Shares of Honasa Consumer Ltd., the parent of FMCG brands Mamaearth and The Derma Co., were locked in upper circuit limit of 20% on Thursday after second-quarter profit nearly doubled.

The company's consolidated net profit rose 93.4% year-on-year to Rs 29.4 crore in the quarter ended September, according to an exchange filing.

Honasa Consumer Q2 Highlights (Consolidated, YoY)

Revenue rose 20.9% to Rs 496.1 crore.

Ebitda grew 53.4% to Rs 40.2 crore.

Margin at 8.1% versus 6.4%.

Volume increased 27%.

Ad costs rose 22% to Rs 174 crore.

In the first half of fiscal 2024, Honasa Consumer delivered revenue of Rs 961 crore, up 33% over the previous year.

This is 3.8 times the median growth of FMCG companies in the country, according to Varun Alagh, chief executive officer of the company. "The beauty market in India is brimming with opportunities, and we are receiving a lot of consumer love for our on-trend innovations across brands."

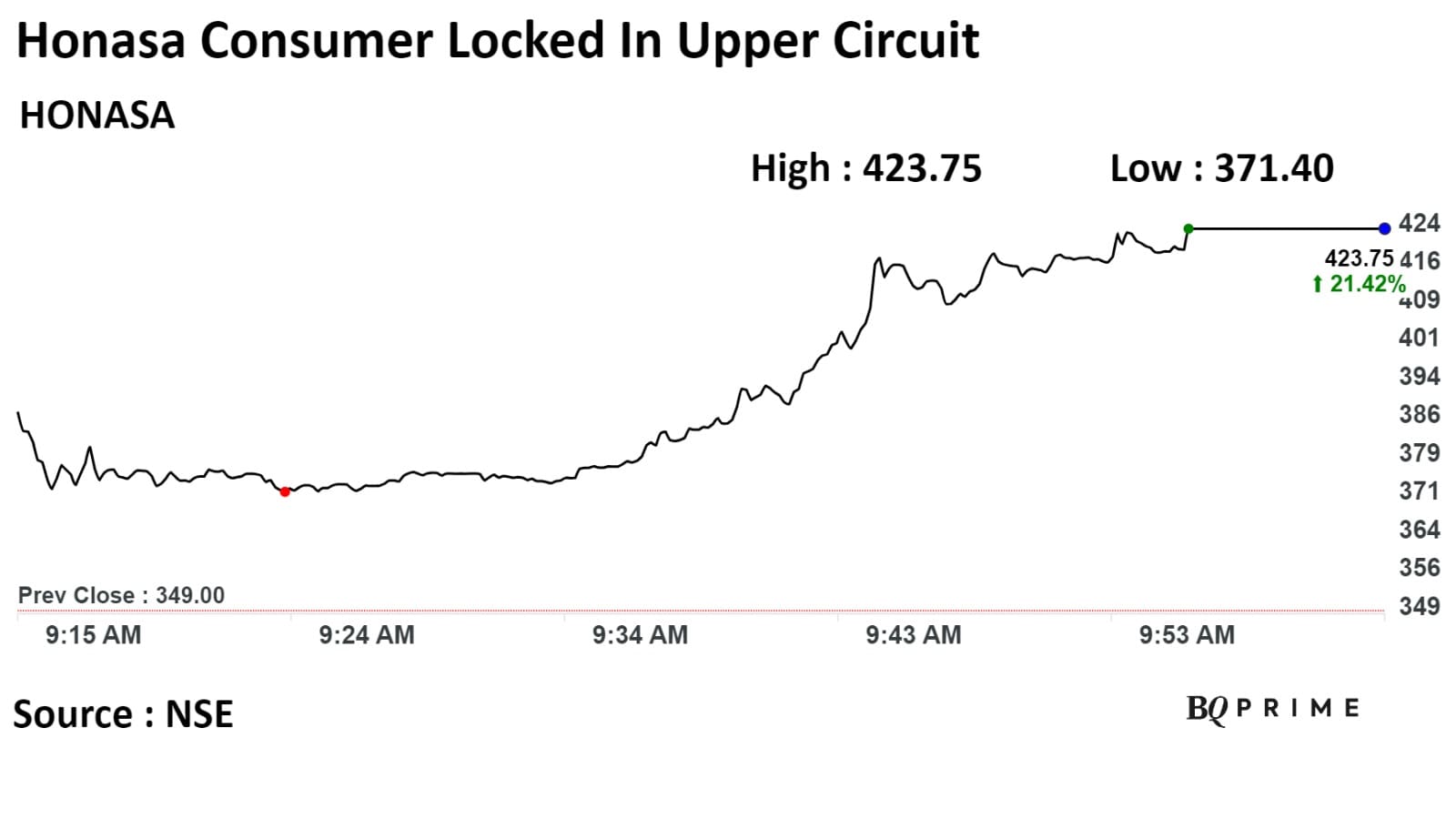

Shares of the company rose as much as 19.99% to Rs 423.75 apiece, compared to a 0.05% advance in the benchmark NSE Nifty 50 as of 10:19 a.m.

An analyst tracking the company maintains a 'buy' rating for the stock, according to Bloomberg data. The 12-month upside return potential is 26.2%, according to Bloomberg data.

Jefferies raised the price target for the stock to Rs 530 from Rs 520 earlier, marking an upside of around 25% from current levels. "We assume a 28% revenue CAGR over FY 23-26, with Ebitda margins improving to 11% in FY26," the brokerage said.

"We value the company at six times Sept. 25 price-to-sales to arrive at a target of Rs 530," it said.

The brokerage also likes the revenue and Ebitda margin outlook by the company's management.

It said, "management remains confident of delivering a 30% plus revenue growth going forward, similar to that in 1HFY24. It also expects Ebitda margins to keep improving on a year-on-year basis over the coming years, led by operating leverage and further optimisation of ad-spends."

Downside catalysts for the company include increased competitive intensity, which slows growth for key brands and execution challenges while expanding in the offline channel, according to Jefferies.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.