The NSE Nifty 50's immediate support level stands at 23,500, with further support near 23,300-23,200, while key resistance is positioned around 23,800, followed by stronger resistance at 23,850, according to analysts.

"Over the past week, the Nifty-50 Index and Sensex remained flat to marginally negative, with the mid-cap index slipping by about 0.45% and the small-cap index down by 1.3%, thus underperforming large-cap indices. Indian markets have lagged behind most global markets as they struggle with both slowing macroeconomic indicators and weaker-than-expected microeconomic conditions," shared Shrikant Chouhan, Head of Equity Research at Kotak Securities.

Additionally, the Q2FY25 earnings season has shown more disappointments than positives, noted Chouhan.

On the technical front, a doji candle formation has appeared near the Nifty's 200-Day Exponential Moving Average (DEMA) support level, signaling uncertainty in the trend. The 200-DEMA, positioned around 23,540, sets up the 23,500-23,540 range as an immediate support zone for the index, according to Hrishikesh Yedve, AVP of Technical and Derivatives Research at Asit C. Mehta Investment Intermediates Ltd.

"A strong break below 23,500 will push the index further down to 23,300-23,200, where a trend line support is situated. Overall, the short-term trend is down, but as long as Nifty holds above 23,500, a pullback rally could be possible," Yedve shared.

The Bank Nifty closed the day on a positive note, reaching 50,180 levels. Yedve highlighted that “Technically, the index on a daily scale has formed an inverted hammer candle near the crucial support of 200-DEMA, indicating strength.”

With the 200-DEMA support positioned near 49,900, any sustained levels above this support could lead to a pullback rally toward 50,500-50,600, where a short-term trendline resistance is observed. Despite a downtrend in the short term, as long as Bank Nifty stays above 49,900, a pullback remains possible, he further shared.

FII/ DII Activity

Overseas investors remained net sellers of Indian equities for the 34th consecutive session on Wednesday, while domestic institutional investors stayed net buyers.

Foreign portfolio investors sold stocks worth Rs 1,849.87 crore, and DIIs mopped up stocks worth approximately Rs 2,481.81 crore, according to provisional data shared by the National Stock Exchange.

F&O Cues

Nifty November futures are down by 0.16% to 23,601 at a premium of 69 points, with the open interest up by 2.7%.

The open interest distribution for the Nifty 50 Nov. 14 expiry series indicated most activity at 26,500 and maximum put open interest at 22,500.

Market Recap

The NSE Nifty 50 and the BSE Sensex ended lower for the second consecutive week in a row on Thursday as earnings from India Inc. continued to weigh on investors' sentiment.

An increase in safe-haven assets like the dollar index and the US Treasury yields weighed on risk assets like emerging markets' equities, which affected Indian stock markets as well.

The Nifty 50 closed lower for the sixth session in a row and recorded the worst declining streak since Oct. 7. The Nifty 50 ended 26.35 points, or 0.11%, lower at 23,532.70, and the Sensex closed 110.64 points, or 0.14%, down at 77,580.31.

Major Stocks In News

Reliance Power: The company received a show-cause notice from SECI for allegedly submitting a fake bank guarantee. According to SECI, a subsidiary of the company provided a bank guarantee purportedly issued by the Manila branch of First Rand Bank. However, First Rand Bank India has confirmed that no such branch exists. SECI stated that this conduct suggests a malafide intent to manipulate the tender's outcome. The show-cause notice demands an explanation from the company as to why criminal proceedings should not be initiated against the company.

Reliance Industries: The company and Disney completed a transaction to form a joint venture for entertainment brands in India. The company invested Rs 11,500 crore in growth capital in the JV. The JV will be spearheaded by 3 CEOs. The transaction values of the JV are at Rs 70,352 crore on a post-money basis. The JV is controlled by RIL and owned 16.34% by RIL, 46.82% by Viacom18, and 36.84% by Disney.

GAIL: The company signed a 10-year pact with ADNOC Gas for the delivery of up to 0.52 MMTPA LNG.

Prestige Estate: The company acquired 22,135 sq. meters of land worth Rs 292 crore in Mumbai for residential development.

Expleo Solutions: The board approved the incorporation of a new wholly owned subsidiary in Saudi Arabia.

SEPC: The board approved raising up to Rs 350 crore via rights issue.

ACME Solar: Udaipur DGGI initiated a search at the company's head office in Gurugram, Haryana.

KPI Green: The board recommended the issuance of 1 bonus share for every 2 shares held.

Global Cues

Stocks in the Asia-Pacific region came under pressure on Monday as the Federal Reserve Chair Jerome Powell's comments continued to weigh on the markets, and traders assessed the implications of the US president-elect Donald Trump's new trade policies.

Equity benchmarks in Japan and Australia led to losses during the session opening. The Nikkei was 408 points, or 1.07%, lower at 38,232, while the S&P ASX 200 was down 16 points, or 0.16%, at 8,269 as of 5:40 a.m.

Fed Chair Powell said on Thursday that the US economy's recent performance has been “remarkably good,” and the economy is "not sending any signals that we need to be in a hurry to lower rates.”

Stocks in the US closed last week lower as they erased more than half of the post-election rally with 'Trump Trades' losing steam. The S&P 500 and Dow Jones Industrial Average plunged 1.32% and 0.70%, respectively, while the tech-heavy Nasdaq Composite declined 2.24%.

The dollar increased by 1.4% last week, notching a seventh straight weekly gain while the treasury yields rose after Powell's commentary. The 10-year yield stood at 4.44%.

Brent crude was trading 0.10% lower at $70.97 a barrel as of 6:00 a.m. IST. West Texas Intermediate was down 0.27% at $66.84.

Key Levels

US Dollar Index at 106.67

US 10-year bond yield at 4.44%.

Brent crude down 0.15% at $70.93 per barrel.

Bitcoin was up 0.89% at $89,940.63

Gold spot was up 0.33% at $2,571.66

Money Market

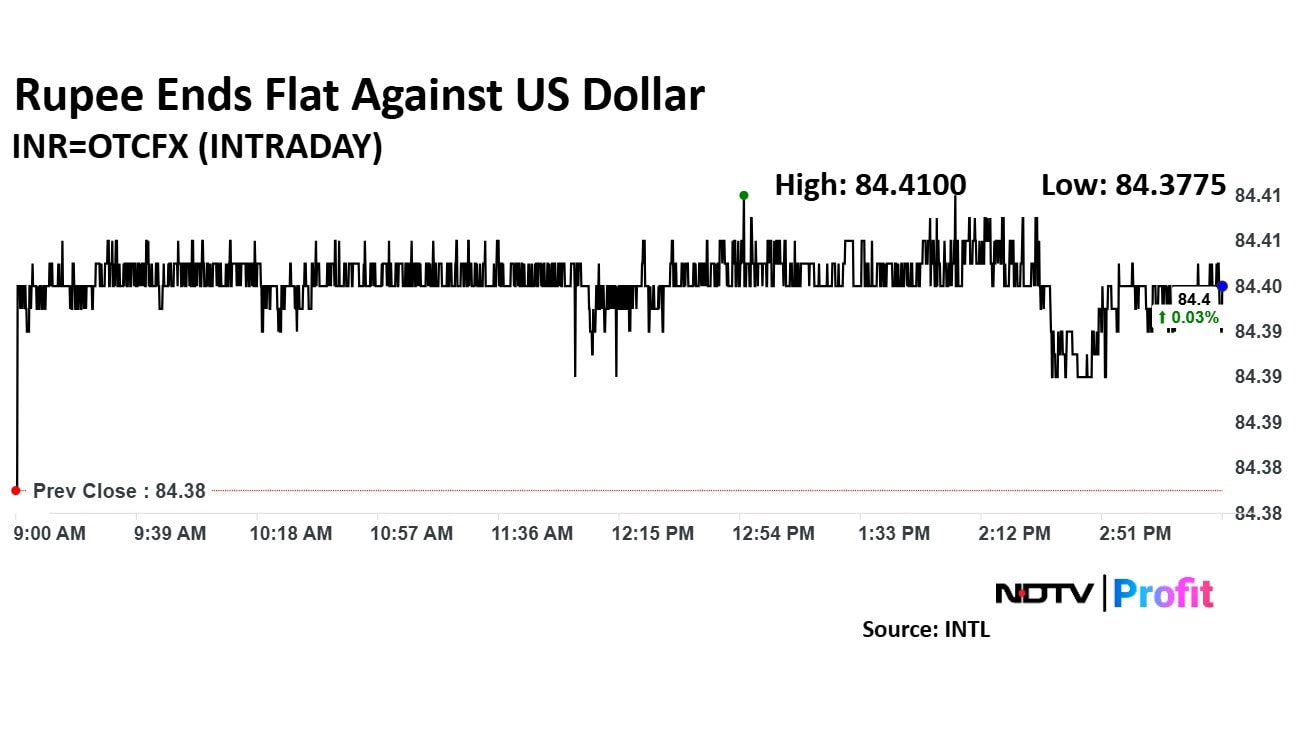

The Indian rupee closed flat at 84.39 against the US dollar on Thursday. It had opened at a record low after falling by 3 paise at 84.41. It had closed at 84.39 on Wednesday.

The opening marked the rupee's weakest level amid continued dollar strength and high yields.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.