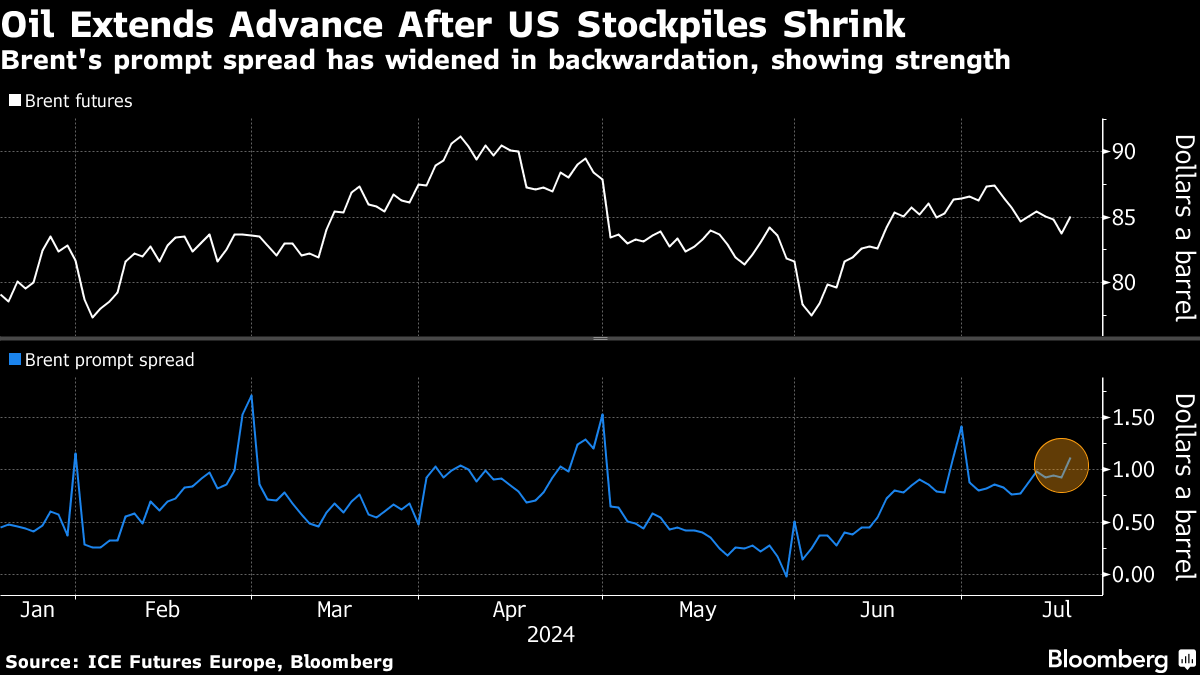

(Bloomberg) -- Oil pushed higher — after the biggest daily jump in a month — as US crude stockpiles logged their third consecutive weekly decline.

Brent neared $86 a barrel after advancing 1.6% on Wednesday, with West Texas Intermediate above $83. Nationwide inventories shrank by 4.87 million barrels last week to the lowest level since February. While stockpiles typically decline at this time of the year, they are below the five-year seasonal average.

Oil remains higher for the year to date, helped by OPEC+ supply cutbacks, which have offset increased production from nations outside the cartel. Expectations for looser US monetary policy have also aided crude, both by boosting appetite for risk assets and weakening the US dollar. A cheaper greenback makes commodities priced in the currency more attractive for most buyers.

Timespreads, meanwhile, have strengthened, signaling robust near-term demand. The gap between Brent's two nearest contracts, known as the prompt spread, is more than $1 a barrel in backwardation — when the nearest contract trades above the next. That compares with 80 cents a month ago.

Futures are “breaking away from a losing streak as a substantial correction in the US dollar supports oil prices,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte. Also, the larger-than-anticipated drawdown in US inventories, a sign of robust demand, outweighed concerns about Chinese economic growth, she said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.