(Bloomberg) -- Profits for global and domestic quant traders in India's options market are set to come under threat as the country aims to slow the rapid growth in equity derivatives trading.

The securities regulator Tuesday proposed measures that could shrink liquidity in the $4 trillion futures and options market and cut into margins for market makers and traders.

India's surge to the top of global equity derivatives volumes has lured high-speed trading firms including Citadel Securities LLP and Optiver. The market grabbed global attention in April after US-based Jane Street Group revealed that a strategy used in India generated $1 billion in profits, highlighting the potential for big gains. This also sheds light on how smaller investors often struggle to compete with the big players in equities trading.

“As liquidity shrinks, the bid-ask in the options market will widen substantially, making it unattractive for high-frequency traders,” said Narinder Wadhwa, managing director at New Delhi-based investment firm SKI Capital. “It was a cat-and-mouse game between HFTs and retail investors. If the mice leave, only cats will be left in the market.”

The regulator proposed a large increase in the minimum contract size for index derivatives, fewer contracts, and higher margins on expiry days. This comes days after a surprise hike in equity taxes and transactions costs for trading options, as authorities try to steer household savings away from speculative trading.

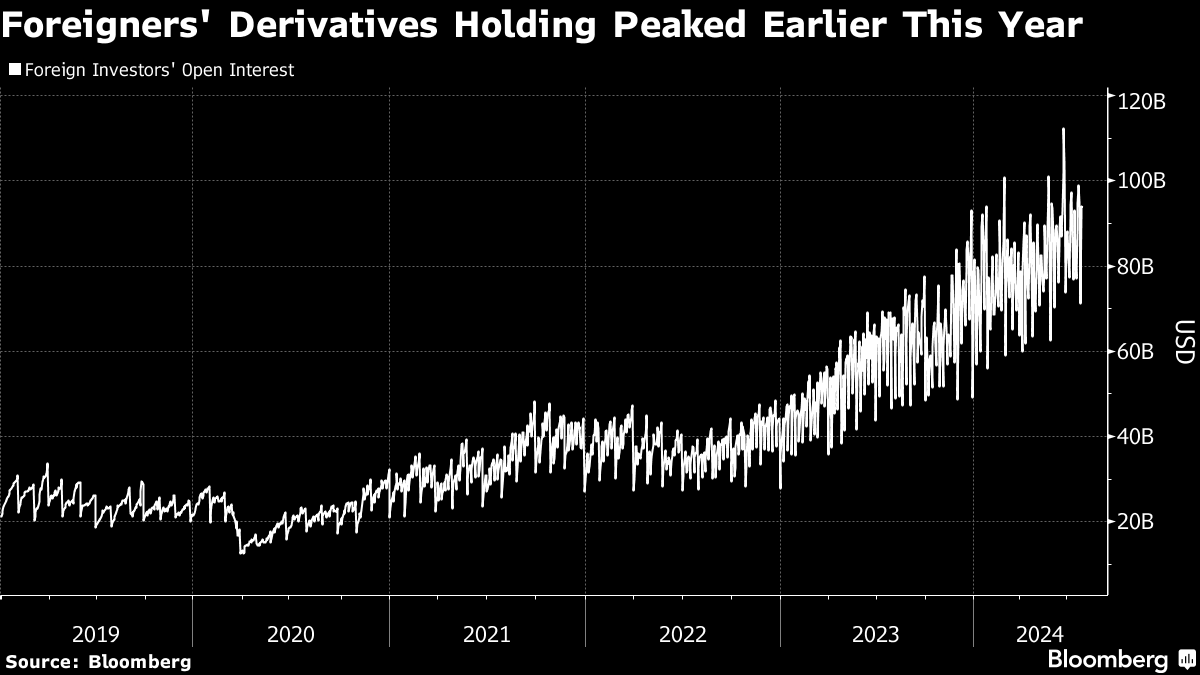

India's notional derivatives turnover hit a record $6 trillion in February, up from less than $150 billion five years ago, driven by millions of individual investors. This explosion in retail participation has led to repeated warnings from authorities, with the finance ministry linking excessive risk-taking to gambling.

Read: Jane Street's $1 Billion Trade Puts Spotlight on Indian Options

The lucrative opportunity has led to global high-speed trading firms to expand in India. Last year, Optiver, one of the world's biggest players in this segment, opened an office in Mumbai. Citadel Securities, Jump Trading, and Tower Research are all hiring traders and analysts to boost their India operations.

“If volumes in the derivatives drop, market makers' profitability is going to get impacted,” said Anant Jatia, the Mumbai-based founder and chief investment officer at Greenland Investment Management, a systematic investment firm that oversees more than $1 billion. “That said, I expect market makers will adjust to the new reality very quickly.”

Jefferies Financial Group expects up to 35% of the derivatives premium turnover to be affected by the proposed measures. As exchanges phase out weekly options contracts — a key driver of the trading boom — traders see a return to mostly monthly contracts.

Tejas Shah, head of derivatives trading at Equirus Securities Pvt., said instances of trading firms making billions of dollars in profit are likely over as the number of tradable instruments shrink.

“Everybody will now have to sit down and recalibrate their current strategies as the Indian market goes back to the older days,” he said.

--With assistance from Ashutosh Joshi.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.