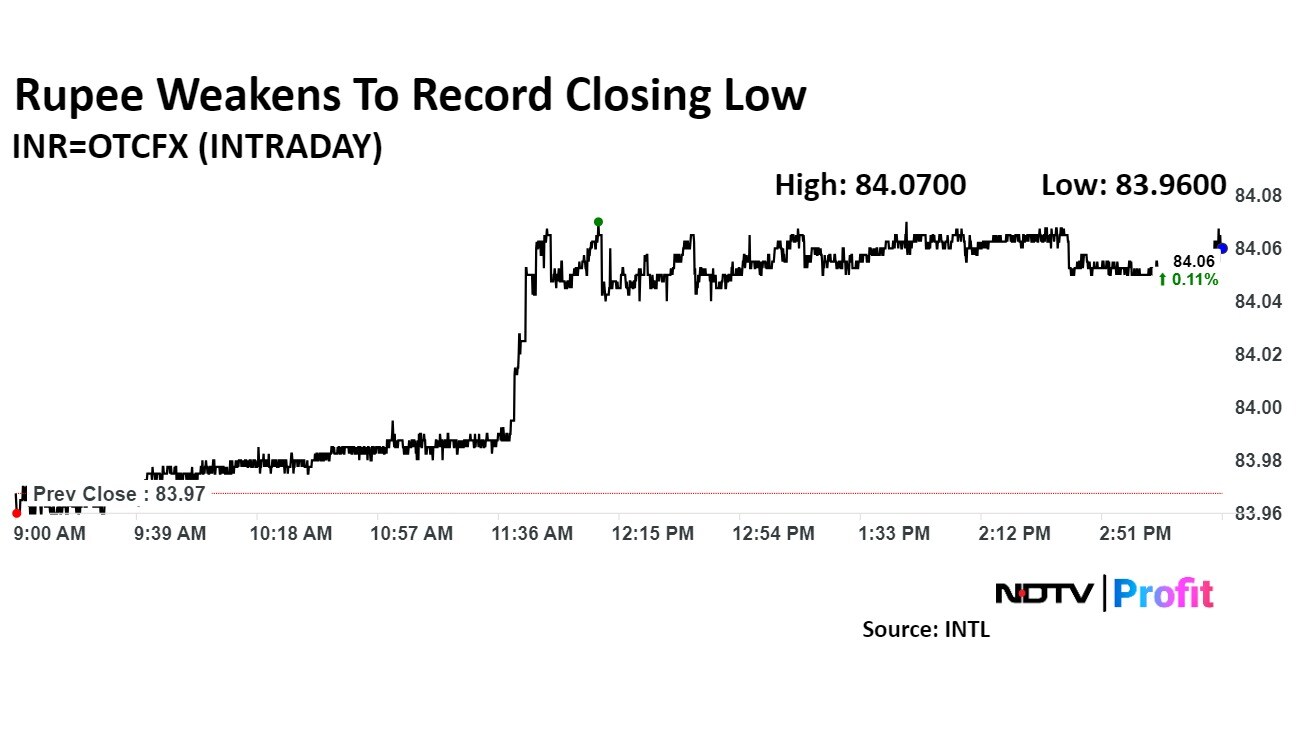

The rupee closed weaker against the US dollar on Friday, surpassing the psychological barrier of the 84 mark, as consistent selling of stocks on Dalal Street by global funds weighed on the Indian currency.

The domestic currency closed at a record low of 84.07 after hitting an all-time low at Rs 84.09 intraday, according to Bloomberg. The domestic current had closed at 83.98 against the greenback on Thursday.

Foreign investors sold Indian stocks for the ninth straight day on revival for Chinese stocks, coupled with valuation worries. In the last nine sessions, FIIs have offloaded domestic stocks worth over Rs 65,200 crore, according to the provisional data from NSE. During the same period, domestic investors mopped up stocks worth Rs 67,500 crore.

The movement comes as the dollar index declined by 0.09%, settling at 102.897, while Brent crude prices dipped 0.65% to $78.88 per barrel.

After keeping it in a range below 83.99 since Aug. 8, RBI finally allowed the rupee to weaken past 84.00, as FPIs who have emerged as big sellers in equities continued to buy dollars to take their money out of the country, said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

We can now expect rupee to move to 84.25 in the short term, he forecasted, adding that importers may continue buying at all dips and exporters may hold their exports with a stop below 83.95.

The Iran-Israel-Lebanon news does not seem good and could keep oil strong and rupee weak, stated Bhansali.

Bhansali forecasted a rupee trading range of 83.85 to 84.05 for the day. He advised exporters to sell on upticks, as the RBI continues to protect the 83.99 level, and importers to buy on dips with a stop loss at 84.02 for unhedged imports.

Amit Pabari, managing director of CR Forex Advisors, noted the impact of rising oil prices, driven by Hurricane Milton, which has pushed crude to around $80 per barrel, further pressuring India's trade deficit.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.