(Bloomberg) -- Oil held a drop as broad risk-off sentiment undercut concerns about escalating conflict in the Red Sea.

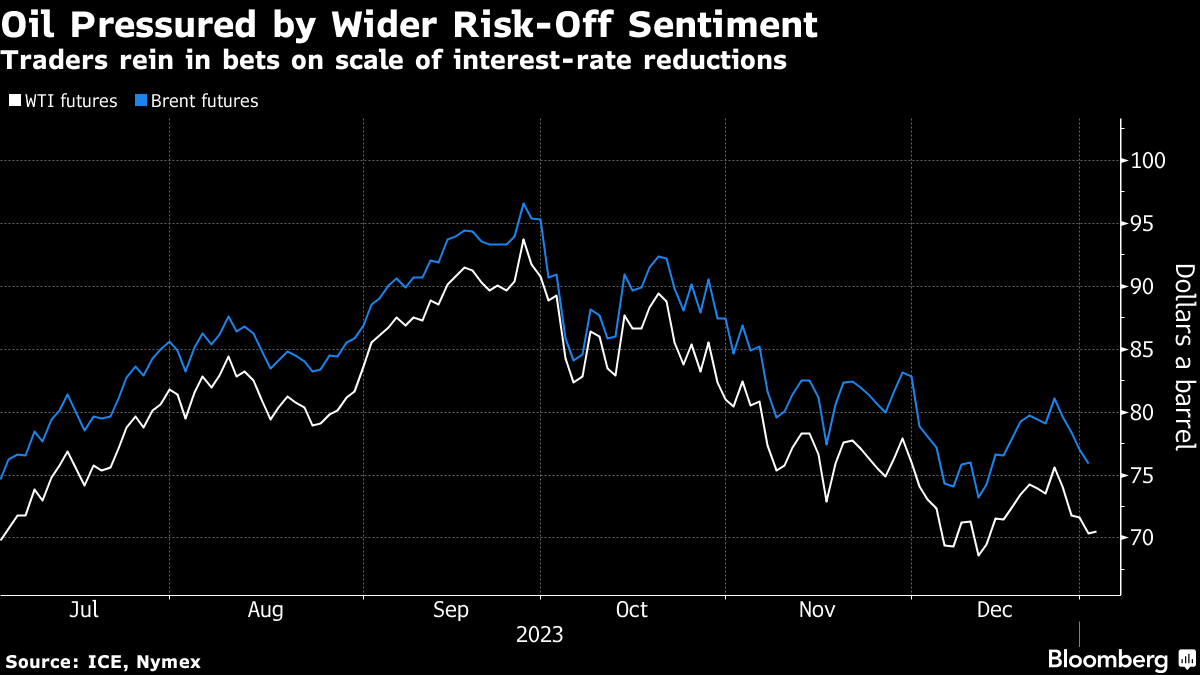

Global benchmark Brent traded below $76 a barrel after dropping 1.5% on Tuesday, with West Texas Intermediate above $70. Traders are paring back bets on the scale of interest-rate cuts from major central banks, leading to one of the worst-ever concerted slumps in stocks and bonds in a year's first session.

The shift in broader market sentiment weighed on oil as traders continued to watch developments in the Middle East. Iran's dispatch of a warship to the Red Sea represents its most audacious move to challenge US forces in the key trade route and may embolden Houthi militants that have disrupted shipping in the waterway to protest Israel's invasion of Gaza.

Read More: Oil's Global Glut Threatens to Drag Prices Lower This Year

Crude last year posted its first annual drop since 2020 amid concerns that increased output from outside OPEC+ would outweigh efforts by the producer group to limit supply amid slowing demand growth. While events in the Red Sea present additional risks and are adding to time and costs, disruptions to the oil market aren't likely to be significant, according to Neil Beveridge, a senior analyst at Sanford C. Bernstein.

“There's not really any disruption to the physical supply in the market” stemming from the Red Sea tensions, Beveridge said on Bloomberg Television. “Markets look fairly balanced coming into the year, so it leaves OPEC with quite a lot of work to do to support prices at current levels.”

The Organization of the Petroleum Exporting Countries and its allies will resume regular oil market monitoring meetings with an online session in the first week of February, according to delegates. The group began a new round of production cuts this month, although traders have been skeptical of the effectiveness of such a move to avert a global surplus.

Elsewhere, China has front-loaded the issuance of its oil import quotas for this year, with bumper allocations allocated to private refiners and traders that nearly match all of the allowances granted for the whole of last year. Chinese refiners had been slow to snap up spot cargoes in recent months due to a lack of quotas, and the market is waiting to see if this will jump-start buying.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.