Shares of FSN E-Commerce Ventures Ltd., operater of online fashion and beauty products platform Nykaa, rose over 5% in early deals on Wednesday after the company reported a multi-fold jump in net profit in the June quarter.

The company's net profit rose 151.7% to Rs 13.64 crore in the first quarter of fiscal 2025, compared to Rs 5.42 crore in the same quarter a year ago Revenue also increased over 22% year-on-year.

FSN E-Commerce Ventures Ltd Earnings Highlight (Consolidated, YoY)

Revenue up by 22.8% at Rs 1,746.11 crore versus Rs 1,421.82 crore.

Ebitda rose 30% to Rs 96 crore from Rs 73 crore.

Ebitda margin at 5.5% versus 5.2%.

Net profit up 151.7% to Rs 13.64 crore versus Rs 5.42 crore.

Citi maintained a ‘sell' rating on the stock based on the company's relative growth/margin outlook. The brokerage has set a target price at Rs 165 apiece, indicating a downside of 11.5% from the closing price of Rs 186.6 apiece on the BSE on Tuesday.

The company's Ebitda fell short of Citi's expectations. Margins at 5.5% of revenues were above last year's figure but below Citi's projection of 5.9%, the brokerage said in a note.

While the 18% YoY growth in contribution profits aligned with Citi's estimates, Ebitda growth of 31% fell 6% short of expectations.

Given the margin trends, Citi has revised its estimates for overall Ebitda margins to 6.2% and 7.9% of revenues for for the fiscals ending March 2025 and March 2026, down from the previous estimates of 6.4% and 8.2%, respectively. Nykaa plans to increase its stake in two of its owned brands—Dot & Key and Earth Rhythm—for a cash consideration of around Rs 300 crore.

In the beauty segment, contribution and Ebitda margins declined by 150 basis points and 20 basis points year-on-year, respectively. This was due to an increased share of eB2B transactions, higher marketing costs and fulfilment expenses aimed at faster delivery. However, ad-monetisation partially offset these costs with a 47% increase on annual basis, according to Citi.

In the fashion segment, growth was weak at 21% on-year, falling short of the medium-term guidance, the brokerage observed.

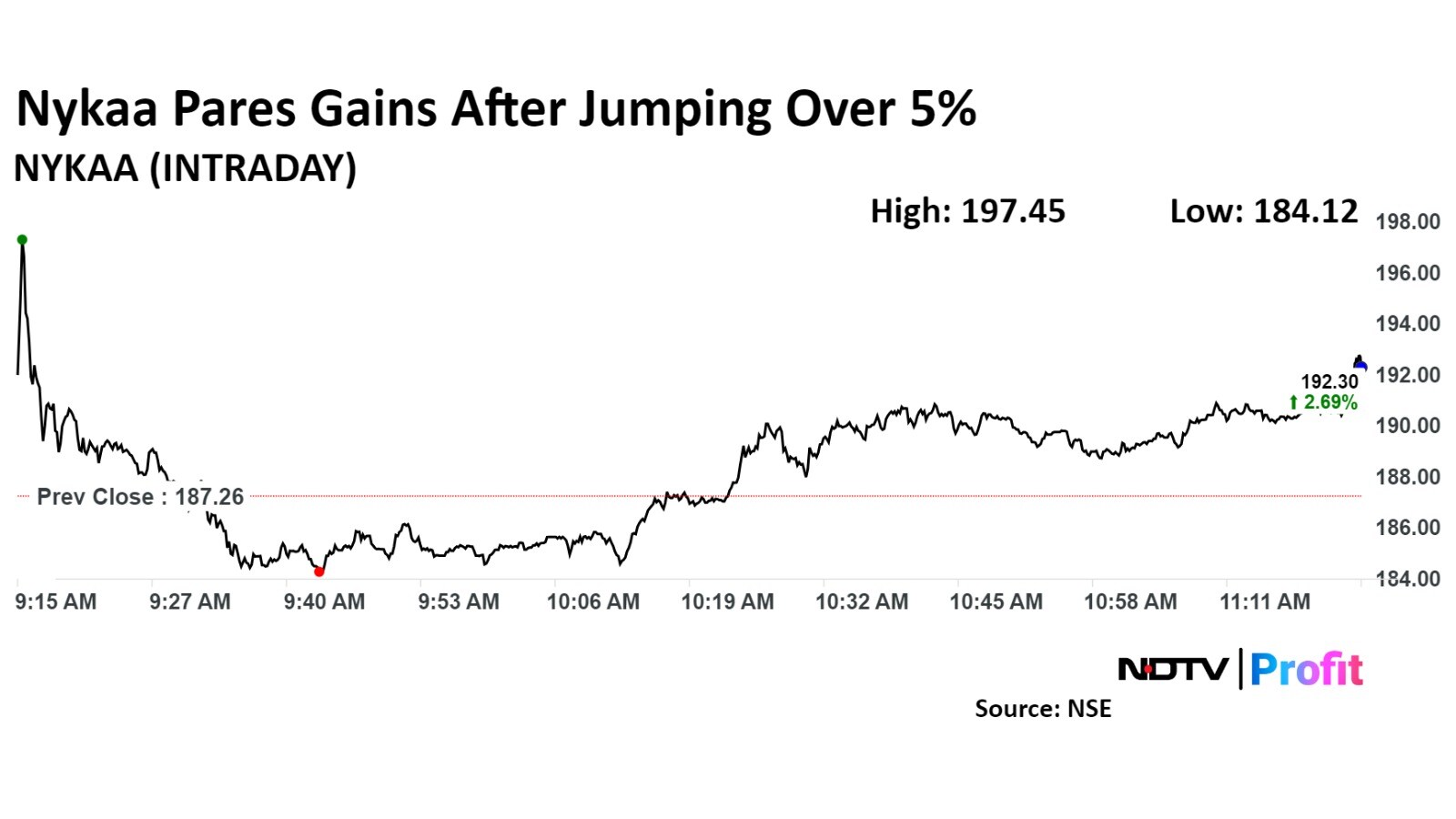

Shares of the company rose as much as 5.4% intraday, the highest level since Aug. 2, before paring gains to trade 2.7% higher at Rs 192.39 apiece, as of 11:25 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 10.7% year-to-date and 44.2% in the last 12 months. Total traded volume so far in the day stood at 1.12 times its 30-day average. The relative strength index was at 55.93.

Out of 19 analysts tracking the company, 14 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.