Raymond Lifestyle Ltd. got a 'buy' rating after Motilal Oswal Financial Services Ltd. initiated coverage on the stock with a target price of Rs 3,200, implying an upside of 36%.

RLL, formed after the demerger of Raymond Ltd., has established itself as a significant player in the men's wear sector, holding approximately 65% of the worsted suiting market. Its portfolio includes several recognised brands, such as Park Avenue, ColorPlus, and Ethnix by Raymond, catering to a diverse range of formal, casual, and ethnic apparel. The company also commands a 5% share of the men's wedding wear industry, the note said.

Motilal Oswal anticipates growth for Raymond Lifestyle to stem from several strategic initiatives: expanding retail presence with plans to double exclusive brand outlets, capitalising on opportunities from Bangladesh +1 and China +1 B2B garmenting trends, launching new product categories like innerwear and sleepwear, and enhancing sourcing efficiencies.

Motilal Oswal forecasted for Raymond Lifestyle's revenue growing at a compound annual growth rate of 11% and profit after tax at an average growth of 15% between fiscals ending March 2024 and March 2027. Its target price for the stock is based on a multiple of 30 times the estimated price-to-earnings for September 2026, equating to an implied 16 times EV/Ebitda.

The Raymond Group has been actively restructuring to boost shareholder value, which includes the vertical demerger of its lifestyle and real estate businesses. This reorganisation aims to streamline operations and optimise financial performance, positioning RLL for growth amid a backdrop of improving margins and net cash management, the note said.

Despite past challenges, including profitability volatility and a high working capital cycle, RLL has taken significant steps to improve operational efficiency. The company's Ebitda margin has risen to around 12% in financial year 2024, up from single digits between financial years 2017-2020.

Looking ahead, RLL's growth strategy emphasises scaling its brand presence, particularly in Tier 1 and Tier 2 cities, while also selectively targeting Tier 3 and Tier 4 markets. The company currently operates 424 EBOs and has the potential to significantly increase this number, as it is underindexed compared to peers.

Key risks to the Raymond Lifestyle target price, as identified by Motilal Oswal, include a prolonged demand slowdown, inflationary pressures, leadership attrition, and competition from established apparel players.

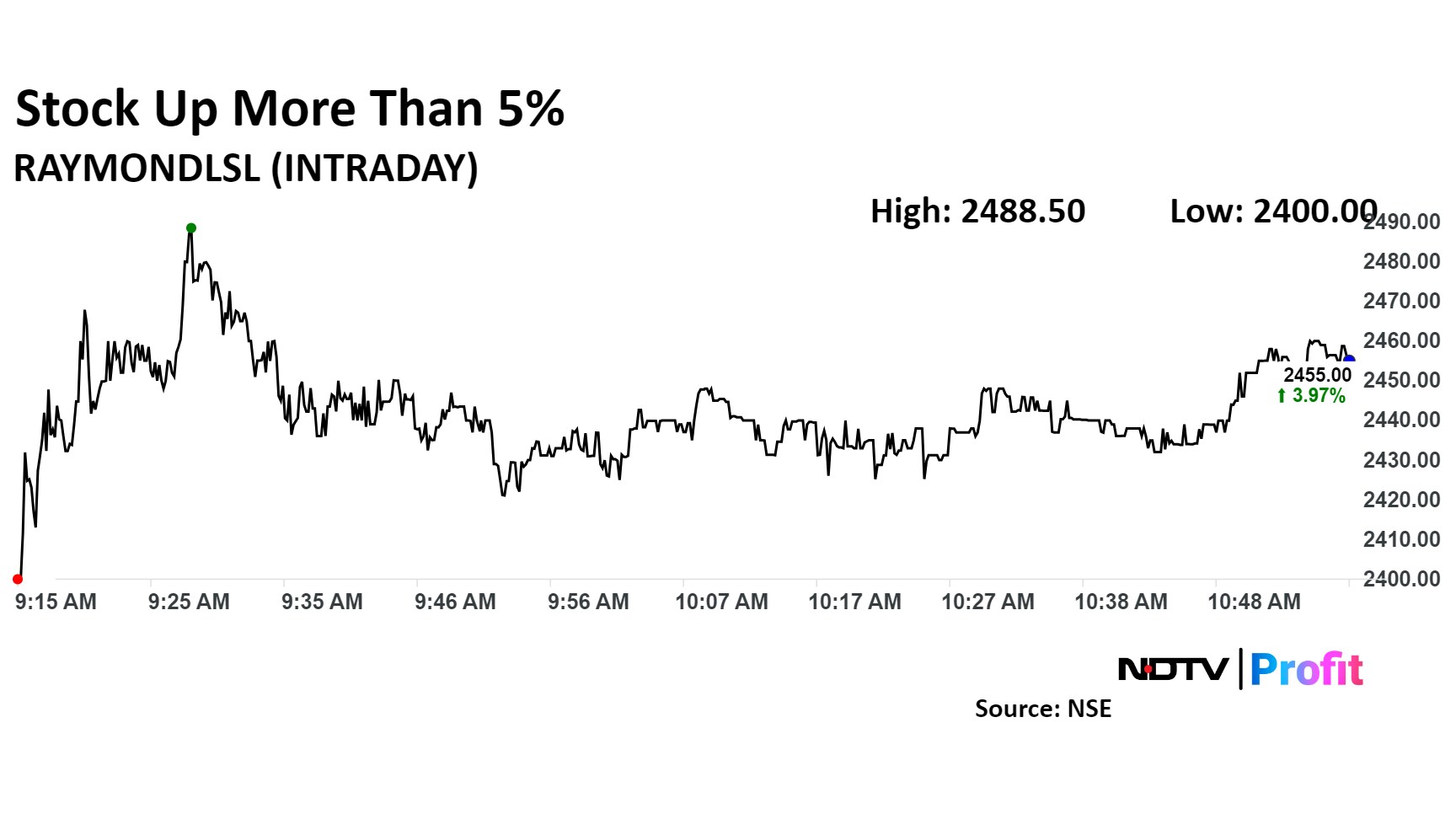

Shares of Raymond Lifestyle rose as much as 5.39% to Rs 2,488.50 apiece. It pared gains to trade 3.94% higher at Rs 2,454.45 apiece as of 10:56 a.m. This compares to a 0.10% decline in the NSE Nifty 50 Index.

It has fallen 14.45% in the last 12 months. Total traded volume so far in the day stood at 1.0 times its 30-day average. The relative strength index was at 51.

One analysts is tracking the company and they maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.