(Bloomberg) -- Emerging-market bonds and currencies have powered ahead this month on optimism over the Federal Reserve's pivot to interest-rate cuts. Falling oil prices are set to deliver a further boost.

Brent crude's slide of more than 20% from its September peak suggests inflation is set to slow even further in developing nations in coming months, which will provide another reason to buy their bonds. Emerging-market currencies are also poised to gain as finances of net-oil importers improve.

“Oil is always going to be an important piece for emerging markets' inflation or disinflation,” said Manpreet Gill, chief investment officer for Africa, Middle East and Europe at Standard Chartered in Dubai. When there's disinflation, local-currency bonds are the place to look because one gets more direct exposure to local rates and the currency, he said.

A Bloomberg index of emerging-market local-currency debt has returned 5.6% this quarter, while an MSCI gauge of developing-nation currencies has advanced 3.3%, both on course for the best quarterly performance in a year.

The bulk of recent gains in developing-nation assets has been due to optimism the Fed is finished raising rates. Traders moved to price in as much as six quarter-point cuts from the US central bank next year following a dovish shift in tone at the Fed's Dec. 12-13 meeting. That saw the dollar tumble, and risk assets rally.

Inflation ‘Peaked'

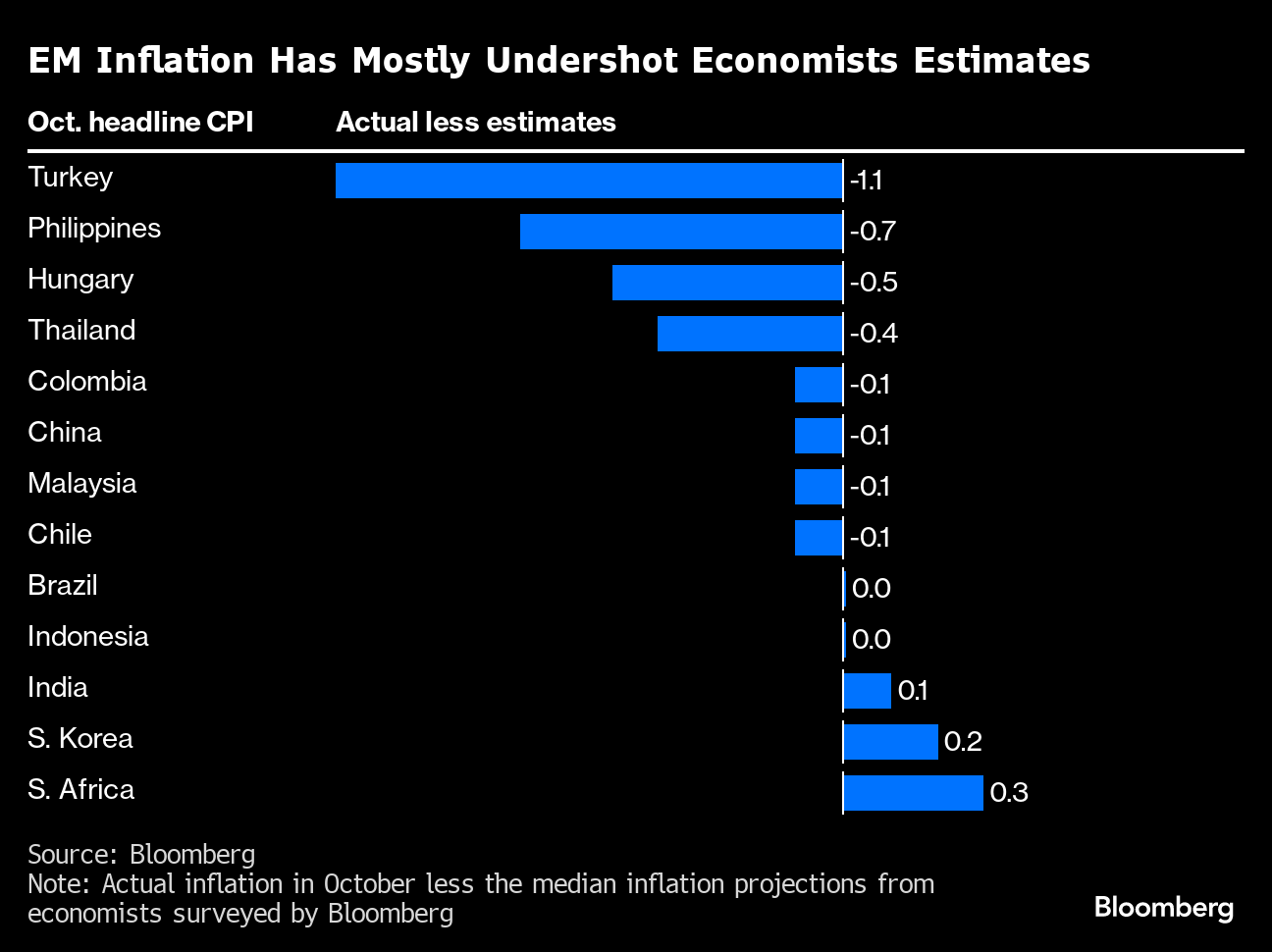

Falling oil prices may spur further gains in EM assets by adding to downward pressure on inflation. Consumer-price-index data across developing nations as a whole have been undershooting economists' forecasts since December 2002, based on a Citibank surprise index.

“It's clear that emerging-market inflation peaked last year, and oil disinflation has led to a continuation of the deceleration,” said Jennifer Taylor, head of emerging-market debt at State Street Global Advisors in London.

While slowing inflation has convinced traders to bet on rate cuts from the Fed and other major central banks next year, policymakers in a number of emerging-market economies have already started easing. Brazil, Chile and Peru have collectively cut their benchmark rates by more than 500 basis points in 2023.

The high volatility in market pricing for global rates means 2024 may still be far from plain sailing for emerging-market bonds.

Disinflation will continue to be interesting to markets, but at some point investors will start focusing on growth dynamics once more, said Kieran Curtis, director of investment at Abrdn in London.

“There will be some countries where I think investors will start to question when the central bank needs to move from tight to stimulative,” he said. There are “others where we're looking at a move back from tight to neutral, and some where we're not really looking at a move away from tight policy,” he said.

‘Usual Suspects'

Some of the major beneficiaries of lower crude prices will be net oil importers, including many nations in Asia.

“Currencies from the usual suspects such as India, Philippines, Korea and Thailand may stand to gain the most from the oil-price pullback given their net import reliance on crude,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. in Singapore. Thailand and India may even leverage further on downstream petrochemical profitability as crude input costs decline, he said.

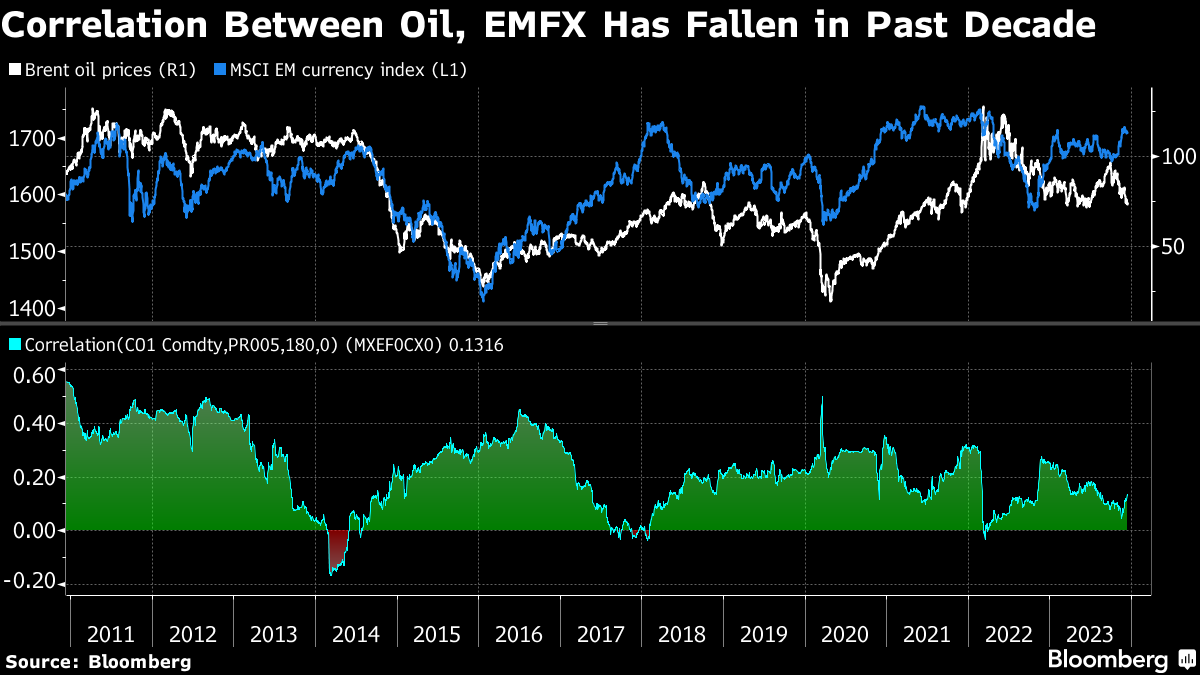

Declining crude prices are also set to boost emerging-market currencies due to the fact the US has become a net oil exporter since the Covid pandemic, according to Bank of America.

“Higher commodity prices are now associated with weaker EM FX, and stronger dollar, the opposite of what happened in 2010-2019,” strategists at the bank including David Hauner in London wrote in a research note this month.

What to Watch

- Hungary's central bank will announce a policy decision on Tuesday after cutting rates by 75 basis points in November. Policymakers in Colombia and Chile also review policy on the same day

- Central banks in Indonesia, Czech Republic, Egypt and Turkey will all announce rate decisions Thursday

- Malaysia will publish November inflation numbers on Friday

--With assistance from Colleen Goko.

(Updates prices in fourth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.