Ola Electric Mobility Ltd., despite reporting impressive first-quarter growth, saw its market share decline due to increasing competition, according to Jefferies.

The electric two-wheeler maker's market share stood at 49% during the first quarter ended June 2024. However, as of August, there has been a notable decline to 33%, despite remaining the leading player in the sector with aggressive expansion and pricing strategies. This change comes amid increasing competition from established manufacturers such as TVS Motor Co. and Bajaj Auto Ltd.

TVS and Bajaj, previously overshadowed by Ola, have expanded their portfolios with more affordable electric two-wheelers, Jefferies said. This shift has allowed them to gain between 4% and 7% of the market share, respectively, with TVS now holding 19% and Bajaj 18%.

Hero MotoCorp Ltd. remains a distant player with just 5%, and Honda Motorcycle has yet to launch its first electric vehicle in India.

Ola Electric is set to launch the Roadster, the first affordable electric bike launched by a mainstream player, as per Jefferies. This move is expected to bolster Ola Electric's market presence and volumes.

However, Jefferies highlights that the success of this new model will hinge on its on-road performance and the overall profitability of electric bikes in India.

Motorcycles dominate the Indian two-wheeler market, accounting for 63% of total volumes. In response to the growing competition and evolving consumer preferences, TVS has diversified its offerings, with its i-Qube now available in five variants and another scooter planned for release in the next six months.

Bajaj Auto has introduced a lower-priced version of its Chetak electric two-wheeler, positioning itself as a more accessible option for buyers.

Hero, known for its traditional internal combustion engine bikes, is also eyeing a move into the electric segment with plans to launch affordable electric scooters in fiscal 2025.

Looking ahead, Jefferies forecasts significant growth in the electric two-wheeler market. Jefferies anticipates a rise in the electric two-wheeler market share from the current 5.6% to 13% by fiscal 2027.

The next phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles scheme will be crucial in determining the pace of this adoption, as per the report.

Within the automotive sector, Jefferies identified TVS Motor and Mahindra & Mahindra Ltd. as top picks.

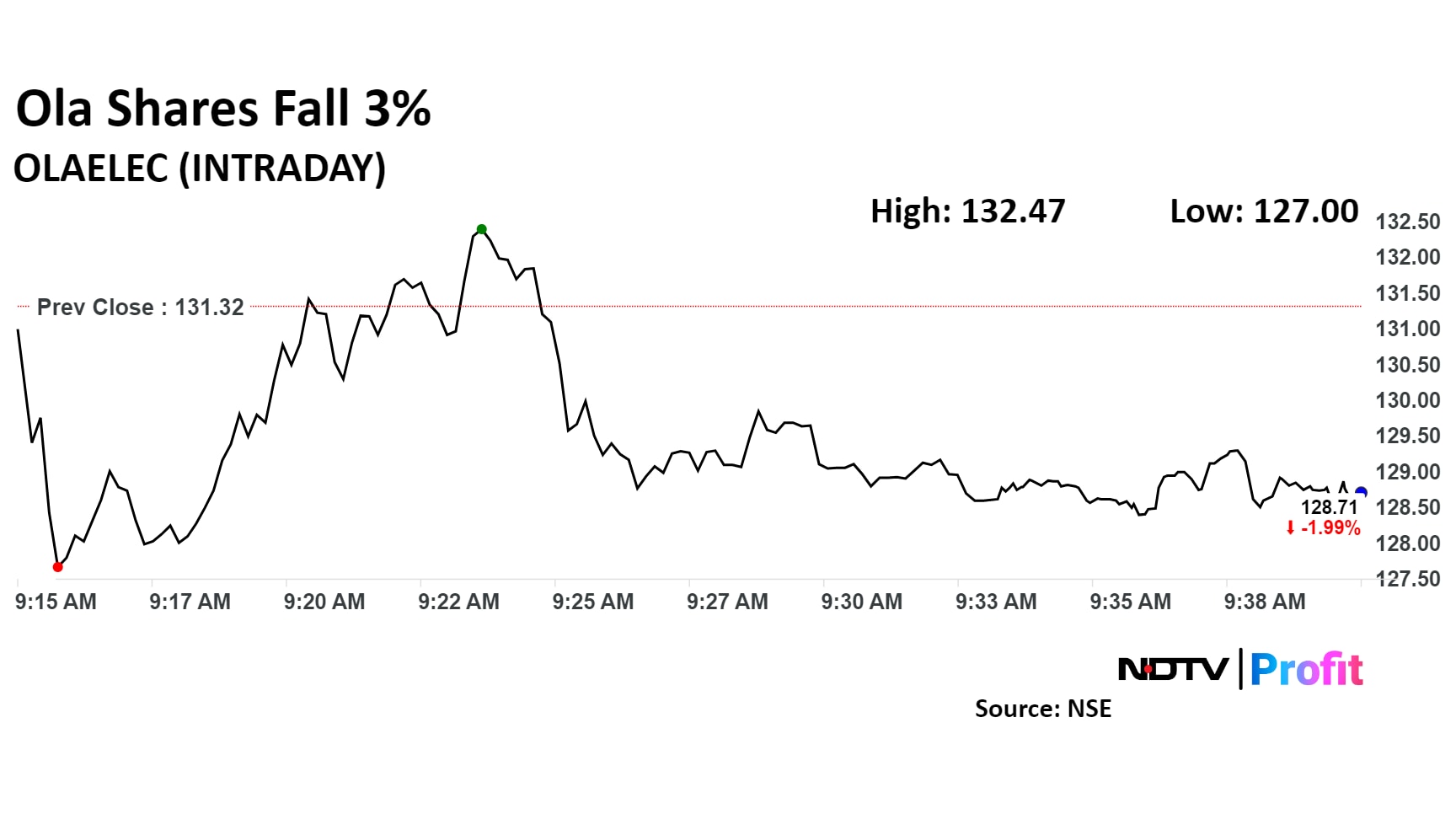

Shares of the Ola Electric fell as much as 3.29% to Rs 127 apiece. It pared losses to trade 1.86% lower at Rs 128.88 apiece as of 09:35 a.m. This compares to a 0.16 decline in the NSE Nifty 50 Index.

The stock has risen 41.32% since listing. One analyst tracking the stock maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.