India's steel demand and capacity expansion among private players could place it above China in the battle for steel supremacy, according to Moody's.

The rating agency did a comprehensive analysis and compared both countries in terms of demand prospects, market dynamics, and resource advantages.

Here is a look at the factors that could position India as a stronger player in the global steel market, as compared with China:

India Steel Demand

India's steel demand is projected to grow by 5-7% over the next 12-18 months, driven by robust economic and population growth, rapid industrialisation and urbanisation, and supportive government policies, Moody's said in its report. In contrast, China's steel demand is expected to decline slightly, due to a sluggish property market and slower economic growth.

India's real GDP is forecasted to grow at 6.6% in fiscal 2025 and 6.2% the following year, outpacing China's projected real GDP growth of 4% for both years, as per a Moody's report issued on May 8.

The higher growth rate in India is supported by significant government capital spending, policy reforms, robust manufacturing activity, and infrastructure development.

China faces challenges, including property sector weakness, fiscal strain in regional governments, and geopolitical tensions.

Market Dynamics: India's Expanding Capacity

India's National Steel Policy aims to nearly double crude steel capacity to 300 million tonne by 2030.

Major steelmakers like Tata Steel Ltd. and JSW Steel Ltd. are heavily investing to expand their production capacities. Despite this, India will still trail China in total production volume, with the neighbouring country producing around 1 billion tonne of crude steel in 2023, as compared with India's 140 million tonne in the same year, as per the report.

The combination of China's overcapacity and India's capacity growth is likely to exert downward pressure on steel prices. China's high production levels and rising exports, driven by domestic oversupply, will increase steel supply in the region.

In India, strong demand will stimulate further steel imports from China, potentially harming local steel prices despite protective measures like anti-dumping duties.

Fragmentation Vs Consolidation

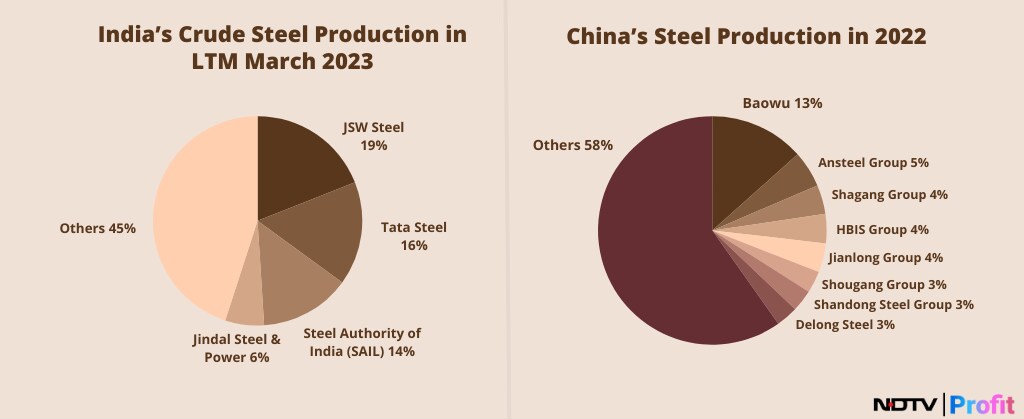

India's steel industry is less fragmented as compared with China's, enabling better pricing discipline and operational efficiency. In a more consolidated market, such as India's, major companies can manage production levels in response to demand fluctuations, avoiding the pitfalls of overproduction that lead to price drops.

China's fragmented industry, on the other hand, fosters intense competition and can result in oversupply, especially during periods of low demand.

In 2022, China's ten largest steel producers contributed 44% of the nation's steel output, whereas India's five largest producers accounted for around 60% of the country's total steel production in the last 12 months ending March 2023, Moody's said.

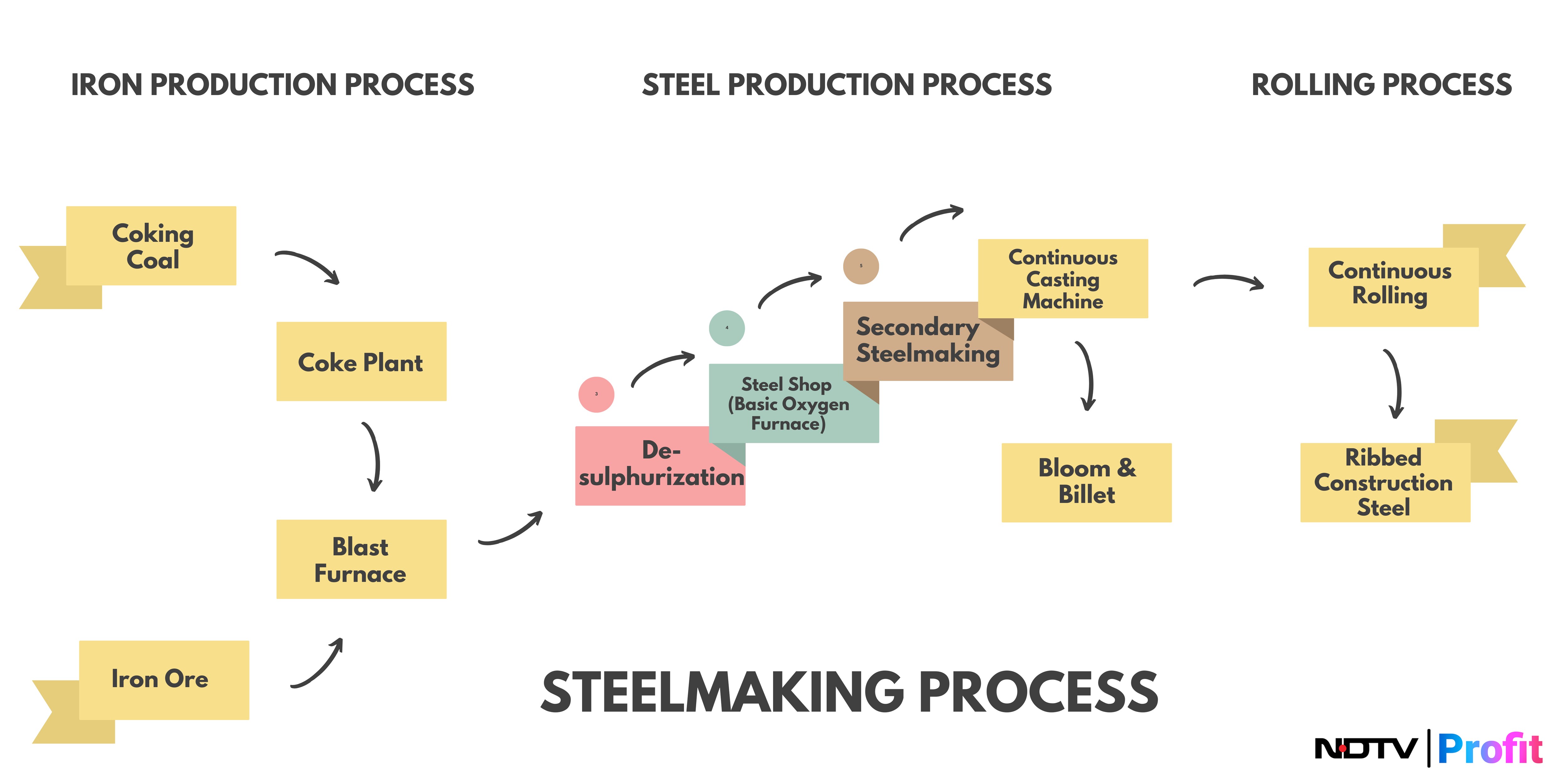

Resource Advantage: Iron Ore Vs. Coking Coal

Both China and India mainly utilise the blast furnace method for steel production, relying on iron ore and coking coal as the primary raw materials.

India benefits from substantial iron ore reserves, which allow for higher vertical integration among steelmakers, resulting in better profit margin.

However, China has a competitive edge in coking coal import costs, primarily sourcing from Mongolia ($133 per tonne) and Russia ($156 per tonne), while India relies on more expensive Australian ($263 per tonne) coking coal.

Indian Steelmakers' Credit Metrics

Indian steelmakers are expected to maintain higher margin and lower leverage than their Chinese counterparts over the next 12 months, according to Moody's. This strength is supported by robust domestic demand, higher selling prices, and greater self-sufficiency in iron ore. Conversely, high debt levels will likely continue to burden Chinese steelmakers, contributing to higher leverage ratios.

As per data, Indian steelmakers generated on average an Ebitda margin of 13.2%, as compared with only 8.6% for Chinese companies. The average leverage, as measured by Moody's-adjusted debt/Ebitda, of Chinese steelmakers was 8.9 times—much higher than the average of 3.6 times for Indian companies.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.