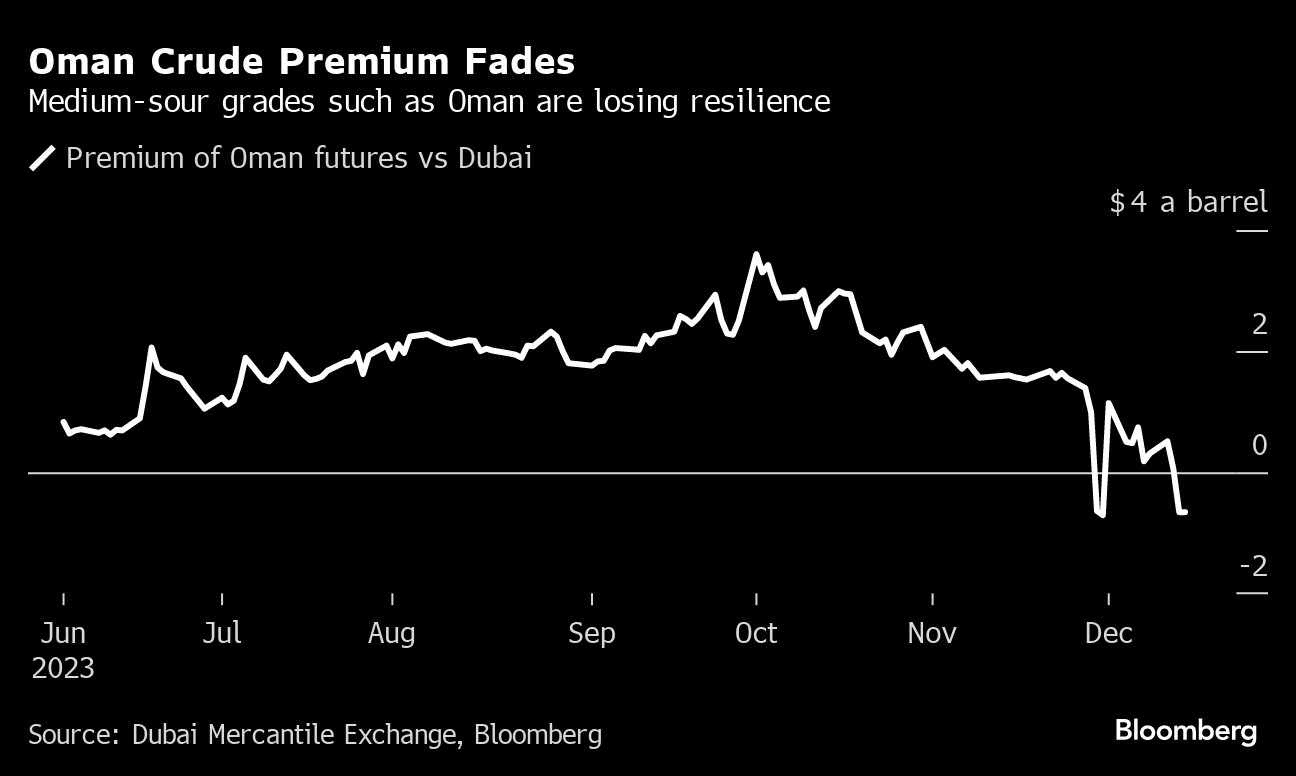

(Bloomberg) -- In a typically resilient corner of global oil markets, crudes similar to those being withheld by Saudi Arabia are plunging in a latest sign of fundamental weakness.

So-called medium sour oil from the Middle East is plummeting against the region's Dubai benchmark on the back of muted Chinese demand and a spike in prompt supplies, said traders. Last week, Qatar's Al-Shaheen grade traded at a discount to the marker for the first time since October 2020, while Oman prices also dipped.

Medium-density crudes with high sulfur content have found support in the past year from prolonged Saudi cuts and robust diesel margins. Their demand has also been bolstered by Asian refiners, which have enjoyed better profits than their European counterparts because of uneven economic conditions and fuel consumption growth. This corner of the market was also spared from a spike in US output, which is mostly lighter and sweeter in quality.

Traders attributed the slowdown in Chinese crude buying to the drawdown of government-issued quotas needed for imports. Meanwhile, lower trading volumes during the holiday season might have also contributed to more drastic price swings, on top of flows of Venezuelan crude and fuel oil to nations such as China and India.

“There's clearly some weakness in Asian buying right now and China is at the heart of Asian demand,” said Christopher Haines, global crude analyst at Energy Aspects. Extended maintenance at a refinery in Oman also translated to less domestic use and more exports, pushing Dubai into bearish contango structure, he said.

In China, refining margins have slumped to 6.55 yuan ($0.92) a ton in the week to Nov. 30, compared with more than 700 yuan at the end of September, according to Mysteel Oilchem. The nation also imported far less crude in November and reduced processing rates to a nine-month low.

Aside from physical trades, market weakness has also been observed in timespreads. In the Dubai oil market, prompt contracts fell to a discount to later-loading supplies for the first time in more than a year in what's known as contango.

Read More: The Oil Market's Latest Setback: Contango Everywhere

In Europe, demand for medium-sour varieties has continued to struggle after some weakness over the past month. Norway's Johan Sverdrup has been hovering at a discount of $2 a barrel to its regional benchmark versus a premium of around $2 in early November.

Paris-based International Energy Agency said global oil demand growth is slowing down sharply, slashing estimates by almost 400,000 barrels a day for the fourth quarter. Refinery run rates are “materially weaker” than expected, according to its monthly report.

--With assistance from Serene Cheong and Sherry Su.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.