(Bloomberg) -- US stock and bond prices will see modest gains as the Federal Reserve pivots to cutting interest rates next year, though the easing may not be as aggressive as markets are now expecting.

Those are the key results of Bloomberg's latest Instant Markets Live Pulse survey with 190 respondents, conducted after the Fed's latest meeting Wednesday, when it set off broad rallies by signaling it's likely to start cutting rates as inflation cools.

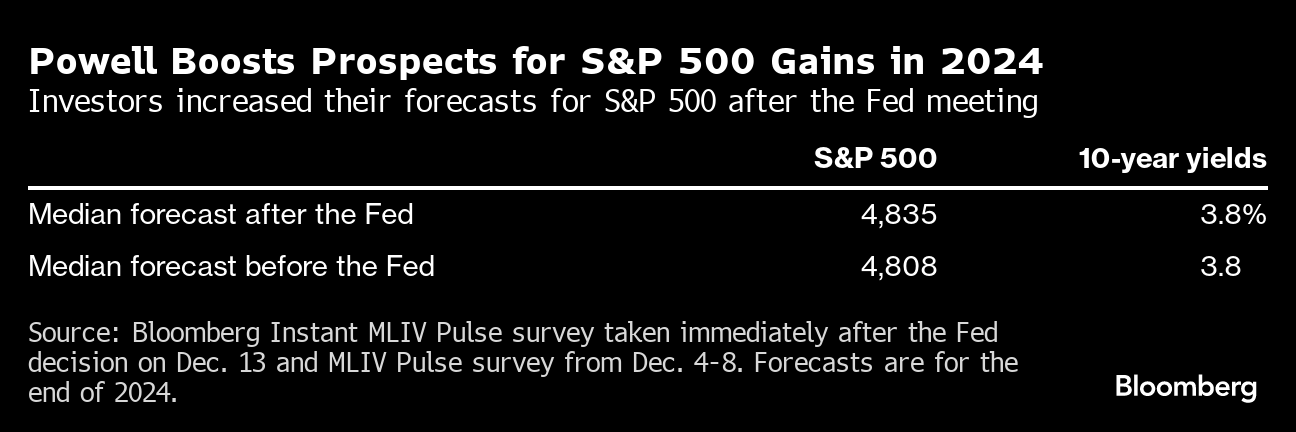

Investors expect the S&P 500 Index to rise to about 4,835 at the end of 2024, an increase compared to the last survey before the Fed decision. Still, such a gain, which amounts to about 3% from current level, reflects skepticism about how much US stocks can rally after this year's advance of almost 23%.

Similarly modest gains are seen for the bond market: The median call in the survey was for the 10-year Treasury yield to slide to about 3.8% from just above 4% currently.

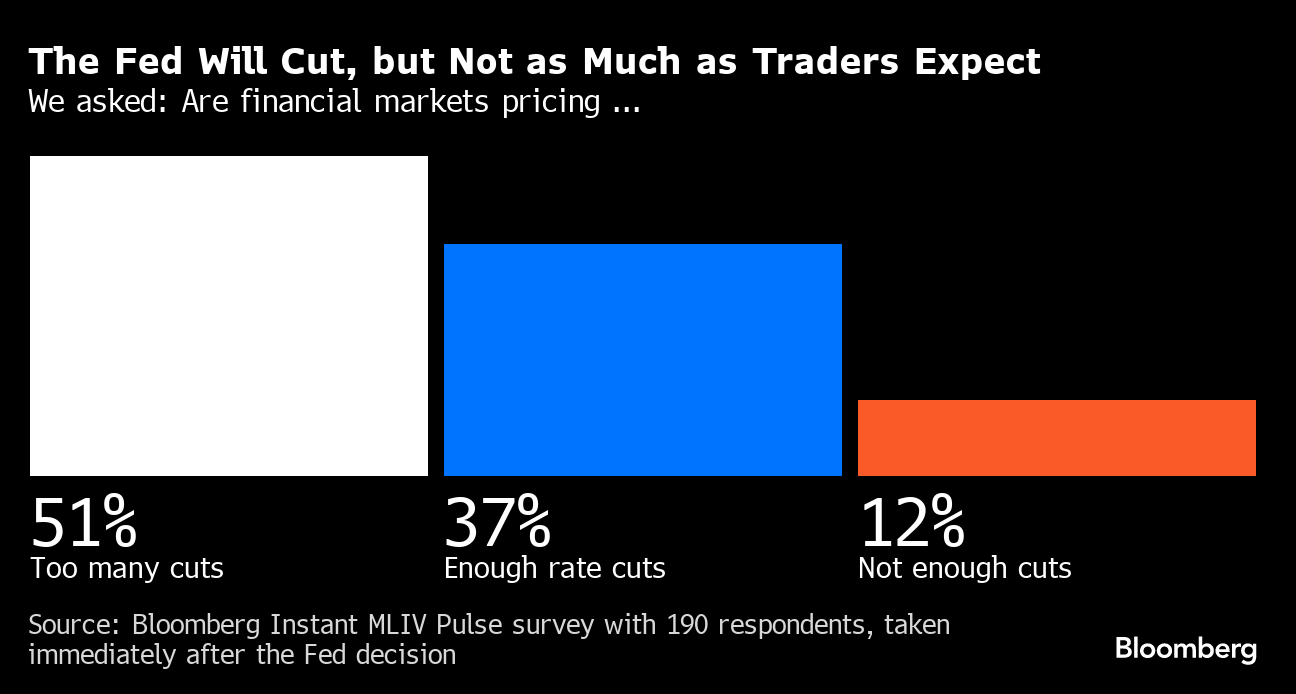

The relatively muted expectation for further gains contrasts with Wednesday's sharp rally in Treasuries and reflects concern markets have run too far ahead of the central bank, with swap traders now pricing in that rate cuts are likely to start as soon as March and reduce the Fed's benchmark by some 140 basis by the year's end. Fifty-one percent of the respondents said the current market pricing is too aggressive.

The rate-cut expectations intensified after the Fed held steady for a third straight meeting and Chair Jerome Powell indicated that policymakers' focus is when to ease policy as inflation pulls closer to its target. Officials' new quarterly rate forecasts showed no further interest-rate hikes and 75 basis points of easing projected for next year. In the September forecasts, there was only 50 basis points of reductions slated for 2024.

The signals set off the biggest rally in the Treasury market since March and sent major stock indexes up by well over 1%, pushing the Dow Jones Industrial Average to a record high.

The “markets absolutely loved this result,” Greg Peters, co-chief investment officer of PGIM Fixed Income, said on Bloomberg Television. But they “are really pushing the limits here. There is so much good news priced in.”

Read more: Fed Pivots to Rate Cuts as Inflation Heads Toward 2% Goal

The 10-year Treasury yield fell about 18 basis points to nearly 4% Wednesday, capping a sharp retreat from the 16-year high of 5.02% hit in October. The S&P 500 rose 1.4% to top 4,700.

Those gains have been stoked by mounting conviction that the economy may be headed toward a soft landing, avoiding a recession that was once seen as virtually inevitable as the Fed pushed up rates.

Some 43% of the Pulse survey respondents said the Fed's policy is decreasing the chance of an economic downturn, with a slightly smaller share saying the opposite.

“The Fed believes more and more in soft landing, lower inflation without much weakness in labor market,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management.

The MLIV Pulse survey was conducted among Bloomberg terminal users immediately after the Fed decision by Bloomberg's Markets Live team, which also runs the MLIV blog. Sign up for future surveys here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.