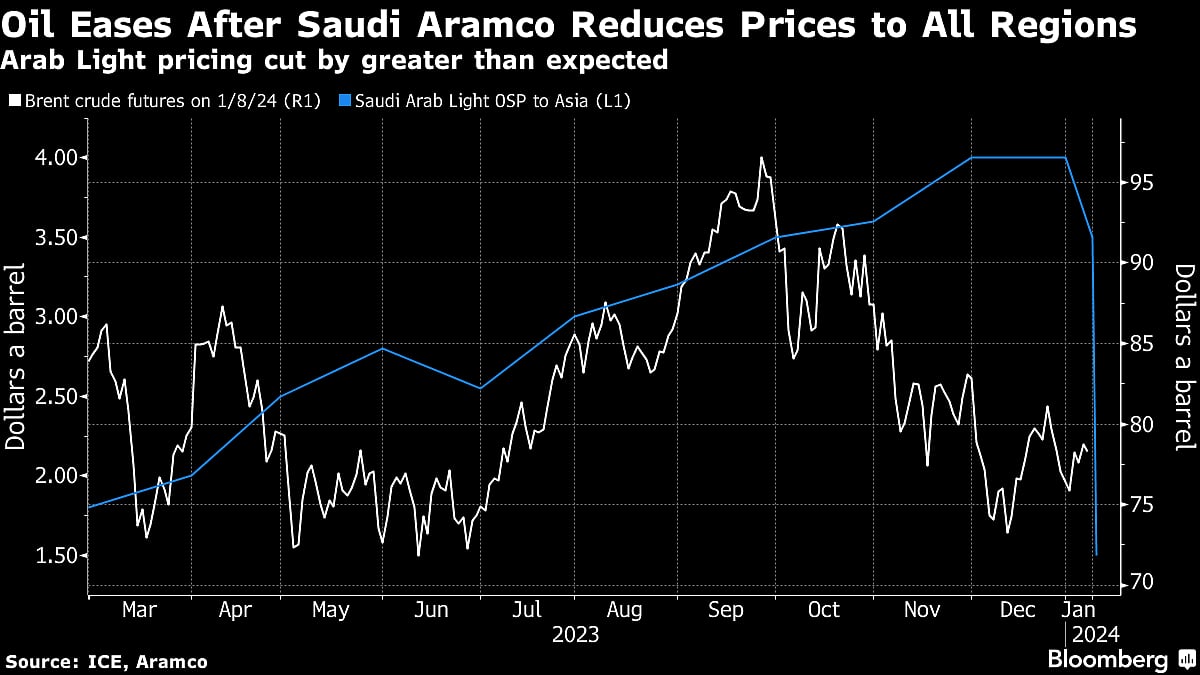

Oil Slumps As Saudi Price Cuts Underscore Softer Market Outlook

Global benchmark Brent fell toward $78 a barrel after rising by 2.2% last week.

(Bloomberg) -- Oil declined after Saudi Arabia cut official selling prices for all regions, the latest sign that fundamentals are worsening.

Global benchmark Brent fell toward $76 a barrel, after rising 2.2% last week. State producer Saudi Aramco lowered its flagship Arab Light price to Asia by a more-than-expected $2 a barrel due to persistent weakness in the global market. Its pricing is the lowest since November 2021.

Read More: Deep Oil Price Cut by Saudis Highlights Softer Physical Market

The move from the world’s biggest producer came just days after speculators posted one of their largest additions of bearish wagers on crude for years. Money managers lifted their combined short positions in Brent and West Texas Intermediate by the second-most since 2017 last week, data showed.

The Saudi price cuts are a reflection of a lackluster end to the year for crude, in which physical markets generally weakened. As 2024 gets underway, there’s been disruption to flows from Libya and continued attacks in the Red Sea, which both could help propel crude higher. But Wall Street is expecting more bearish challenges ahead, with major banks already cutting their outlooks for this year.

“There is definitely a lot of supply,” Francisco Blanch, head of global commodities and derivatives at BofA said in a Bloomberg TV interview. “Demand is decelerating, we’ve had a very, very sharp increase in interest rates which has really been slowing things down. That combination is, I think, what is pulling prices lower.”

Traders will also be monitoring the annual rebalancing of the two largest commodity indexes over the coming days. Funds tracking the Bloomberg Commodity Index and the S&P GSCI are likely to sell about $2 billion worth of WTI in the coming days, Citigroup Inc. estimates, as the annual realignment of their portfolios takes place.

--With assistance from Sharon Cho, Manus Cranny and Dani Burger.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.