Records tumbled on Dalal Street as the first initial public offering from the House of Tata in nearly two decades lived up to the hype, and then some more.

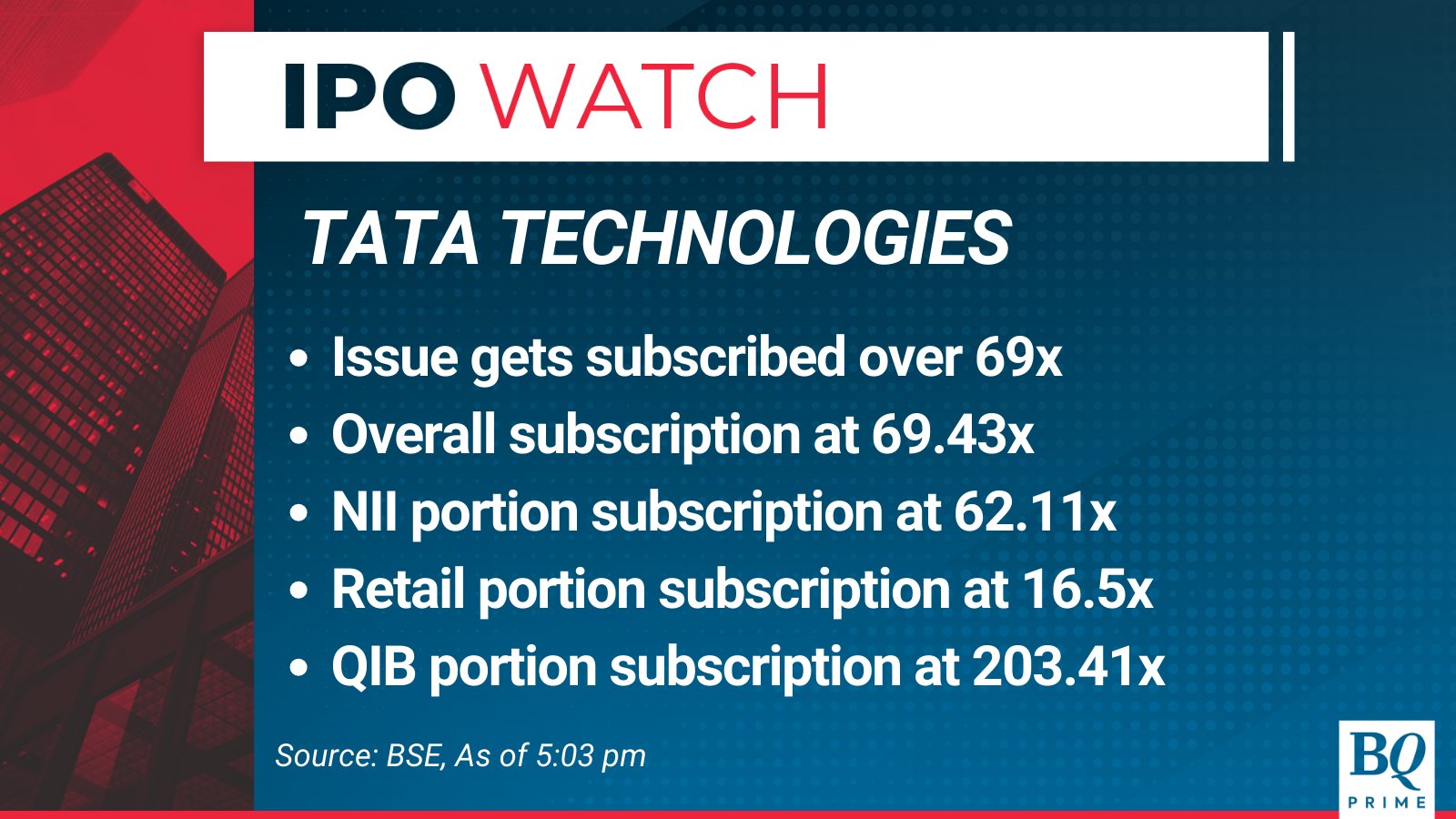

The Tata Technologies IPO, a pure offer-for-sale of 6.08 crore shares, was subscribed 69.43 times as of 6:06 pm on Friday, the final day of the three-day share sale, according to data on the stock exchanges.

Qualified institutional buyers poured into the offering in the final hours, picking up 203.41 times the shares allotted to them, while the portion reserved for non-institutional investors drew 62.11 times the demand. Retail investors and Tata Motors Ltd. shareholders subscribed 16.5 times and 29.19 times, respectively.

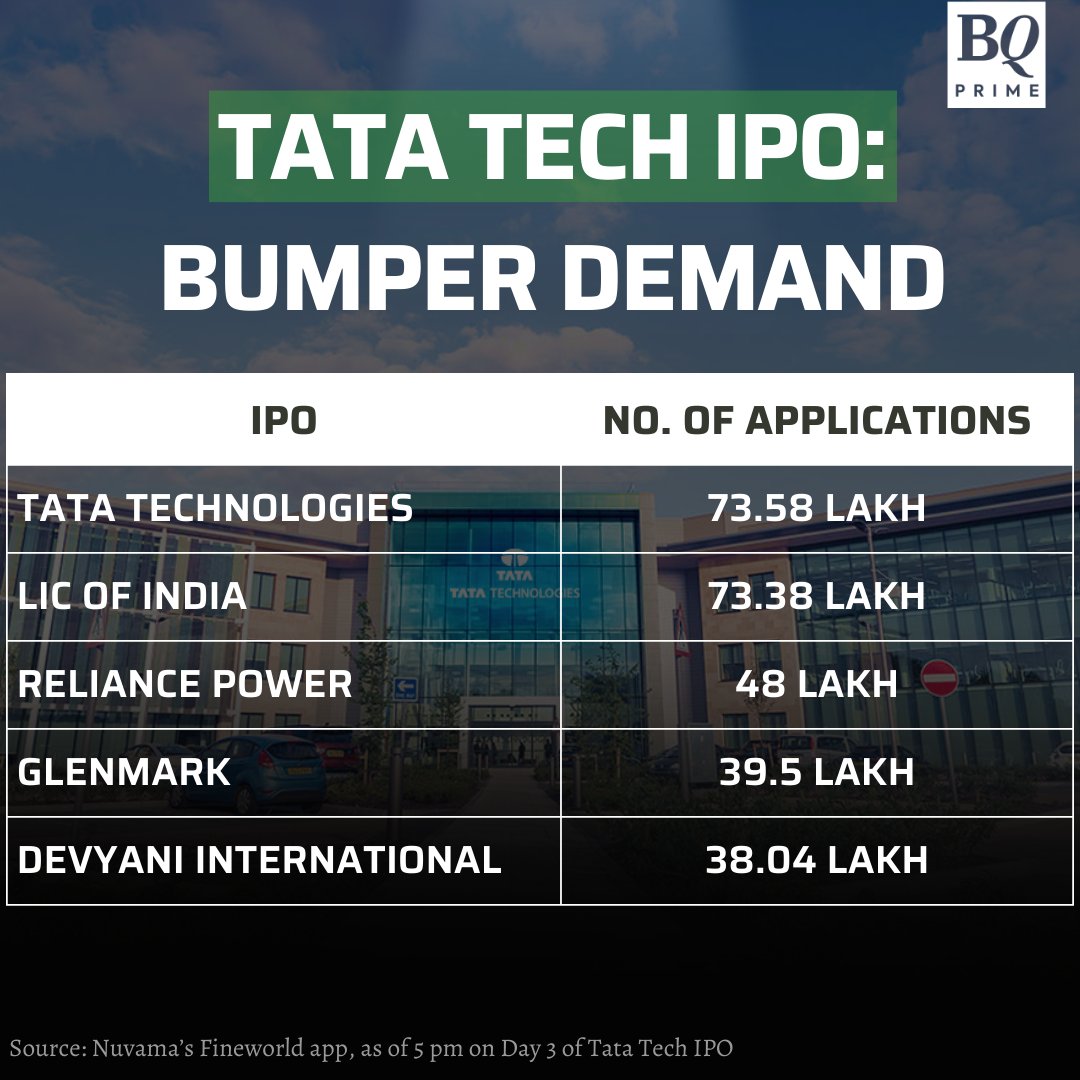

Additionally, at 73.58 lakh, the Tata Technologies IPO attracted the highest number of applications for an Indian IPO, toppling Life Insurance Corp. of India, according to Nuvama's Finworld app. The total bid value stood at Rs 1.56 lakh crore at the last count.

“The response has been remarkable, to say the least, from all categories of investors—be it QIBs, NIIs or retail,” Atul Mehra, joint managing director at JM Financial, lead manager to the Tata Technologies IPO, told BQ Prime over the phone. “The response (in terms of bid value and number of applications) has been the best seen for an Indian IPO.”

“It is particularly heartening for JM Financial because we were the left lead manager for the TCS IPO in 2004, which also witnessed record participation. Nearly 20 years later, we are once again left lead manager to the Tata Technologies IPO, and we have only bettered the response this time again.”

While it's too early to speak about the listing, Mehra said he is hopeful of an equally good performance. “We just have to wait for a few days and the right moment.”

Tata Technologies IPO: The Details

The Rs 3,200-crore Tata Technologies IPO was a pure offer-for-sale of 6.08 crore shares by selling shareholders promoter Tata Motors (4.62 crores), investors Alpha TC Holding Pte (97.16 lakh), and Tata Capital Growth Fund I (48.58 lakh) in the price band of Rs 475-500 apiece.

On Tuesday, the Tata Group firm raised as much as Rs 791 crore from anchor investors in a pre-IPO placement.

At the upper end of the price band, Tata Motors stands to make a 68-times return on investment, having acquired a controlling stake in Tata Technologies at Rs 7.41 per share in 1996.

Tata Technologies IPO: Perfect Timing

The timing of the IPO couldn't have been more apt.

Global spending on ER&D—the segment Tata Technologies operates in—is set to grow at a compounded annual growth rate of 10% over the next five years to $2.7 trillion, according to a Zinnov report. The automotive sector, which is the largest manufacturing ER&D vertical, is primed for a once-in-a-century disruption courtesy of the advent of connected, autonomous, shared and electrified mobility. Global automakers, according to Zinnov, are likely to spend $1.2 billion through 2030.

Tata Technologies, which derives nearly three-quarters of its revenue from the auto industry, believes it is well-positioned to make the most of these shifting sands.

It is the only Indian firm, and among a handful globally, that services automotive clients in every stage of a product's lifecycle—from the drawing board to the showroom floor. The Pune-based firm is expanding into aerospace through Airbus and Air India deals, though anchor clients Tata Motors and Jaguar Land Rover make up a third of the top line.

Tata Technologies IPO: Valuation Game

What worked in favour of the Tata Tech IPO was its valuation, despite questions on pricing.

Exactly a month ago, Tata Motors sold 9.99% of its stake in Tata Technologies to TPG Rise Climate SF Pte, also an investor in Tata Motors' electric mobility unit, and the Ratan Tata Endowment Foundation at Rs 401.8 apiece. While the management said that was “a deal between a willing buyer and a willing seller," an investor will end up paying 25% more for each share in the IPO.

Still, Tata Technologies is the cheapest stock in the space, with a price-to-earnings ratio of 32.8–30.8 times for the fiscal ended March 31, 2023. That compares with the P/E ratios of crosstown rival KPIT Technologies Ltd. (80.31 times), in-house rival Tata Elxsi Ltd. (61.55 times), and L&T Technology Services Ltd. (37.47 times).

Tata Technologies is also unperturbed by the competition, purely from a business perspective.

“Our value proposition represents the difference that matters to the overall market,” Chief Executive Officer Warren Harris said in a press conference in the run-up to the IPO. “We are going to be focused upon exploiting the opportunities that afford us.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.