(Bloomberg) -- Oil climbed after Iran seized a tanker in the Gulf of Oman, the latest in a run of incidents that could threaten key shipping lanes.

West Texas Intermediate rose 0.9% to settle above $72 a barrel after another session of trading in a range wider than $2. The tanker's capture adds a fresh dose of volatility as the US and allies weigh options for retaliating against Yemen-based Houthi militants for attacks on Red Sea shipping.

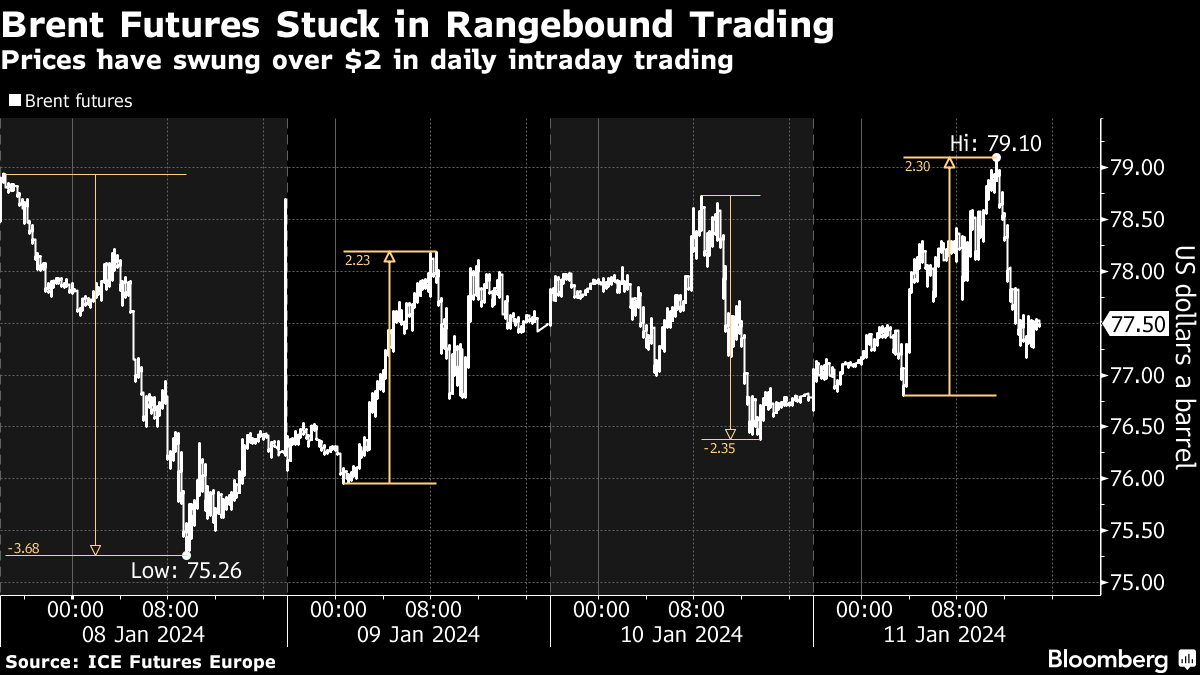

Despite the tumult in the Middle East, oil has struggled to find a clear direction this year, remaining stuck in a narrow range as traders attempt to gauge crude's prospects. Brent futures have been unable to break out of a $74-to-$79 channel for weeks despite “very noisy” trading, Ben Luckock, Trafigura's global head of oil, said on Bloomberg Television.

Crude is swinging “$2 every day, but it's not actually moving,” Luckock said. “We are probably in for a year that is rangebound on prices.”

Despite the modest gains so far this year, analysts are turning more pessimistic on oil. Barclays cut its 2024 estimate for Brent by $8, to $85 per barrel, as inventories remain higher than expected and the chance remains that OPEC+ will take longer than anticipated to normalize spare production capacity.

There are signs that Saudi Arabia's recent decision to slash its crude prices is starting to affect the market, too. European refiners will import more oil from the kingdom next month, with at least three processors seeking full contractual volumes, instead of reductions as in previous months.

--With assistance from Alix Steel and Guy Johnson.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.