Marico Ltd. has reported a robust business update for the second quarter of financial year 2025, showcasing a stronger-than-expected performance. Brokerages such as Nomura and Nuvama have reacted positively to the update, maintaining their 'buy' ratings and target prices of Rs 780 per share for the stock. The stock was also upgraded to 'add' from 'reduce' by Emkay.

In its latest report, Marico indicated a consolidated revenue growth of high-single digits year-on-year, closely aligning with Nomura's estimate of 8%. Volume growth in India also showed signs of recovery, registering mid-single-digit growth, slightly above the expected 4%. The company attributed this uptick to improved performance in its flagship Parachute coconut oil brand.

Key Highlights from the Update

1. Segment Performance

Parachute Coconut Oil: Reported mid-single-digit volume growth, recovering from a weaker 2% in the previous quarter. This was aided by double-digit value growth, attributed to previous pricing interventions despite recent grammage adjustments.

Saffola Edible Oils: Showed low-single-digit sales value growth, slightly below the anticipated 5%. Notably, pricing growth transitioned from negative to flat-to-positive for the first time in eight quarters.

Value-Added Hair Oils: Sales remained subdued due to heightened competition, although management anticipates improvement through increased promotional activities.

Foods and Digital-first Brands: Continued strong performance, meeting the company's growth aspirations.

International Business: Delivered impressive low-teen constant currency sales growth, outperforming expectations. Bangladesh reported high-single-digit growth despite a challenging operating environment.

2. Margin Trends: The gross margin is expected to contract year-on-year as rising input costs, particularly in copra and edible oils, weigh on profitability. While the Ebitda growth is anticipated to lag behind revenue growth, Marico is prioritising volume expansion over immediate margin recovery.

3. Outlook: Marico forecasts a shift towards double-digit consolidated revenue growth in the latter half of financial year 2025, despite ongoing inflationary pressures on raw materials. The company remains optimistic about managing competition from unorganised players and believes that recent price hikes will support future growth.

Analysts' Perspectives

Nomura analysts have emphasised that Marico's ability to navigate the competitive landscape, coupled with its strategic pricing actions, bodes well for its growth trajectory. It maintains a 'buy' rating on the stock, highlighting an expected EPS CAGR of 13% from financial year 2024 to financial year 2027.

Nuvama also reflects a positive sentiment, noting that Marico's solid update offers reassurance amid a generally weaker performance in the sector. It expects sustained growth in the international markets and a gradual improvement in the domestic business.

Emkay also upgraded Marico to 'add' from 'reduce', with 12% upside. Given the improving demand setting, thrust on enhancing distribution, emerging moderate inflation in core (coconut oil, edible oil), and healthy growth in the new engine (premium personal care, digital brands, foods), the brokerage expects better growth and earnings delivery ahead.

"For edible oil, while prices turn neutral (-ve earlier) in Q2, we expect price hikes (with custom duty pass-through) in 2H to induce double-digit growth," the brokerage said.

It also raised valuation multiple to 50 times (15% premium to the average 5YF P/E) from 47 times, building in better demand and steady execution.

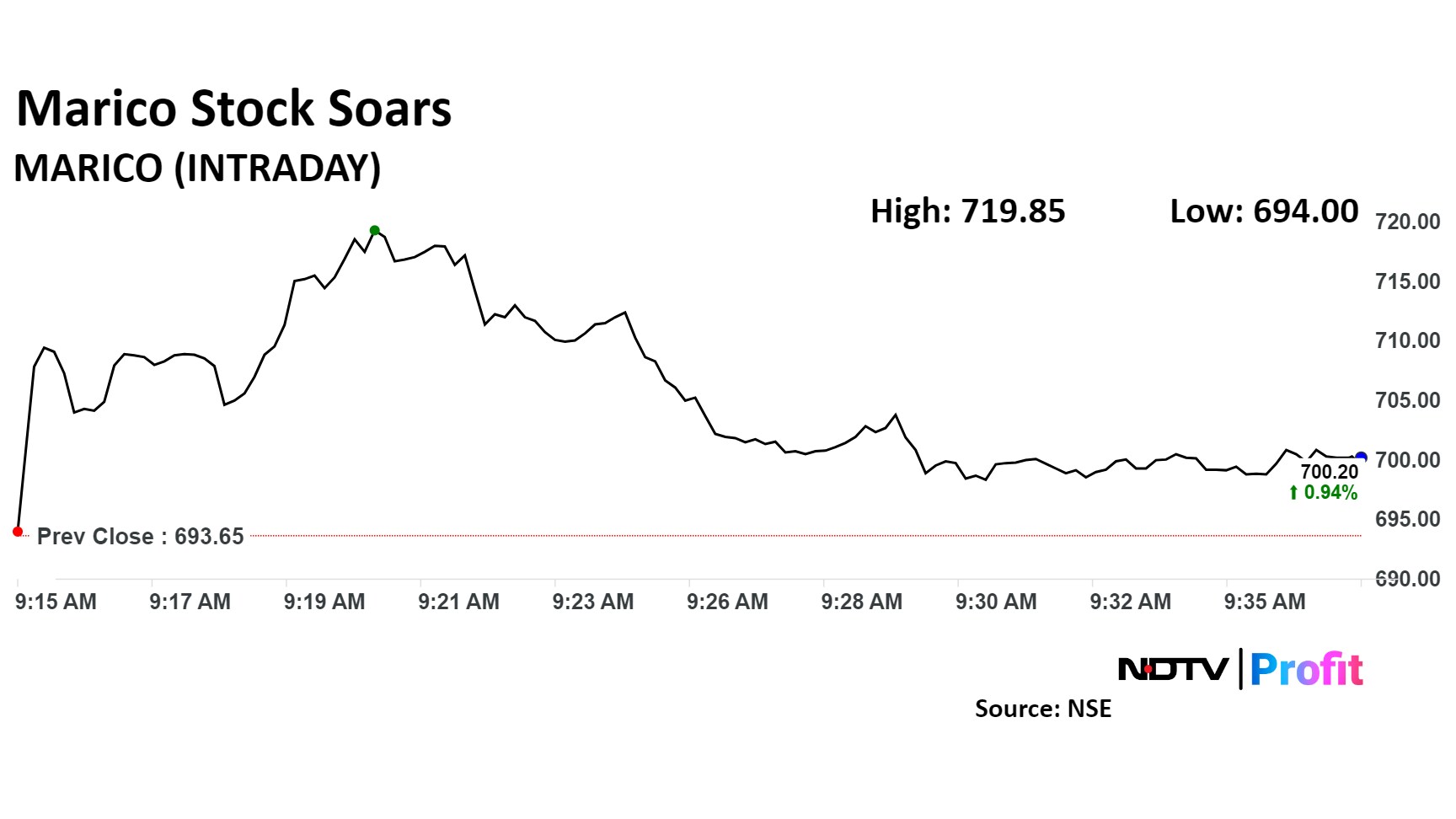

Marico Share Price

Shares of Marico Ltd. rose as much as 3.78% before paring gains to trade 1.19% higher at Rs 701.90 apiece, as of 09:32 a.m. This compares to a 0.79% decline in the NSE Nifty 50.

The stock has risen 21.92% in the last 12 months. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 59.

Out of 41 analysts tracking the company, 29 maintain a 'buy' rating, seven recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.