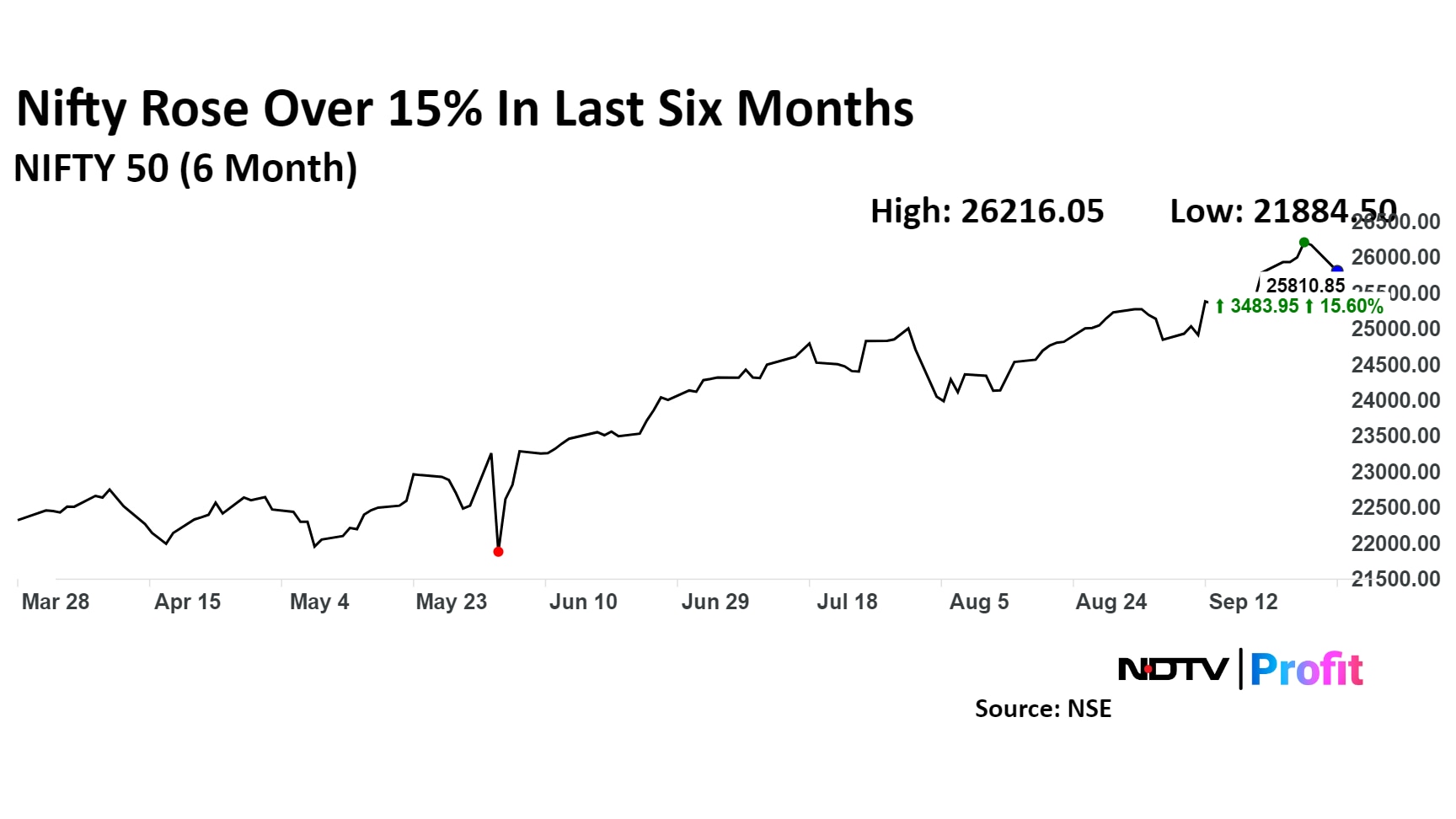

The Indian equity markets have had a strong 18 months, but now they are at an inflection point and it is becoming increasingly bottom up, according to Jeetu Panjabi, chief executive officer at EM Capital Advisors.

A low return, high volatility regime is emerging in the next six to nine months, Punjabi told NDTV Profit's Niraj Shah in an interview.

After the Indian market has observed a lot of froth in the recent months, he emphasised on the probability of a more turbulent investment environment and the need to adopt a more bottom-up approach, stating that global markets are also expected to give zero returns during the period.

China And The World: Tough Times

In the past seven weeks, China has taken bold steps to revive its struggling economy, leading to a remarkable market rally. Chinese stocks saw their best weekly surge since 2008, with the CSI 300 index climbing 22% from its September lows. Easing measures, including interest rate cuts, liquidity injections for banks, and incentives for homebuyers, have bolstered confidence in the short term.

However, the road ahead is far from smooth, according to Punjabi. "It's going to take five to seven years to solve all of China's problems," he said, underscoring the structural issues that still plague the economy despite recent rallies.

Among the most significant moves was China's central bank slashing the interest rate on its one-year policy loans by a record amount. The People's Bank of China lowered the medium-term lending facility rate to 2% from 2.3%, marking the largest reduction since the tool was introduced in 2016. This unprecedented cut is part of a sweeping effort to restore confidence in the market and stimulate growth.

Watch The Conversation Here

Here Are The Excerpts

It's been a long time, and it's been, what maybe 18 months since we last spoke. Now, when we last spoke, which was probably March or April 2023, you were structurally skittish, cyclically constructive. If I got that right, what's changed from then and now?

Jeetu Panjabi: So, you know, if you look back in the last 18 months, we had a really good 18 months. We've seen liquidity turn positively. We've seen a lot of countries do really well, and markets have been raging. I think we're at an inflection point where this is about to change. So we've been in a high return, low volatility market. I think that is just reversed.

The next six to nine months, we're going to be in a low return, high volatility market. If you ask me, put a gun to my head and say, What do I think markets do globally in the next six to nine months? My best case, zero return, probably plus to minus five with huge volatility, huge volatility. Second dimension of the market that's changed is we've been in a topdown market.

So like in places like India, you've got themes like Railways and Defence and a lot of other, you know, short financials, for example. I think the market moves to a bottom-up market. Within the environment, you'll have within a sector, you'll have five companies that do well and three that don't and you're in the cherrypicking zone. You've got to go and pick the right company.

You got to make sure the company does it right and just a top-down call is going to be much tougher to make. So, I think this is really what's changed, and you know, you got to change the game where the market changes.

It seems a bit counter intuitive, Jeetu, in that we are talking of the U.S. economy being in a Goldilocks scenario, India being one of the few, maybe you were talking about this from a global market perspective, but still the U.S. doing okay. We are at the start of an easing cycle. China has done some moves as well to revive growth. So global GDP may not look as bad over the next 12 months as people might have feared it to be, and you're saying that we will not have returns at all?

Jeetu Panjabi: So, I think, well, the two dimensions to it. One, I very respectfully disagree that the world is in a good shape. I think the U.S. is in a very difficult shape. We saw the consumer confidence data collapse in last month's print. We've seen Chinese profit data collapse, 18% fall in Chinese profits after a huge collapse in many years. So if I look at Europe, if I see the advisories that have come out of the large European Autos, everyone is saying we were expecting 2% growth, now we're going to be down 5 or 7 or 9% and two, the profits are going to collapse. I don't think this is in market horizons.

If I see what the markets are saying, I think there's a disagreement between what the markets are saying and where I think the world is heading. It's just where I'm coming in and saying, I think the global economy looks really, really difficult. Data will show you in the next six months that things don't look good. The rate cut was clearly needed. Maybe 50 is not enough. Maybe you need another 50 by December. I think you saw the Swiss National Bank cut yesterday. I think you will have a synchronous rate cut cycle globally, including India, by the end of the year, and I think you're at a point where all this is needed.

Now why do you cut, because things are bad, things aren't good, and you're going to see it in the numbers. So, on one side you will have fundamental numbers going down. On the other side, you will have liquidity going up. There's a push and a pull. Markets are overvalued globally, especially the U.S., and you will see the push and the pull result in high volatility and flat markets in my best guess.

I completely agree. What I meant to ask was that we know the world's growth numbers, save for maybe the U.S. and you said you disagree, but let's assume that some people believe that number is still looking okay, and a few of the markets are looking okay. I'm not disputing on growth, but you don't believe that markets can still deliver positive returns in an easing cycle. You don't think that will happen. Central banks have moved the markets since the Covid lows, you don't think so?

Jeetu Panjabi: If the valuations were not where they were, I would agree with you. I don't think the valuations are models, and these are 30-40, year models are saying valuations are stretched. Can liquidity still push it up? Can there be other stuff happening? Possible.

I think it's going to be a lot tougher, and the numbers are just not going to look good. They're just not pricing in what the real world is doing. In my view, the high frequency data in the last two months is much worse, especially in Europe, than most people expect.

Which is where I'll invoke in the second half of our conversation, what does it mean for Indian companies, which are outward facing versus domestic facing as well and can India be slightly different? But just before I come to India, a word of China, because I know you look at that very, very closely, that data coming from there and the implications thereof. China has made some serious changes to what it has been doing for the last 12 months, in the last two months, and especially in the last few days as well. What do you make of all the moves that have happened in China, and the resultant implications on Commodities and on other economies, if you will?

Jeetu Panjabi: Okay, this is a great question. The way I've been watching China for almost 24-25 years as an analyst and continuing to do that. In the last seven weeks, China's completely changed, and I don't think some markets have recognised it, but I think the policy side needs to recognise it. So let me explain.18 months, March ‘23 through July ‘24 China followed the policy of easy FX and tight money. So essentially, they let the currency go down, and they neutralised the pain on inflation and anything else by using monetary policy.

Since July '26 or '27, the FX appreciation game started, the Chinese Yuan is more 4.5% up since and this is a big change, a huge change to do in seven weeks. What you normally do is, when you have an FX tightening, you do a monetary easing, and they started the monetary easing last week. So, you can see two legs happening, the entire change happening. I see other countries haven't done the same. So, do I think India is behind the curve on this? Yes. Do I think Governor Das is going to look at this and say, yes, he needs to be following the same trajectory? I think so.

Okay, let me just squeeze in that question, and then I come back to the Chinese impact. But you reckon that, by virtue of the fact that the U.S. easing cycle has begun, and that is, to a lot of people, a bit of a trigger as well for India and the fact that China has done this, leads to an October policy change?

Jeetu Panjabi: I don't know whether it's October or December. My humble opinion, you need to ease liquidity first before you cut rates. So all the interventions in the FX markets need to pause. You need a Rupee to appreciate at least a percent or two, and then you need because you have a problem with deposits in the system.

So unless liquidity flows into the system and flushes the system, a rate cut might create other problems, and you need to do that. But essentially, if we're sitting six months from now, there has to be a significant easing cycle, and RBI knows what best to do. You know, first, second, third, all that they understand that well.

Coming back to China because I want to understand that. Now that there is a move that has happened, people have been crying for months about how China is not making any kind of policy move. They've made a move. There has been a resultant impact in that the Chinese markets have done well. Metals and Commodities have done well, save for Crude, but Industrial Metals have done really well.

What happens next now that the first signs of the move have come, there might be more things that might happen, assuming that those happen as well. How do you see Chinese markets? How do you see Commodity markets and the resultant impact of what China does in other markets happening over the next two months?

Jeetu Panjabi: Okay, so let's first understand what's the problem in China, a lot of problems in China are structural. You have a policy leadership that has issues of its own. The battles within that to the real estate sectors, huge oversupply, digesting that and cleaning up the system and the deflation that's ensuing is a significant structural problem. It's going to take five, seven years to solve and the third, the collateral damage on the household balance sheet and confidence isn't going away.

So, the point is, and then on top of that, you have an export chain, in my view, which is going to see much more pressure in the coming quarter or two and the only way you can do is throw more money into the system, create more domestic demand and try and neutralise that pain. Now that's what I can see they're visibly doing, right, a 4% move on the FX plus monetary easing and hopefully kind of buffering the pressure is on the downside.

How does this play out in your commodity markets? In my view, the demand is still very, very weak. Is the real estate sector going to structurally turn? Answer is no. Is there a big upside there? Answer is No. Are Commodities going to be exported the hell out of globally? Yes, they're doing it. Is the world in great shape to absorb that? I don't think so. So, this commodity move is a financial market move, in my humble opinion, do I see volume changing in a hurry, I don't think so, and it just wobbles around, and which is when I come to the high volatility market zone. So, all of this, the pushes and the pulls of liquidity and real demand are going to create high volatility. Do we end at the same price six or nine months from now? Very possible.

Okay, the only antidote to this, or the other antithesis to this is, if liquidity really picks up and there are, I mean, one argument that I got at the recent JP Morgan Conference, which a few people made was this, that there are funds sitting, just sitting pretty at the 5.25 rate, or higher than that, in fixed income, U.S. Treasuries, which, as the rate easing cycle begins, will move searching for greener pastures, because they don't want that number. They want a higher number. They don't want the for % number or a 4.45% number, or even a 4.75% number and if that liquidity were to find its way into Emerging markets, as you could argue, traditionally, has happened. Could that keep markets afloat, or maybe even more inflated?

Jeetu Panjab: Typical rate cut cycles, money is going to come into EMs, no debating that. Does that happen this time around? I think so. Is that what creates positivity? Yes. Are domestic flows going to create positivity? Yes. Is the supply side heavy? Yes. But the valuations are stretched. At some point someone's going to walk, and so the market can be 5-7% higher, six or nine months out? Absolutely.

But do you kind of see the geopolitical side just cracking globally? Is that a possible risk factor where the winds change, and people get scared and run? Possible. I don't know. So, there's, I'm saying, a lot of factors.

Could the reverse happen if there's a Trump Presidency, if there is a pause in the wars across because the world has learned to live with geopolitical conflicts. I mean, the crude behaviour is a sign that geopolitics doesn't seem to be worrying the world anymore?

Jeetu Panjabi: So your words to God's ears, I hope! I think you know seeing such large human loss is not good. Markets aside, I think yes, markets will be pleasantly surprised if that happens. But again, all my models are saying the valuations are stretched, businesses are not doing well. In fact, I'll just make one point.

There are three places in the world in a very weak global economic environment that seem to be doing well. Japan, India and Spain. Do I understand exactly what's going on? Spain? Not enough. But the point is, there are three places out of 43 markets in our models that look decent, and the rest are in really, really bad shape. In my view, their air pockets, not yet hit the markets, have not yet hit the results data, and we're going to see really lousy numbers going forward.

That's the other thing, though, and just before we come to that, just wondering, is this where you are at, for lack of a better word, loggerheads with the Common Market wisdom that when the numbers start coming in, the world will wake up and smell coffee or is it somewhere else?

Jeetu Panjabi: I think this is one big piece. The fact that valuations are high and the numbers are going to be much lower than what markets think. I think that's one area where I disagree with the markets: Can liquidity prove me wrong? Absolutely? Am I going to be humble enough to change my view and say yes, there's an economic cycle that bottoms on March ‘25 and turns and we will be looking great on December ‘25 and we'll price it through liquidity now. I could be wrong, and I'm happy to be proved wrong in that scenario.

But you need to understand that this is what the milestones look like. You can jump a few milestones and go 18 months out. I'm not so aggressive.I'm a little cautious right now, saying you've got a good run. You have to date numbers in the U.S. 16%. Normative numbers are 8-9% and with the data not looking that good. Every rate cut cycle is a reason, because the economy is not good. Companies are not doing well, the consumers are hurting, and you need to cut rates and that's what's happening.

So how do you play India in such a scenario then?

Jeetu Panjabi: So in my view, India's had a phenomenal run, phenomenal run. I mean, you know, watching markets for 30 years, this is, you know, whether there's huge froth in a lot of small pockets, parts of the market, the SME market and other parts of the market, markets are really frothy, really frothy, as I see it. How do you play this? In my view, the one big difference you make is global cyclicals. You need to be extremely cautious and domestic driven in parts of the market, you need to be constructive. That's one big thesis.

Second thing, what do I expect? I think liquidity gets much better. Now what was the malaise of the banking system for the last 12 months, liquidity was really tight. When that eases, there's more deposits that go into the banking system. The banking system starts lubricating faster, growth comes back. Banks have been the cheapest they've been in a long, long time. So do I think banks do well over the next six, nine months? Yes, and I think the domestic side still has some legs to it. Hopefully that turns out to be true, but I'd be very, very cautious in the global cyclicals.

Before I go to Global cyclicals, because you mentioned Banks. I know Jeetu Panjabi is a guy who invests for growth. I'm hearing Jeetu Panjabi talk about banks from a valuation perspective, not from a growth perspective. Why is that?

Jeetu Panjabi: The fundamental growth investing hasn't changed. We're seeing huge opportunities in a lot of sectors where there's entrepreneurship raging. You see the air conditioning, manufacturing with PLIs. You see the EMS stuff. You see a lot of smaller companies doing dredging, companies doing other stuff. All of that continues, and that's driven by entrepreneurship, that's driven by energy, that's driven by domestic demand, that's driven by policy being supportive, and that's driven by an Indian economy growing and doing well.

None of that changes. What I'm saying is, you know, when you're looking from a big asset allocation standpoint and thinking, what do I do? I think the easy one is Financials.

Okay, well, low hanging fruit, the low ball, if you will. Do you sense that if the Financials have to make money? The money will be made by valuation reprising as opposed to growth because if everything that we're talking about is something that even entrepreneurs identify with, then the much-awaited private capex cycle might just take that much longer to kick start. In fact, also on that point, Jeetu, would love to understand from you there's a lot of voices that we picked up at the JP Morgan Investor Conference, again, that if indeed tariffs come about, then China dumps its goods which it was sending to the U.S., to Europe, etc, and stuff like that. But if that gets curtailed, it goes into the EM in the Asia pack, and it deflates the end product prices in areas where Indian manufacturers might have wanted to step up capacity. So is the Private Capex cycle under a bit of a question mark in a very near term?

Jeetu Panjabi: So you know, when you look at macro data and try to look for the private capex cycle? The answer is, what you're saying, it's coming, not yet come. But if I go down to the companies we're looking at closely and say what are they doing in terms of Capex? Are they putting money on the table? The answer is yes. Are they putting it in very Capex intensive industries? The answer is no. Are they doing it where India has a demand side and not enough of a supply side to be met? The answer is yes.

So when I look at the macro data, I kind of say, Oh, the capex cycle is still not here. When I go and see the operating companies, they're saying, Oh, we're adding capacity. We need capacity. We're adding capacity. Do you think the global cyclical commodities, which are fungible globally, like steel and other stuff. Are you going to see pressure points? I think there are pressure points, but India is adding capacity there too. So the answer is somewhere in between that the macro data is showing you that it's taking some time, but certain businesses and certain industries, it's happening as of yesterday.

Okay, which themes because I heard you say that dredging might be there. But where is it that you see business confidence being very high or high?

Jeetu Panjabi: You look at the manufacturing side. You look at the air conditioning and electronic manufacturing side. Ten years ago, how many ODUs were made out of India from China? India, the market size is 20 million units. One factory in China was 20 million units, right? Today, you're seeing the capacity in India has come up to 30, 35 million units. It's all happened in six, seven years. Did you see that scale-up coming? I don't think so. Was it a bit of government help? Yes. Were there PLIs in place? Yes. Do I see each of the large international OES taking a PLI and setting up manufacturing here? Yes. Are there suppliers into that manufacturing chain? Yes. Are there opportunities to find and invest alongside Absolutely, that's what I'm saying.

So, there are chains. There are food chains in the industrial side and manufacturing side where we see huge opportunities. Even the solar side. So the polysilicon, the polysilicon companies and the top two three companies in polysilicon in China are hurting. The profits are really hurt. They are trading at point two times, points three times book value. It's like death over there and here, you're seeing a completely opposite picture. But are you seeing Indian companies who are executing the Indian solar dream and growing it 150% per annum? Are they doing well? Yes. So you've kind of found that the government has helped ensure these guys stay alive. Do well, use the pain in China, get the stuff in and then slowly integrate and build greater capacities. It's going to take some time, but it's happening.

Okay, so manufacturing is your favourite. Just one quick question before the last couple of questions, maybe, one is, I heard you say that global cyclicals are an avoid. What about I.T. Services, how do they fare?

Jeetu Panjabi: I don't have a strong view. When I see the advisories coming out of the big guys globally, it is kind of nervous. When I see the hiring data coming out of Google's and Amazons and Facebooks is telling you things are hurting. Have you seen a change over there? So once they start hiring, you know that this scale is going to get faster, but I think people are nervous, and I'm supportive of that, saying, let's wait.

Let the global economy turn, it's going to take six or nine months. My starting point is that the world is not in good shape. The data is going to show it in the next three to six months. Once you're somewhere in the bottom, you have a business cycle bottom, your market cycle bottom; that'll be the time to get in.

The bottoms now could be a lot quicker to arrive at. You believe this could happen in the next six to nine months, and then the cyclical recovery could come back as well?

Jeetu Panjabi: Let's wait for the data. I mean, at this point, I can see there is downside that's not priced in. Let's wait for a bit of pain, and then we talk about the upside after that.

One last question, can the pain in India be exacerbated by the valuations that we are trading at, or is the wall of liquidity going to ensure that the dips are not so large?

Jeetu Punjabi: I'd lean on the latter, the fact that there's 2 lakh crores of liquidity with the mutual funds. There's a lot of money coming in every day. Is that going to buffer some of the pain, if possible. Yes. But you know when, let's say, a company reports a 50% fall in earnings, that company is toast. So I'm saying, I'm going back to saying this is a bottom-up market over the next six to nine months.

Focus on your companies and there will be some guys who do really well. Some guys do really badly. Focus on your companies, focus on who's doing well within a sector as well, execution is going to be tougher, and be careful about certain sectors.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.