The Indian rupee closed flat on Friday after the Reserve Bank of India vehemently protected the local currency from depreciating beyond Rs 84 amid consistent FPI outflows from domestic equity due to rising tension in the Middle East.

The stock market was also impacted by the Securities and Exchange Board of India's regulatory curbs on derivatives trading.

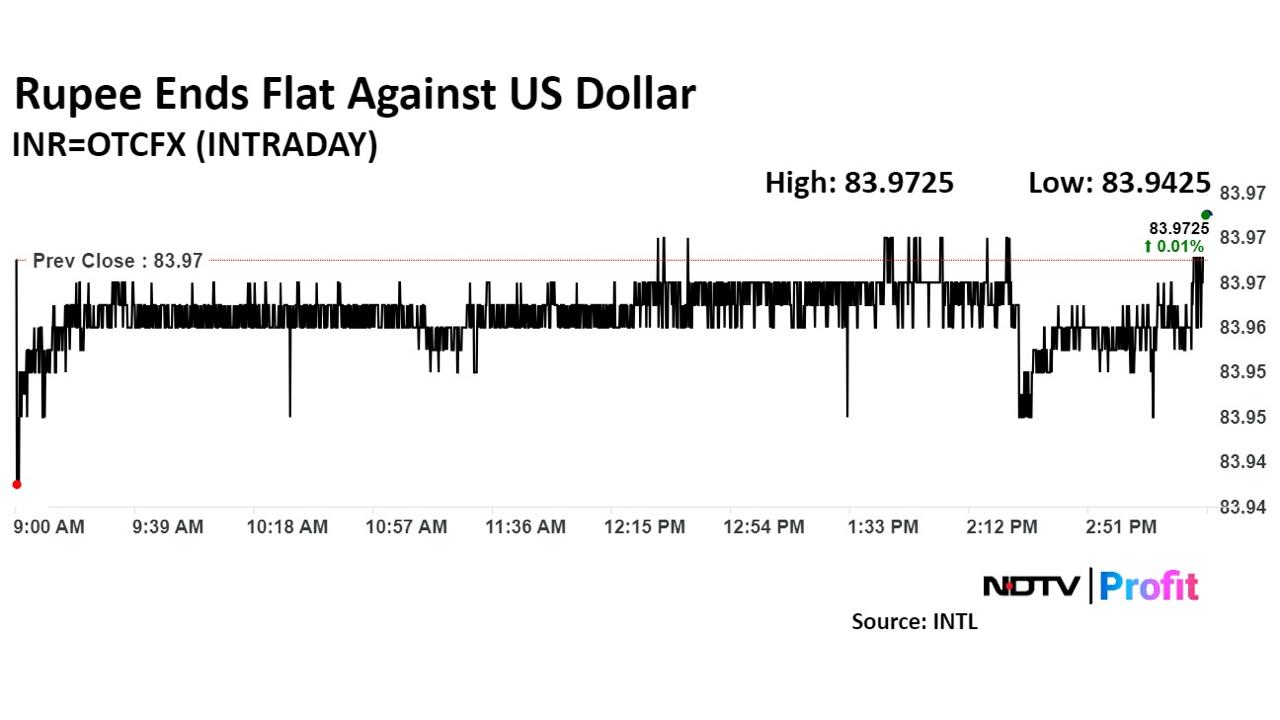

The Indian currency closed flat at Rs 83.97 against the US dollar. It had closed at Rs 83.97 on Thursday, according to Bloomberg data.

"The rupee again fell to Rs 83.9775 today, where RBI was present to not allow any move beyond this level as Rs 84 remained protected," said Anil Kumar Bhansali, the head of Treasury and executive director of Finrex Treasury Advisors LLP.

Bhansali stated that foreign portfolio investors have been dollar buyers as they sell off in equities and that oil companies are buyers as oil prices rise.

India's benchmark equity indices recorded their worst weekly loss in over two years amid rising tensions in the Middle East. Globally, market participants are awaiting the release of US payroll data for September. Both the Nifty and Sensex fell more than 4% this week, their worst fall since the week ended June 13, 2022.

The US Dollar Index was trading 0.09% lower at 101.89 at 3:43 p.m., and Brent Crude was trading 1.08% higher at $78.46.

Bhansali said that was a good level for exporters to sell at, and recommended that those who were "left behind" sell here.

"Importers needed to keep a stop loss of Rs 84.02 to ensure that they remain covered, or wait for lower levels on the pair to hedge," he said.

"The Securities and Exchange Board of India's recent regulatory tightening on derivatives trading has played a role in curbing market enthusiasm," Amit Pabari, managing director at CR Forex Advisors, said.

The new rules, including higher entry barriers and increased margin requirements, are aimed at controlling the retail-driven surge in futures and options trading. However, these measures have also led to reduced trading volumes, worsening the market's decline, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.