The Indian rupee strengthened on Monday as the dollar index slid after the U.S. unemployment rate rose to a two-year high.

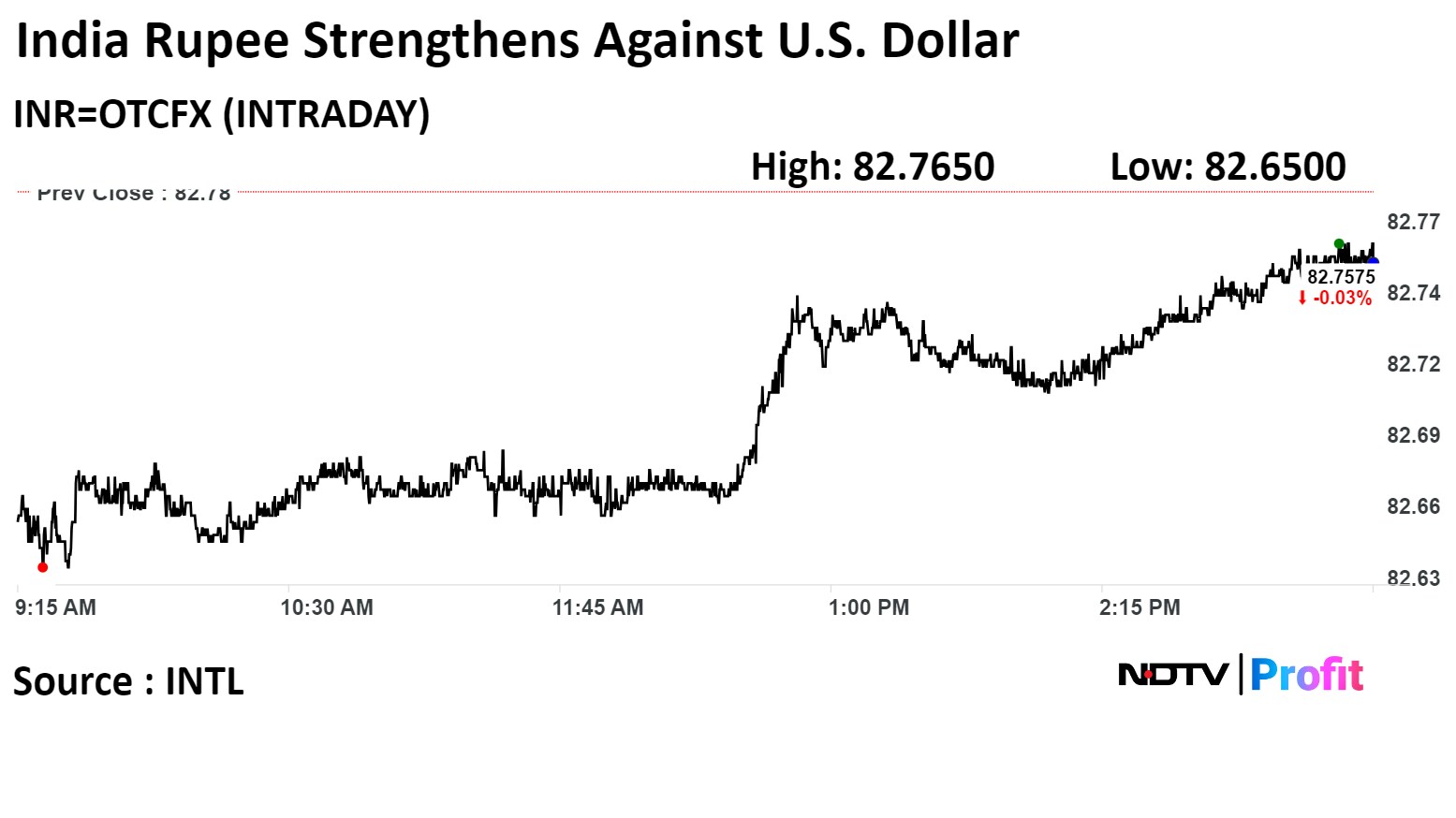

The local currency gained 2 paise to settle at Rs 82.77 against the greenback. Intra-day, the rupee strengthened as much as 14 paise to Rs 82.65 against the dollar, touching over a six-month high. It had closed at Rs 82.79 a dollar on Thursday.

"The dollar index weakened after the U.S. unemployment rate increased to a two-year high of 3.9% in February, up from 3.7% in the preceding three months, reaching its highest level since January 2022," Ritesh Bhanshali, director of Mecklai Financial Services Ltd., said.

Market participants await the U.S. inflation print to get fresh cues about the Fed rate trajectory. The U.S. consumer price index, scheduled for release on Tuesday, is expected to show core prices rising 0.3% in February on a sequential basis and 3.7% year-on-year, which may mark the smallest rise since April 2021, Bloomberg reported.

"U.S non-farm payrolls increased by 2.75 lakh in February, and unemployment rate rose more than expected to 3.9%. Uncertainty still prevails in the timing of rate cut. The dollar index and the 10-year U.S. Treasury yields were lower," said Kunal Sodhani, vice president at Shinhan Bank.

"For dollar/rupee, Rs 82.62 will act as a support and Rs 82.90 as a resistance," Sodhani said.

"Inflows will continue and exporters to continue selling on all upticks for the medium term, while importers can buy the dips to hedge very near term," Anil Bhansali, executive director at Finrex Treasury Advisors LLP, said.

"This week, the range could be Rs 82.50-82.90 a dollar with inflows continuing, the RBI absorbing and upticks getting sold off," he added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.