LTIMindtree Ltd.'s share price recorded its worst fall since January after several brokerages raised concerns over the company's guidance on margins following the release of its second-quarter results.

The company recorded a sequential rise of 3.2% in revenue to Rs 9,432.90 crore in the July-September quarter, compared to consensus Bloomberg estimates of Rs 9,431 crore. The company said that earnings before interest and taxes was Rs 1,458.20 crore against a Bloomberg estimate of Rs 1,462 crore, whereas the Ebitda margin contracted to 15.5% from 18.4%.

Nomura, which has a 'reduce' rating for the stock and a lowered target price of Rs 5,140 from Rs 5,340 earlier, said LTIM's medium-term aspiration to hit 17-18% EBIT margin is contingent on it hitting double-digit growth.

"We lower our fiscal 2025-2026 EBIT margin estimate by 50-80 basis points and now expect 14.9% and 15.9% EBIT margin in fiscal 2025 and 2026, respectively," it said.

Morgan Stanley, in a report, said that there was a lack of positive surprises in the September quarter, and a softer than expected third quarter could drive near-term weakness. The report noted that the stock has performed well since the sector's lows at the end of May, and given potential cuts to consensus earnings estimates, they believe the stock could trade down in the near term.

Despite this, the brokerage maintains an 'overweight' rating with a target of Rs 7,050, implying 10% upside. It recommends using any weakness to accumulate the stock.

Bernstein maintains an 'equal-weight' rating on the stock due to its slower growth compared to larger peers like Infosys Ltd. and HCL Technologies Ltd. The management anticipates a moderation in the third quarter due to seasonal furloughs and fewer working days. "Margin improvement to focus on correcting the pyramid," it said.

The brokerage has a target price of Rs 4,800 for the stock, implying a 25% downside.

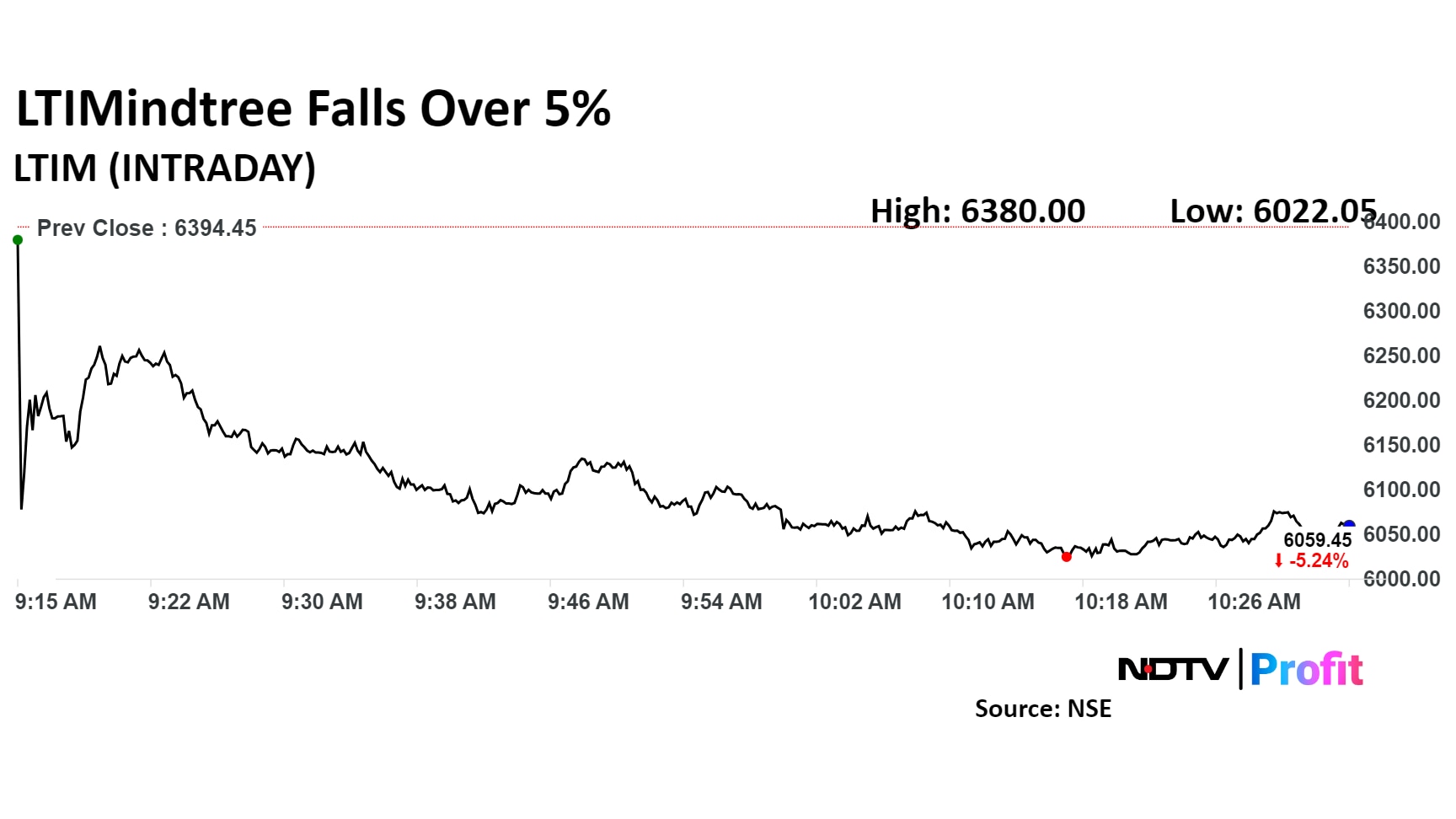

Shares of the company fell as much as 5.82% to Rs 6,022.05 apiece, the lowest level since Sept. 4. The stock pared losses to trade 5% lower at Rs 6,071.25 apiece as of 10:37 a.m. This compares to a flat advance in the NSE Nifty 50 Index.

The stock has fallen 3.5% on a year-to-date basis but risen 20% in the last one year. Total traded volume so far in the day stood at 0.54 times its 30-day average. The relative strength index was at 42.14.

Out of the 39 analysts tracking the company, 19 maintain a 'buy' rating, eight recommend a 'hold,' and 12 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.