Paytm, India's leading digital payments platform, could see a significant upside in its share price, potentially doubling, according to a new note by Bernstein. The firm has outlined bullish scenario in which Paytm's earnings per share (EPS) could rise by nearly 100% by FY30, driven by key growth catalysts, including margin expansion, an increase in lending from its own balance sheet, and the revival of key products such as Buy Now Pay Later.

The firm also has a bearish case scenarios where it expects to see a 40% downside to base case FY30E EPS numbers largely from assumptions of weaker cost control, continued contraction of payment margins and slower lending disbursal growth.

Bernstein believes Paytm's payment processing margin, which dropped significantly after regulatory changes, could see a resurgence. The firm anticipates margins returning to pre-regulatory action levels of 15 basis points (bps) from the current 10bps. This could be achieved through the return of products like wallets, greater adoption of credit products on UPI, and a stronger consumer base leading to increased volume in bill payments and higher GMV (Gross Merchandise Value). The margin recovery alone could contribute a 25% upside to Paytm's EPS.

Paytm's share of the UPI market has declined to less than 10%, but Bernstein believes regulatory moves could provide a tailwind. Specifically, the National Payments Corporation of India may impose market share caps on players like PhonePe and Google Pay, which could allow Paytm to reclaim a larger share of UPI transactions. Bernstein estimates this could lead to an 8% upside in the company's EPS, with GMV growth potentially accelerating to a 25% compound annual growth rate through FY30.

Bernstein also sees significant upside if Paytm can channel more loans through its own balance sheet, rather than sharing profits with third-party lenders. By securing a Non-Banking Financial Company license, Paytm would not only improve its profitability but also reduce regulatory risks. This shift could account for a 30% upside to Paytm's earnings.

While the upside potential is substantial, Bernstein acknowledges that several factors need to align for the bull case to play out. Most importantly, regulatory changes are critical to unlocking these opportunities. This includes a favorable regulatory environment allowing Paytm to revive its wallet and BNPL products, and the possibility of obtaining an NBFC license. Additionally, management's willingness to return to more heavily regulated businesses, particularly in lending, will be key to executing on the upside scenario.

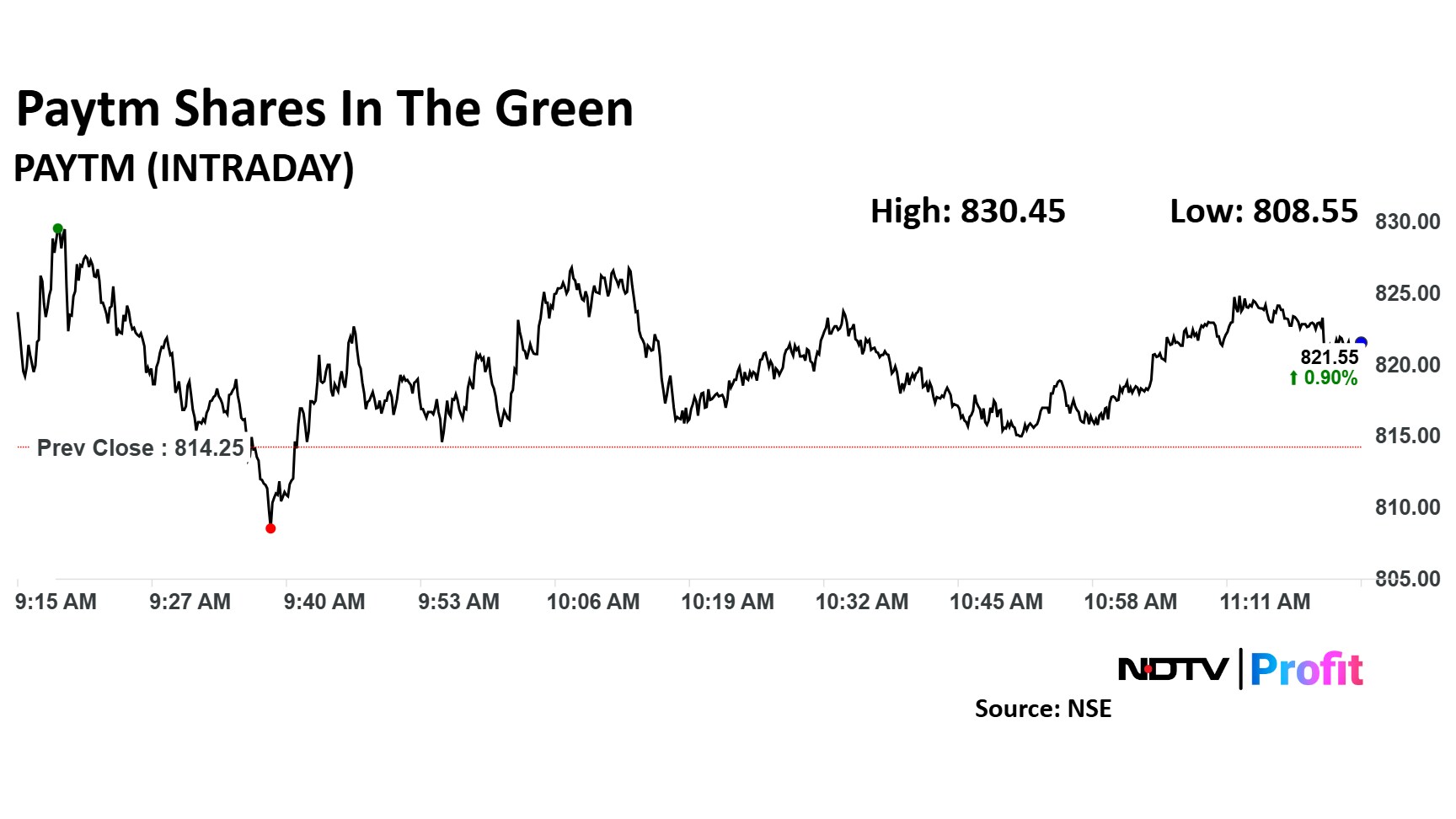

The scrip rose as much as 1.99% to 830.45 apiece. It pared gains to trade 1.63% higher at Rs 827.50 apiece, as of 11:31 a.m. This compares to a 0.75% decline in the NSE Nifty 50 Index.

It has fallen 9.31% in the last 12 months. Total traded volume so far in the day stood at 0.50 times its 30-day average. The relative strength index was at 61.5.

Out of 18 analysts tracking the company, seven maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 12.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.