Shares of Nykaa parent FSN E-Commerce Ventures Ltd. rose nearly 6% even after a muted quarterly update as the retail company's customer base and total sales value remained positive.

The online beauty and fashion retailer posted a 5% decline in profit to Rs 12.97 crore in the quarter ended September, in comparison with Rs 13.6 crore in the year-ago period.

The overall gross merchandise volume growth—a measure of the total value of sales—rose 24% in the quarter compared to the year-ago period. The beauty vertical recorded a 29% year-on-year growth in GMV.

The retail firm saw its customer base increase 31% compared to the same period last year, while its physical stores footprint remains strong with 210 stores. There was a 25% growth in retail space, including two new flagship stores launched in Mumbai and Delhi. With a GMV of Rs 3,500 per square feet per month, Nykaa enjoys industry-leading retail store productivity.

The revenue from the beauty segment grew 24% to Rs 1,702.9 crore, while the fashion segment revenue rose 22% to Rs 166.1 crore.

However, Citi retained its 'sell' call and cut the target to Rs 155 per share from Rs 165 apiece earlier, implying a downside of 13.6% from the previous close.

Push for growth keeps margins rangebound and the company missed estimates on higher marketing spends, the brokerage said. Citi lowered its margin estimates for fiscal 2025-26.

Nykaa Share Price Today

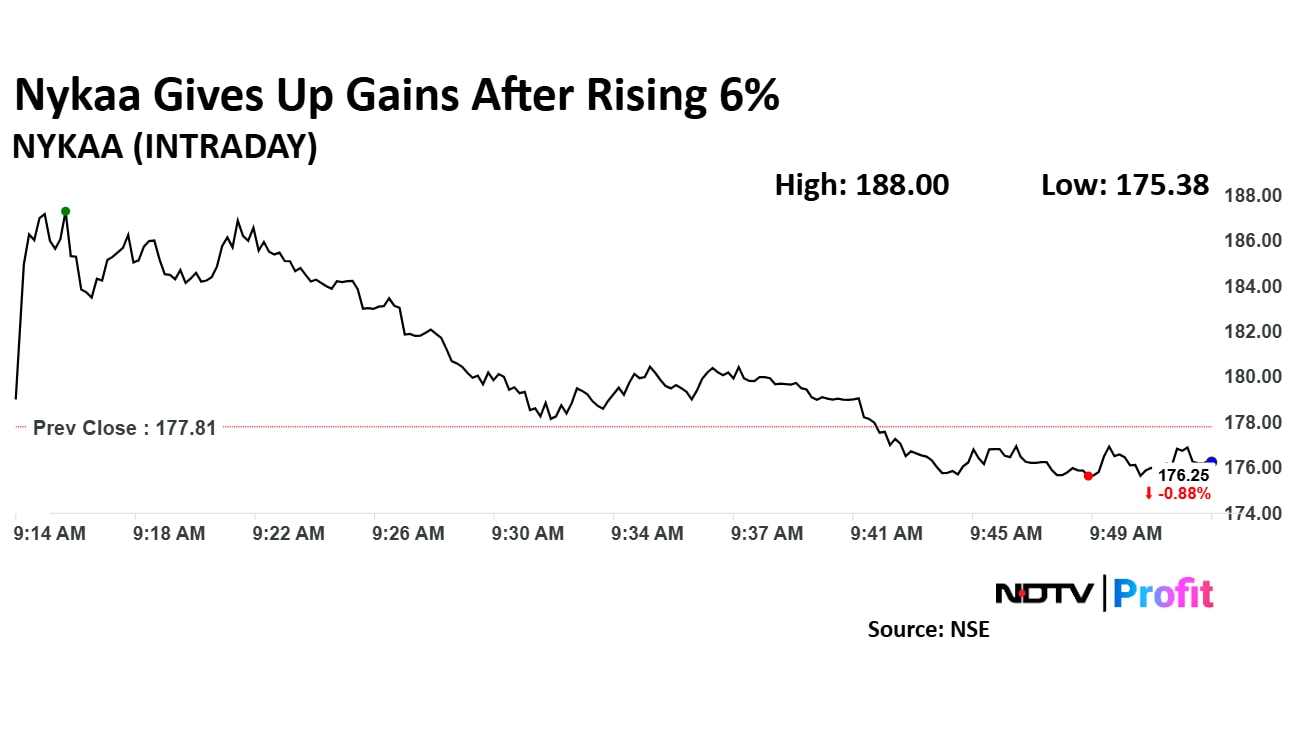

Nykaa's stock rose as much as 5.73% during the day to Rs 188 apiece on the NSE. It gave up gains to trade 0.2%% lower at Rs 177.4 apiece, compared to a 0.5% decline in the benchmark Nifty 50 as of 9:44 a.m.

It has risen 17% during the last 12 months and has advanced by 1.2% on a year-to-date basis. Total traded volume so far in the day stood at one times its 30-day average. The relative strength index was at 37.

Fourteen out of 24 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and five recommend a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.