State-owned lenders have the highest exposure to Reliance Communications Ltd.'s debt that was downgraded to default by rating agencies amid mounting worries about the company's repayment ability.

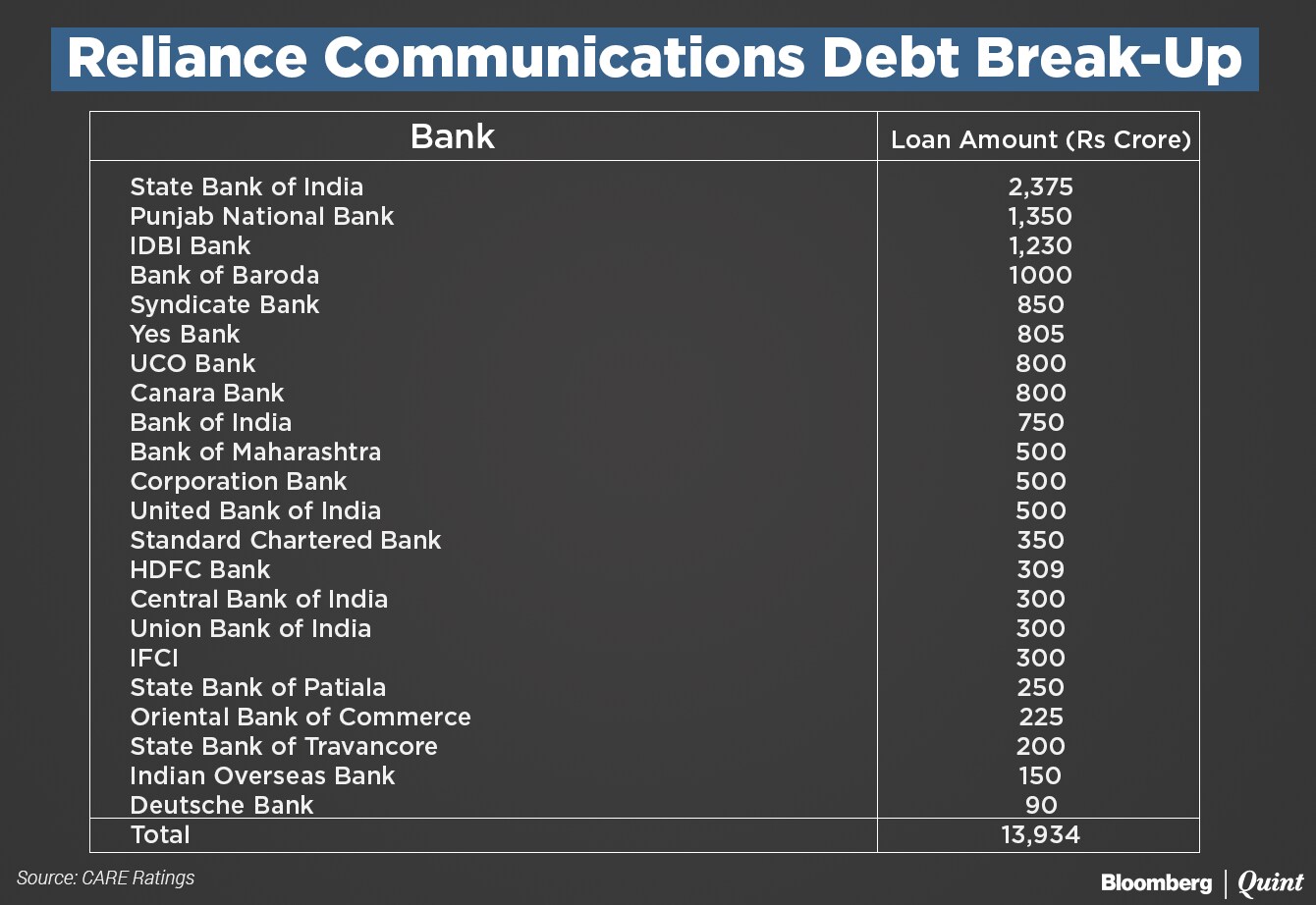

CARE Ratings Ltd. has downgraded the ratings on loans worth Rs 13,934 crore, a third of telecom operator's gross debt. More than three-quarters of the default-rated debt is held by 17 public sector banks, according to data provided by the ratings agency to BloombergQuint. State Bank of India Ltd., Punjab National Bank Ltd., IDBI Bank Ltd. and Bank of Baroda Ltd. are the four major public sector lenders to the Anil Ambani-run company.

Private lenders that have exposure to Reliance Communications' (RCom) downgraded debt are Yes Bank Ltd., Standard Chartered Bank, HDFC Bank Ltd., IFCI Ltd. and Deutsche Bank.

While IDBI Bank and Yes Bank refused to comment, other lenders didn't immediately respond to BloombergQuint's emails seeking a response on their exposure to the telecom operator's debt.

RCom's cash and cash equivalents have been depleting for the last three financial years. The company had Rs 1,319 crore of cash in its books at the end of March. In comparison, debt worth Rs 6,789 crore is scheduled for repayment in 2017-18, according to its annual statement. Of its total gross debt of Rs 45,733 crore, Rs 20,141 crore are foreign-currency loans and the rest are rupee-denominated.

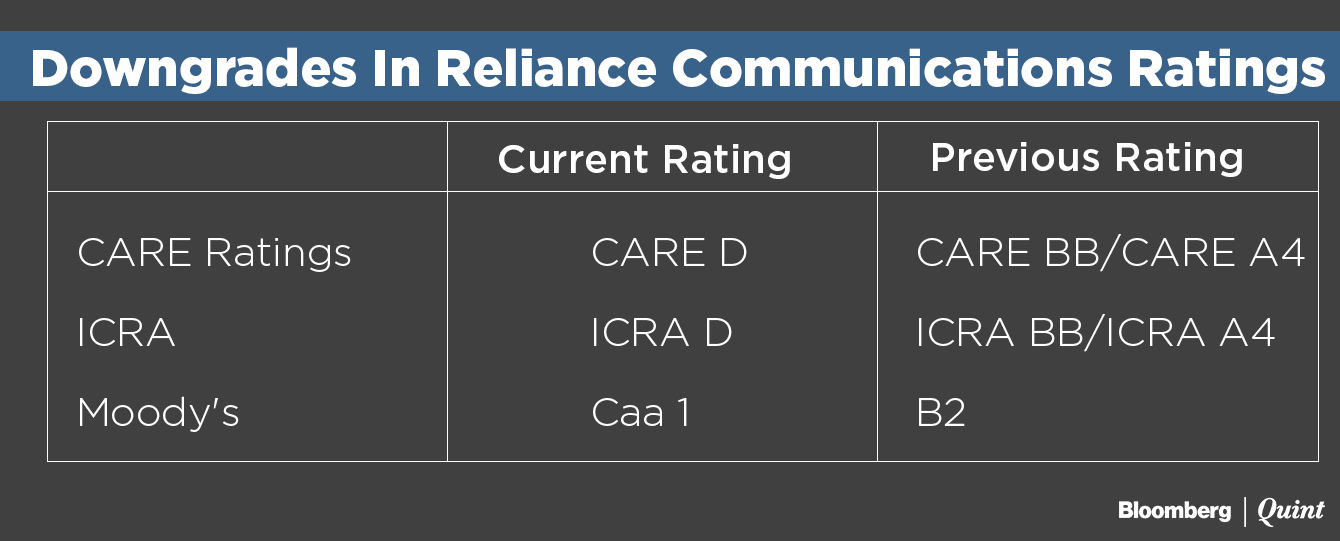

After RCom posted disappointing earnings in the quarter ended March and disclosed the Rs 375-crore default on non-convertible debentures, multiple rating agencies downgraded the company's ratings on Tuesday. The revision was on account of delays by RCom in “servicing its debt obligations on account significant stress on its cash flows and high level of debt”, CARE said in its statement.

CARE was the first rating agency to downgrade RCom's debt to default, followed by ICRA. International rating agency Moody's Investors Services downgraded RCom's corporate family rating and senior secured bond rating to ‘Caa1', that is speculative of poor standing or high credit risk, from ‘B2' and put their ratings under review for further downgrade.

Shares of Reliance Communications have plunged close to 30 percent in the last four trading sessions compared to a 1.5 percent decline in the S&P BSE Telecom Index. The stock has fallen more than 60 percent in the last one year.

Also Read: Were Rating Agencies Slow In Downgrading Reliance Communications' Debt?

(Corrects an earlier version to remove a reference to Franklin Templeton Mutual Fund holding default-rated NCDs)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.