(Bloomberg) --Nvidia Corp.'s estimate-beating results would be the envy of most companies, but after a more than 800% share-price gain in two years, great is no longer good enough for Wall Street.

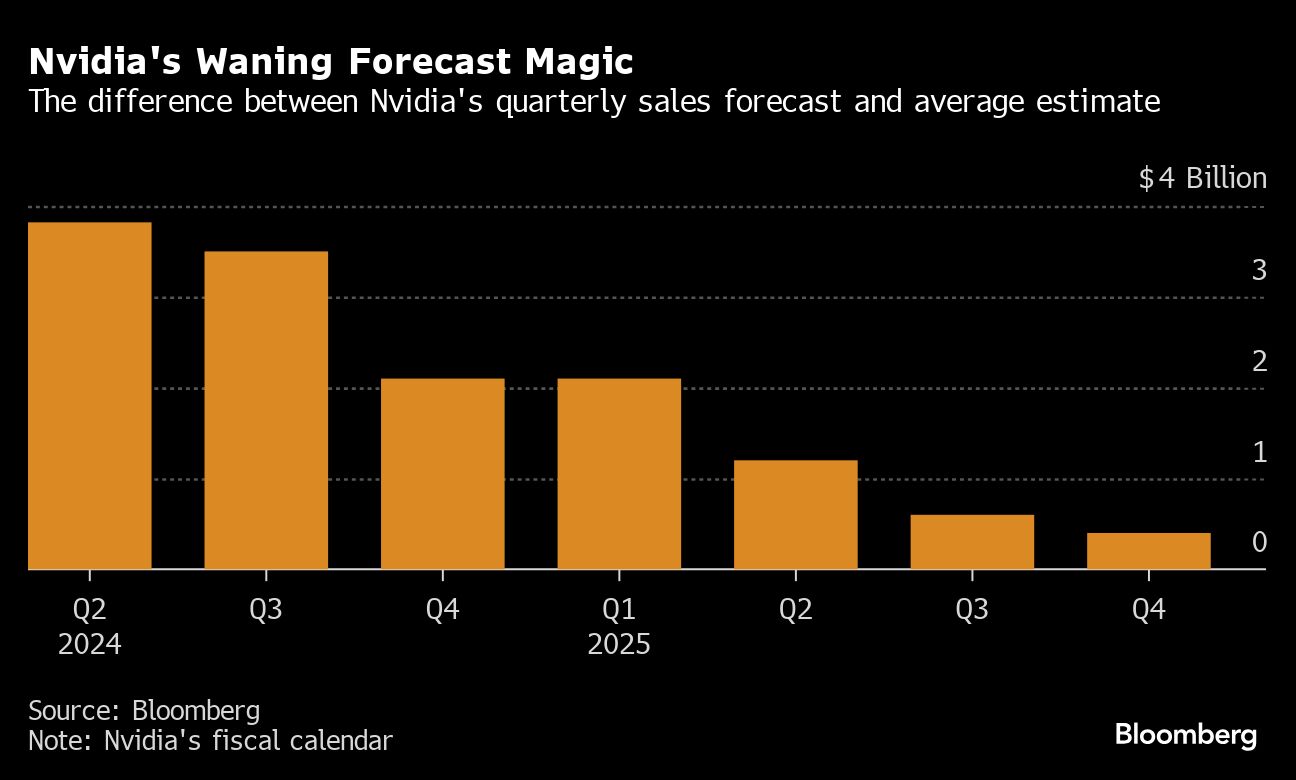

The main sticking point was the revenue forecast for the current quarter, which exceeded the analyst estimate by a mere $400 million. It marked the second-consecutive period that Nvidia's quarterly sales projection didn't top the average analyst estimate by $1 billion or more, suggesting that the hyper growth that has fueled its rally is rapidly fading.

While that didn't exactly trigger the big stock swing that many were bracing for thanks to management's assurances that demand for new Blackwell chips is “staggering,” it's clearly going to be a lot harder to impress investors. Shares flipped between gains and losses in early trading Thursday and were up as much as 4.8% and down as much as 1.1%.

“The market has begun to understand that Nvidia won't be able to deliver that kind of beat every quarter,” said Quincy Krosby, chief global strategist at LPL Financial. “You have to really shoot out the lights, give a real knockout, to see the kind of rallies we have seen in recent quarters.”

Even though there was an unusually large gap between the highest and lowest analyst estimates for fourth quarter sales, the fact that the average was relatively close to Nvidia's forecast shows that after many quarters of wildly underestimating its financial performance, Wall Street has finally caught up.

Prior to Nvidia's fiscal second quarter, which ended in July, its forecast had exceeded the estimate by more than $2 billion for four-straight quarters, starting with the second quarter of fiscal 2024 when Nvidia's forecast beat the estimate by a staggering $3.8 billion.

Investors had been bracing for a potential stock move of about 8% in either direction, based on options market trading. With a market value of roughly $3.6 trillion, Nvidia is the most valuable company in the world and with the heaviest weighting in the S&P 500 Index, its stock moves can have an outsized bearing on the benchmark.

Still, for Jamie Cox, managing partner at Harris Financial Group, a breather for the shares is welcome and “healthy.”

“It means people are paying attention to the reality, which is that this kind of growth is not sustainable,” Cox said. “We shouldn't expect the kind of forecast beats Nvidia has shown in the past. AI isn't going anywhere, but you can't expect 90% revenue growth indefinitely.”

Tech Chart of the Day

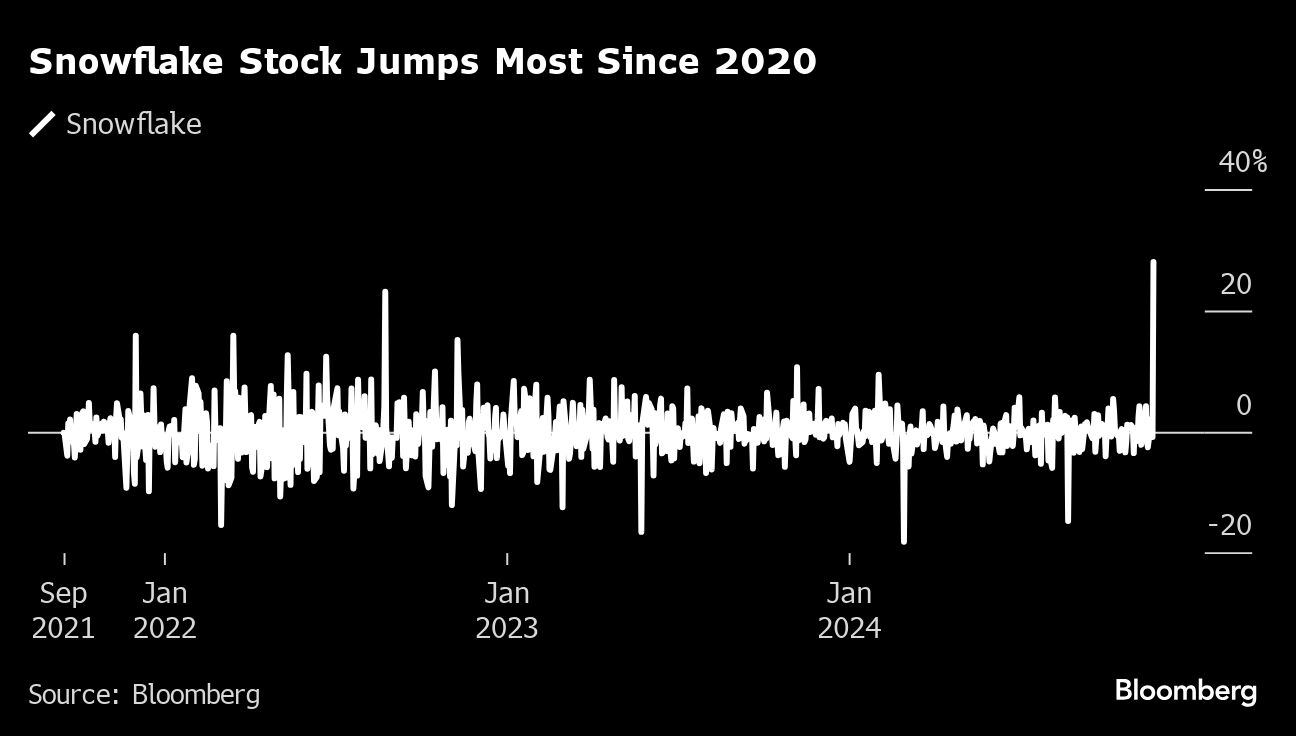

Snowflake Inc. gained as much as 31% Thursday, its biggest intraday jump since September 2020, after the company gave a better-than-expected sales outlook, suggesting newly launched products are receiving a strong reception from customers.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.