Shares of mining and metal companies fell on Wednesday after the apex court of India allowed states to collect past royalty dues from April 1, 2005, under certain conditions.

The Supreme Court held that its nine-judge bench verdict on the nature of mining royalty and the state's power to tax mineral rights will be given retrospective effect, subject to conditions.

States will not be allowed to tax transactions made prior to April 1, 2005. The tax payment can be staggered over 12 years, commencing from April 1, 2026, it said.

Additionally, interest and penalties on demands for periods prior to July 25, 2024, shall be waived, the apex court said.

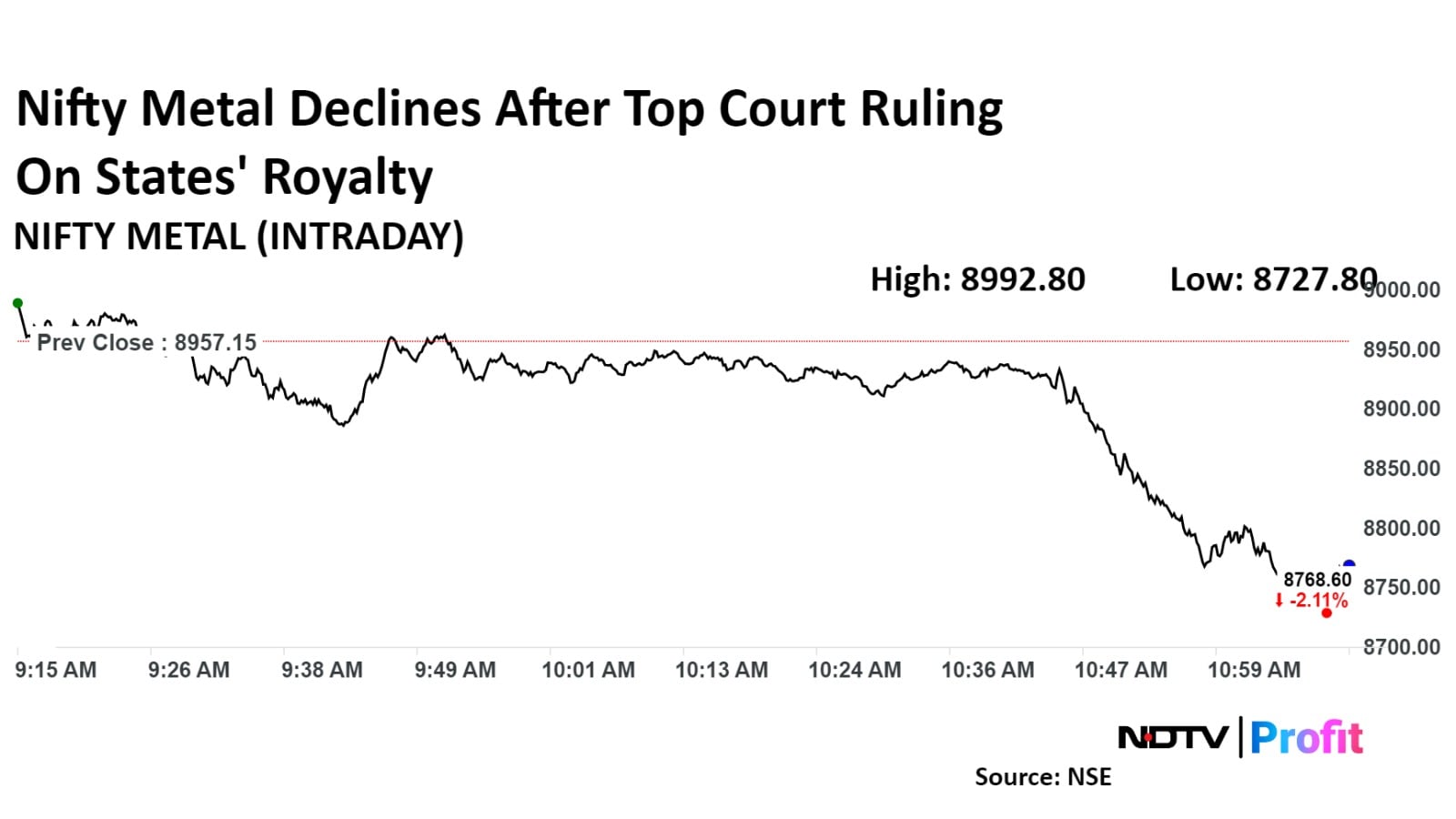

The Nifty Metal index declined as much as 2.5% to a two-month low as investors feared the impact of tax liabilities on companies' balance sheets even as headwinds persist for the sector on demand worries. All 15 constituent companies from private and public sector dragged.

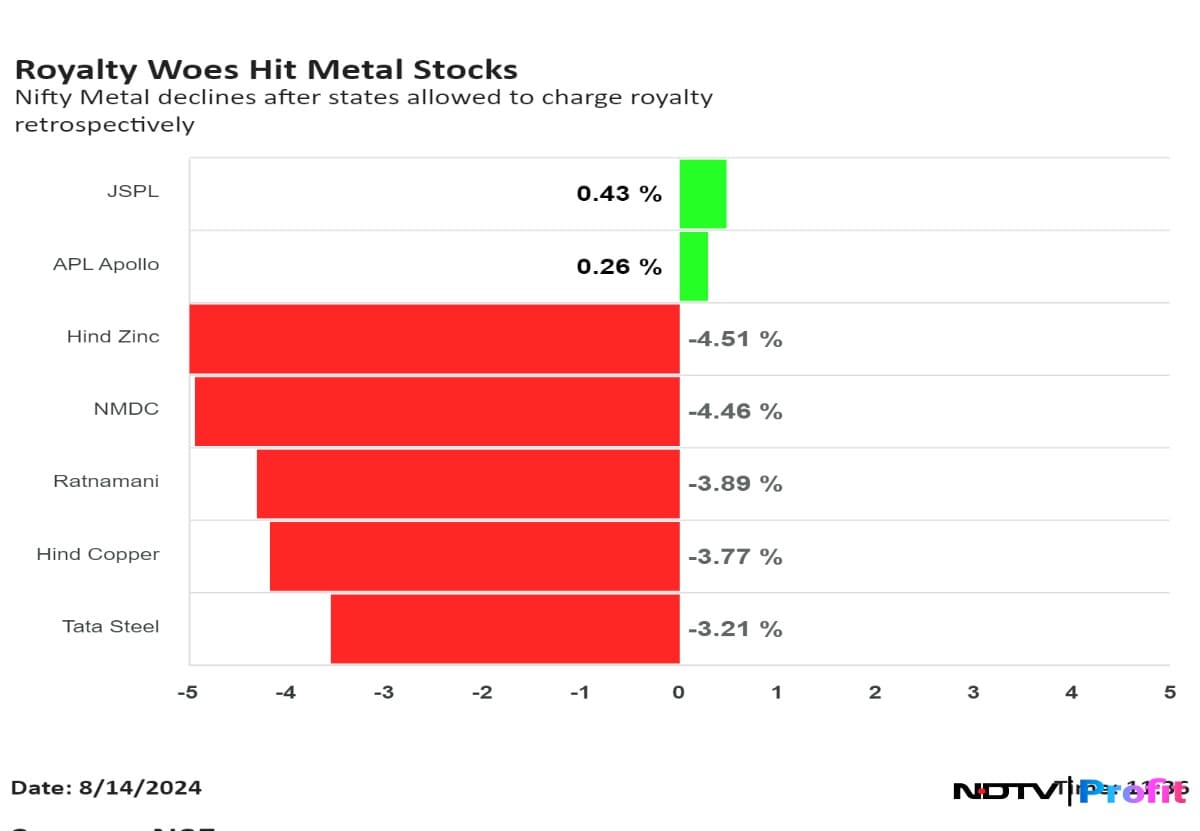

Hindustan Zinc Ltd. and NMDC Ltd. fell over 4%, while Hindustan Copper Ltd., Tata Steel Ltd. and Ratnamani Metals and Tubes Ltd. dropped over 3%.

Axis Securities Ltd analyst Aditya Welekare said the market will asses if companies like Hindalco Industries Ltd, Vedanta Ltd and Nalco Ltd announce contingent liabilities, like Tata Steel did, but more importantly if the court ruling goes for an appeal.

Key Highlights

Tax on mineral wealth to be applied retrospectively.

Companies to pay tax on mineral wealth to states.

To pay taxes liable from 2005 to July 25, 2024.

States will be able to collect tax over a period of 12 years.

Solicitors expect impact of Rs 70,000-80,000 crore. (Note- This includes interest and penalty, which the court has waived on demands for period prior to July 25, 2024)

Negative for Coal India, Hindustan Zinc, NMDC, Hindustan Copper, MOIl, NALCO, NMDC Steel, SAIL.

Advocates expect demand upwards of Rs 1 lakh crore.

Tata Steel has already provided contingent liability of Rs 17,347 crore.

Negative for Vedanta Ltd., Hindalco Industries, JST Steel Ltd., Tata Steel Ltd. and cement firms.

In a landmark judgment delivered last month, a nine-judge bench of the top court ruled that royalty paid by a mining leaseholder to the lessor was not a tax but a contractual consideration for enjoyment of mineral rights. The court said the legislative power to tax mineral rights rests with state legislatures, and the Parliament does not have the legislative competence to tax mineral rights.

The ruling put an end to a 35-year-old controversy regarding the nature of mining royalties paid by the leaseholders. However, as soon as the top court pronounced the judgment, the lawyers questioned the court regarding its applicability, meaning whether the judgment would be applied retrospectively or prospectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.