Shriram Finance Ltd. remains among the top picks for Jefferies India Pvt. as it sees the financier's growth to hold up with a potential rise in its assets under management.

Healthy demand for used personal vehicles, rollout of MSME and gold loans in erstwhile branches can drive a 17% AUM growth over financial year 2024–26, according to Jefferies.

The non-banking financial company can also gain from potential expansion in addressable used-commercial-vehicle pool after fiscal 2026. It can deliver a 17% compound annual growth rate for earnings per share and a 16% return on equity over fiscal 2024–26, Jefferies said in a March 21 note.

Citing a reasonable valuation, the brokerage has a 'buy' rating on Shriram Finance with a target Rs 2,750 per share, implying a potential upside of 18% over the current market price of Rs 2,313.7 apiece on the BSE.

The financier has not hiked lending rates, but loan-mix changes can lift yields by 10–12 basis points over fiscal 2024–26, during which the margin can be stable. Operational expenses can increase slightly in the fourth quarter, but it can ease from the second half of the next fiscal due to moderation in marketing and other costs, according to Jefferies.

The brokerage estimates a credit cost of 2.2–2.3% over fiscal 2024–26, and the current credit costs reflect slippages from restructured books, which can fade after the current fiscal.

It has outperformed auto NBFC peers and trades at 1.6 times the book value for the next fiscal. This is in line with its five-year average of 1.6 times despite better growth and returns outlook, Jefferies said.

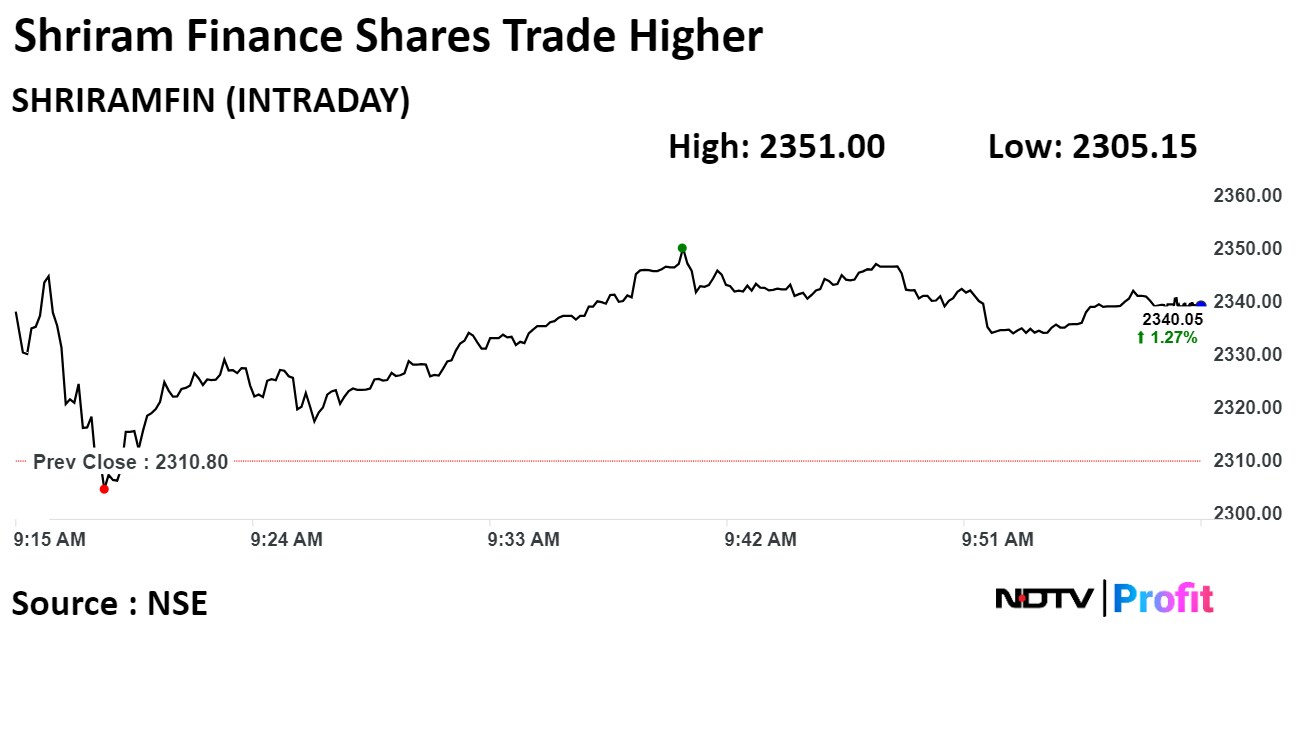

Shriram Finance's stock rose as much as 1.74% during the day to Rs 2,351 apiece on the NSE. It was trading 1.05% higher at Rs 2,335 per share, compared to a 0.22% decline in the benchmark Nifty 50 as of 9:56 a.m.

The share price has risen 87.3% in the last 12 months. The relative strength index was at 48.

Thirty-six out of the 38 analysts tracking the company have a 'buy' rating on the stock, one recommends 'hold' and another suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.