Structural trends such as limited range anxiety for electric two wheelers, lower running costs compared to internal combustion engine two wheelers, declining battery costs, and the emergence of new total addressable markets like electric three wheelers could benefit Ola Electric in the long term, holds Goldman Sachs.

The firm initiated coverage on Ola Electric Mobility Ltd. with a 'Buy' rating and a target price of Rs 160, implying a potential upside of 50%. As of August 2024, Ola Electric holds a 32% market share in India's fast-growing electric two-wheeler market.

However, Goldman Sachs also pointed to potential volatility drivers, including the company's progress in building its in-house battery cell manufacturing capabilities, its direct-to-customer sales and after-sales model, upcoming product launches by rivals, and its journey towards free cash flow breakeven.

The firm expects Ola Electric to achieve earnings before interest, taxes, depreciation, and amortisation breakeven by fiscal 2027 and free cash flow breakeven by fiscal 2030, based on an estimated revenue CAGR of 40% in financial years 2024-2030.

Looking ahead, key catalysts include the launch of Ola's electric motorcycle portfolio in the March 2025 quarter and its expected entry into the electric three-wheeler market by mid-2025.

Ola Electric is projected to achieve 11.9% Ebitda margin and 27% return on invested capital by fiscal 2030, a sharp improvement from -19.7% and -32%, respectively in fiscal 2024.

In terms of valuation, Goldman Sachs estimates that Ola Electric is trading at six times forward the enterprise value/sales ratio with a 40% revenue CAGR, comparable to Tesla's valuation but at a significantly higher growth rate than traditional Indian two-wheeler manufacturers, which trade at three to six times with lower growth rates.

Bear And Bull Case Predictions

In its base case, Goldman forecasts a 50% upside, with a bull case estimating 115% growth and a bear case predicting a 16% downside. Risks may include competitive pressures, the company's ability to scale its battery cell manufacturing, execution challenges in its D2C network, and key person risks.

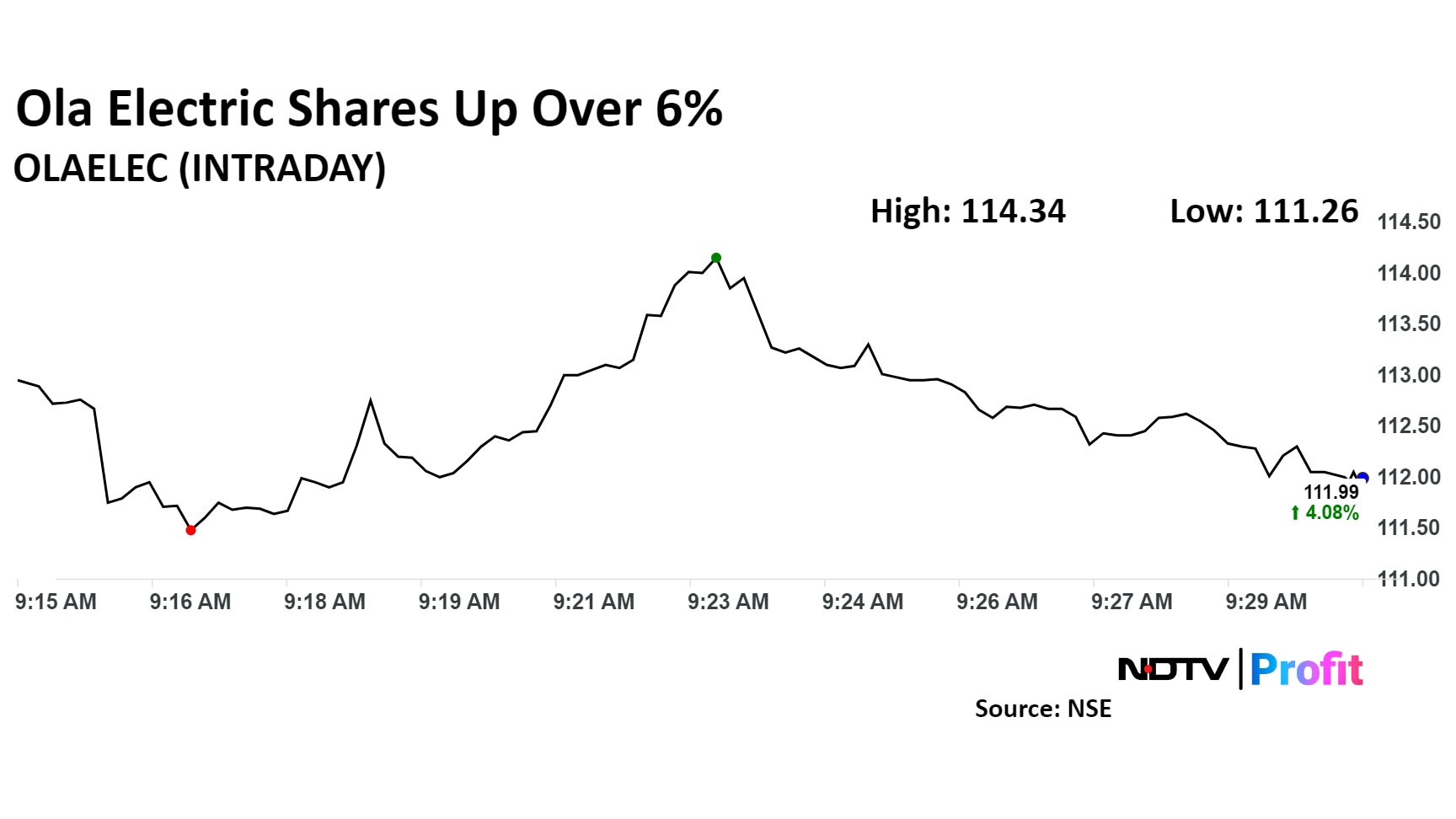

The scrip rose as much as 6.26% to Rs 114.34 apiece to the highest level since Sept. 12, 2024. However, the stock pared gains to trade 5.10% higher at Rs 112.70 apiece, as of 09:28 a.m. This compares to a 0.04 decline in the NSE Nifty 50 index. The relative strength index was at 56.9.

Out of five analysts tracking the company, four maintain a 'buy' rating and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.