Shares of LTIMindtree Ltd. gained 7% on Wednesday after a local brokerage raised the target price on the stock, coupled with the Karnataka High Court granting a stay on the GST demand notice.

Kotak Institutional Equities upgraded the ratings on the stock to 'add' from 'reduce' and raised the target price to Rs 6,200 apiece, implying an upside of 7.79% from the previous day's close. This new valuation is based on 28 times the projected earnings per share for September 2026. The upgrade reflects an anticipated recovery in the BFS segment, where LTIM is well-positioned to benefit from increased investment in capital markets and core modernisation, according to the analyst.

"Increasing enterprise acceptance of niche vendors and 'challenger vendors' bodes well for share gains from incumbents, given its status as a strong challenger," said the report.

The Karnataka High Court has granted a stay on the tax order worth Rs 378 crore issued by the Department of Goods and Services Tax, which accused the company of not paying integrated GST on export turnover related to services provided to clients abroad.

LTIMindtree remains optimistic about a favourable resolution, with the company's preliminary assessment and legal counsel advising that the financial impact, if any, is expected to be minimal, as per its exchange notification.

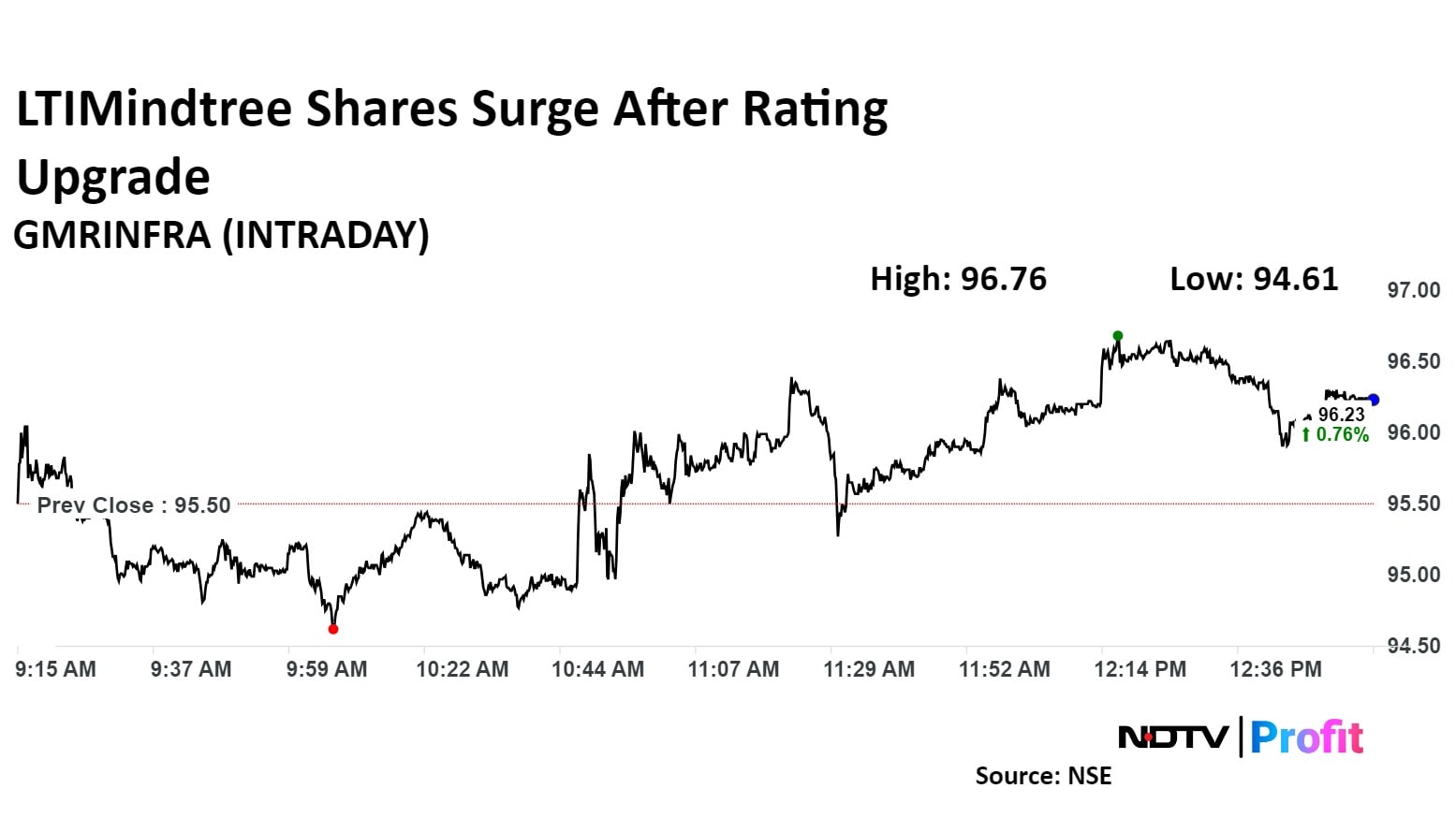

Share of the company rose as much as 7.01% to Rs 6,155 apiece, the highest level since Jan. 17, 2024. It pared gains to trade 6.8% higher at Rs 6,144.95 apiece as of 12:33 p.m. This compares to a 0.36 advance in the NSE Nifty 50 Index.

It has fallen 2.45% on a year-to-date basis. Total traded volume so far in the day stood at 6.49 times its 30-day average. The relative strength index was at 73.62, indicating that the stock has been overbought.

Out of 40 analysts tracking the company, 16 maintain a 'buy' rating, 10 recommend a 'hold,' and 14 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 7.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.