Investors across the globe are rushing to scoop up Chinese stocks as Beijing's stimulus blitz sets off an epic rally. Just don't count Rajiv Jain among them.

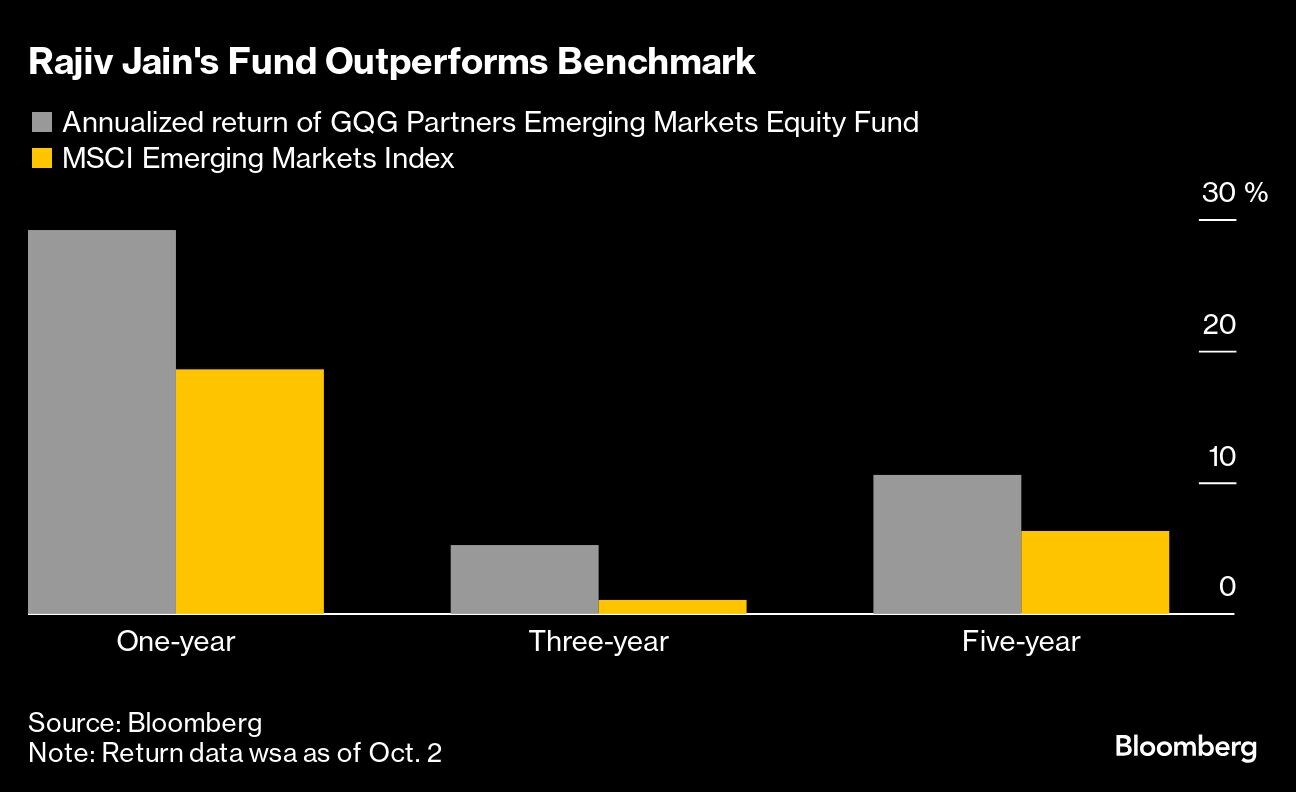

The manager of the top-performing $23 billion GQG Partners Emerging Markets Equity Fund has kept his holdings in Chinese stocks at about 12% of the fund — roughly half of the weighting of its benchmark. As a result, the fund's outperformance this year has been wiped out as the MSCI China Index ripped more than 30% higher in just 10 days.

Despite the swift turn in fortune, the stock picker is steadfast and unfazed because he sees the rally as fleeting. The latest run-up reminds Jain of the so-called “reopening trade” in late 2022, when a similar buying spree took place after China lifted Covid restrictions. That rally fizzled within a few months because the economic recovery disappointed.

“How many times in the last three years have we seen these excitements” only for them to dissipate, said Jain, whose fund beat 92% of its peers tracked by Bloomberg over the same period.

Jain's view contrasts with his peers. Goldman Sachs Group Inc.'s hedge fund clients made their heaviest weekly net buying of Chinese equities since its prime brokerage unit started to track such data in 2016. On Tuesday, the $8 billion KraneShares CSI China Internet Fund attracted $700 million — the largest inflow since the exchange-traded fund debuted in 2013.

While the current stimulus — including interest-rate cuts — helps boost sentiment and provide more liquidity to the stock market, President Xi Jinping needs to address the country's troubled housing market, Jain said.

At least 48 million homes sold in China before completion remain unfinished, according to Bloomberg Intelligence. Analysts estimate China will need up to 5 trillion yuan ($712 billion) to buy unsold homes from developers and convert them into affordable housing.

“How do you make sure the real estate situation stabilizes — because most people don't really own stocks?” Jain said.

Jain was on track for another stellar year, in part thanks to his long-held underweight position in Chinese stocks. His fund returned 14% in the first eight months, handily beating the MSCI Emerging Markets Index's gain of 9.6%. But by Oct. 2, it trailed the benchmark by 3 percentage points as Chinese stocks surged.

“If the party goes on without us, that's fine,” he said.

According to Jain, the latest rally unduly benefited consumer tech stocks, such as Alibaba Group Holding Ltd. – a favorite among hedge fund investors like David Tepper and Michael Burry — because of their big presence in the MSCI China Index. These names climbed as investors swooped in to cover short positions or to get exposure in China.

But these internet consumer companies aren't growing as fast as they used to, he said. Once the crown jewel of China's New Economy, Alibaba's revenue growth has been stagnant, as e-commerce competition intensifies.

“They're basically a trade,” Jain said. “That's a nice trade. But can you really invest in it for three years, five years?”

Jain has grown Florida-based GQG Partners into a $156 billion investment powerhouse since 2016. He became well-known last year for investing in Adani Group's companies after they were thrashed by a short-seller report. His investment in the Indian conglomerate has surged, helping Jain's emerging-market fund return 29% in 2023, almost triple the gain of its benchmark.

Jain's preference for safer, “high-quality” stocks means the fund's underperformance is all but guaranteed when everything rallies. As of June, his biggest holdings in China are predominantly state-owned companies, including China Construction Bank, China Shenhua, PetroChina and Zijin Mining Group, according to the latest filings. He likes SOEs because they pay high dividends and trade at cheap valuation.

If China succeeds in lifting the economy, cyclical names such as banks are likely to benefit from a recovery more so than the likes of Alibaba, Jain said. There are limited signs that Xi is shifting his preference for state-owned enterprises over the private sector, after cracking down on industries from finance to technology over the past three years, he added. The SOEs are favored by the Chinese Communist Party, which wants them to succeed.

“In China, you do what CCP tells you to do,” Jain said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.