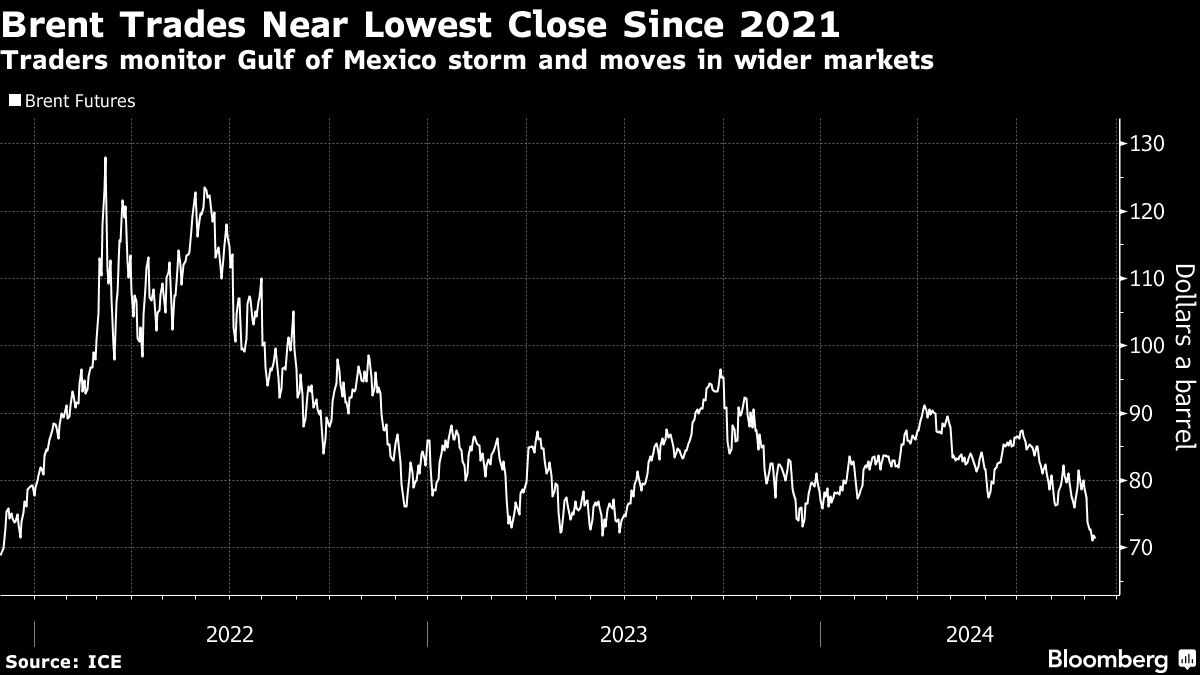

(Bloomberg) -- Oil prices slipped to near the lowest since 2021, as traders tracked moves in wider financial markets and monitored a storm that could affect some supplies in the Gulf of Mexico.

Global benchmark Brent crude was near $71 a barrel after snapping a six-session losing streak on Monday. Equity markets are also struggling for direction, with key inflation data due later this week.

OPEC kept its demand forecast steady, even after the producer group chose to prolong its supply restraints for another two months. The International Energy Agency — which previously forecast a surplus next year — is due to publish its own monthly report this week.

Tropical Storm Francine is set to become a hurricane Tuesday as it churns toward Louisiana, forcing some oil drillers to halt production and evacuate crews in the Gulf of Mexico. On its expected track, Francine may rake nine major platforms.

Brent closed at the lowest since 2021 on Friday amid growing concerns about restrained demand in major economies and abundant supply. The market's increasingly bearish tone spurred Wall Street banks to pare price forecasts for the coming quarters.

“The tone of the oil market remains downbeat,” said Norbert Ruecker, an analyst at Julius Baer. “The fundamental headwinds should persist. Demand is partially stagnant, production grows in the Americas, and the oil market likely heads into surplus supplies next year.”

Prices

Brent for November settlement was down 1.2% at $70.98 a barrel at 1:35 p.m. in London.

WTI for October delivery was 1.2% lower at $67.88 a barrel.

At the Asia Pacific Petroleum Conference in Singapore this week, most speakers have been cautious about the market outlook. Among them, Ben Luckock, head of oil at Trafigura Group, one of the world's top traders, warned that Brent was probably going to slip into the $60s “relatively soon.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.