A packed week lies ahead, with the stage set for the closing show of India's longest-drawn elections, a highly anticipated India versus Pakistan cricket match, India's monthly mutual funds data, and crucial economic data releases across the globe, all vying for attention.

Modi's swearing-in as the country's Prime Minister for a historic third term will be setting the tone for the week ahead, while traders closely watch for India's inflation data and the US Federal Open Market Committee's policy later in the week.

The first week of June saw significant volatility in the markets as uncertainty around the Lok Sabha election results led to a panic selling on Tuesday, where FIIs recorded the highest-ever single-day sell-off of Rs 12,436 crore. However, the benchmarks recovered over the course of the week as the Bharatiya Janata Party was able to secure the support of major regional allies like Andhra Pradesh's Chandrababu Naidu and Bihar's Nitish Kumar.

The week ended with the Modi-led National Democratic Alliance staking claim to form the new government at the centre.

The effectiveness of policies implemented by the coalition government will determine India's growth trajectory for the next five years, if not more, according to Moody's Analytics' Aditi Raman.

The union budget, due in the September quarter, will be an early indicator of policy priorities, including short- and long-term responses to some key economic challenges, the economist said.

The Reserve Bank of India kept the repo rate unchanged for the eighth consecutive time, while maintaining its stance at 'withdrawal of accommodation'. It also revised upwards India's fiscal 2025 GDP growth target to 7.2% from 7%.

Despite positive cues, there may not be a runaway rally in the market, according to Aditya Agarwala, head of research and investments at Invest4edu.

"Markets might see some profit-booking on Monday, despite some exuberance during the opening."

Markets This Week

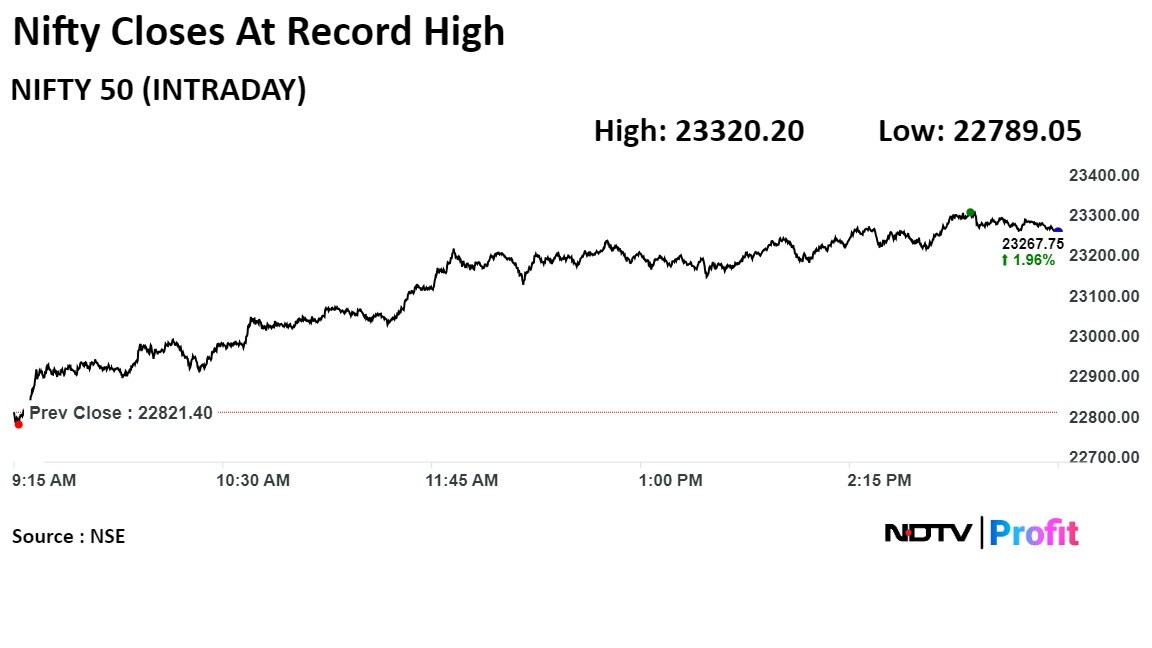

The benchmark equity indices recovered from their loss on counting day and recorded their highest close on Friday, as heavyweights led the rally.

On a weekly basis, the NSE Nifty 50 gained 3.37% and the S&P BSE Sensex gained 3.69%.

.jpeg)

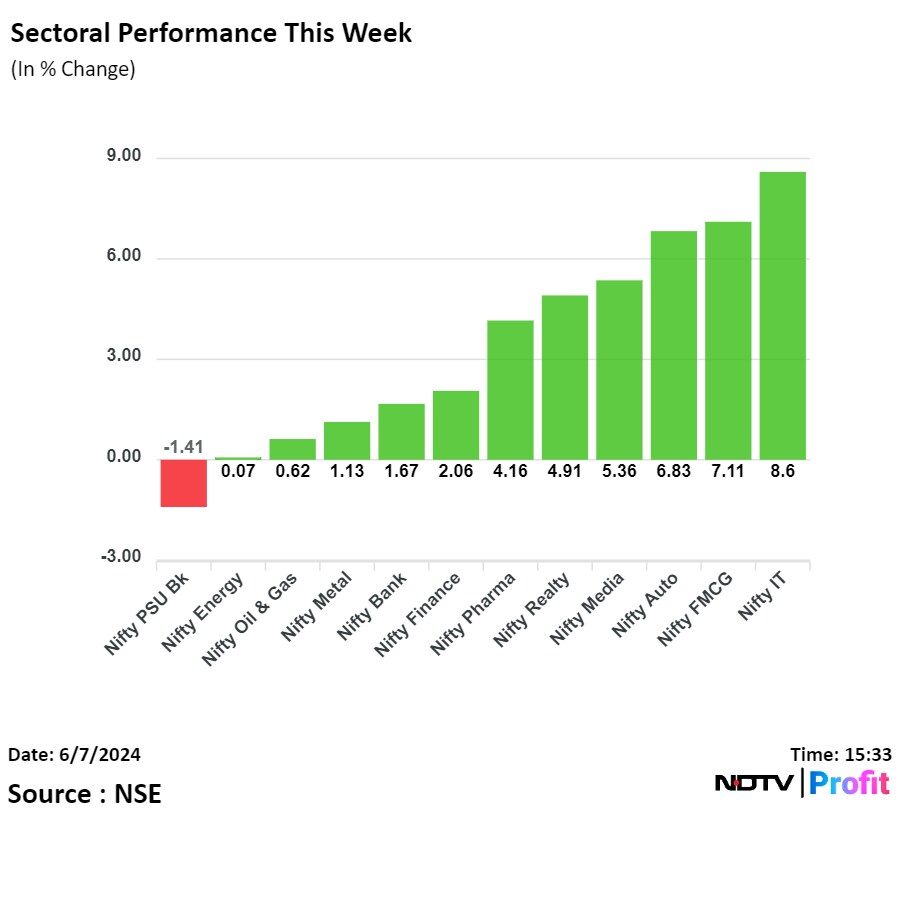

Most sectoral indices on the NSE ended the week higher. Nifty IT gained nearly 9% and Nifty PSU Bank was the only index that ended with weekly loss.

All 20 sectoral indices on the BSE rose, with the BSE Telecommunication rising the most.

The broader markets underperformed; the BSE MidCap closed 1.28% higher and the BSE SmallCap ended 2.18% up.

The market breadth was skewed in the favour of the buyers as 2,889 stocks rose, 970 fell and 93 remained unchanged on the BSE.

F&O Cues

Nifty June futures were up by 1.9% to 23,325.15 at a premium of 35 points, with its open interest down by 2.5%. Nifty Bank June futures were up by 1.01% to 49,908 at a premium of 105 points, while its open interest was up by 0.34%

Open interest distribution for the Nifty June 13 series indicated that the 23,000 level was seeing the most put strikes, and call strikes of 24,000 had the maximum open interest.

For the Bank Nifty options' June 12 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 47,000.

On the upside, the immediate resistance for Nifty is placed near the 23,340 level. If the index sustains above that, the rally could extend to 23,500-23,800 levels, according to Neeraj Sharma, AVP technical and derivatives research at Asit C. Mehta Investment Intermediate Ltd.

"On the downside, immediate support for the Nifty is placed near 23,000, followed by 22,560, where the 34-Day Exponential Moving Average support is placed. Traders are advised to take some profit off the table," he said.

Domestic Cues

As the BJP has managed to consolidate majority support via the NDA coalition, the next big event that domestic investors will be watching out for is the portfolio allocation under the new government.

The spotlight will remain on how negotiations play out between the BJP and its two key allies—Telugu Desam Party and Janata Dal (United)—each of which is batting for plum posts at the centre.

Maharashtra Chief Minister Eknath Shinde's Shiv Sena faction and Chirag Paswan's Lok Janshakti Party are also seeking key portfolios in Narendra Modi's new cabinet.

The Association of Mutual Funds in India will be releasing its monthly data on mutual fund flow for May on June 10. In April, mutual funds saw highest-ever inflows, while SIP contributions reached a new peak of Rs 20,371 crore.

On the macro front, investors await India's Consumer Price Index and Index of Industrial Production data, which will be released on June 12. Wholesale Price Index data for May, to be released by the Ministry of Commerce on June 14, will also provide a view on producer price inflation.

The second week of June will also see the commerce ministry releasing the merchandise trade data for the previous month.

Meanwhile, India's cricket team will face arch rivals Pakistan in the ninth edition of the ICC Men's T20 World Cup on Sunday, June 9. Team India goes into the highly-anticipated clash after a comfortable victory against Ireland on June 5.

Global Cues

The US will see a slew of data coming in, including the Federal Open Market Committee's policy decision on June 12, which will follow a landmark rate cut, the European Central Bank announced earlier this week. Economists surveyed by Bloomberg expect Fed Chair Jerome Powell to announce a status quo for interest rates in his speech, but a few hours before that, the country's Bureau of Labor Statistics will be releasing its annualised and sequential CPI data for May.

In Japan, the central bank will be announcing its decision on interest rates after raising rates in March for the first time since 2007.

The three most prominent oil forecasters, OPEC, the EIA and the IEA, will publish their monthly market outlooks during the week as well.

Primary Market Action

Following relatively subdued activity in the primary markets in the last five sessions, the week starting June 9 will see only one mainboard public offering, and a new listing.

Le Travenues Technology, which operates travel booking platform Ixigo Ltd., will open its Rs 740 crore initial public offering for retail subscription on June 10, with a price band of Rs 88-93 per share.

The Gurugram-based company has already raised Rs 333 crore from anchor investors.

Vadodara-based Kronox Lab Science, a mainboard IPO having price range of Rs 129-136 per share, will be listing on both NSE and BSE on Monday. The IPO was subscribed 117.25 times by the last day of offer.

Corporate Action Ahead

On the corporate actions front, Dr Lal Pathlabs Ltd., Asian Paints Ltd., Bajaj Auto Ltd., and several Tata and Adani group companies will be the big names that have record dates for their final, special, or interim dividend in the coming week.

Meanwhile, Motilal Oswal Financial Services Ltd. will be issuing bonus shares in the ratio of 3:1 during the week.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.