(Bloomberg) -- Oil held near the highest level in three weeks as persistent geopolitical tensions countered concerns over the demand outlook.

Brent crude was trading near $83 a barrel in London after rallying almost 8% in the previous two weeks. Crude futures in New York were above $79. Activity was subdued as a result of a holiday in the US.

Attacks on shipping in the Red Sea and the Israel-Hamas war have added a geopolitical premium to crude. For the first time, the crew of one ship was forced to abandon the vessel after it was hit by a missile. Israel said it will launch a ground offensive in the Rafah area of Gaza unless hostages are released before mid-March.

Still, in the medium term there are lingering concerns about a market surplus, flagged last week by the International Energy Agency, which also argued that global consumption is slowing. Travel in China, the world's top importer, surpassed pre-Covid levels over the Lunar New Year holiday period, offering a potential bright spot in a patchy consumption outlook.

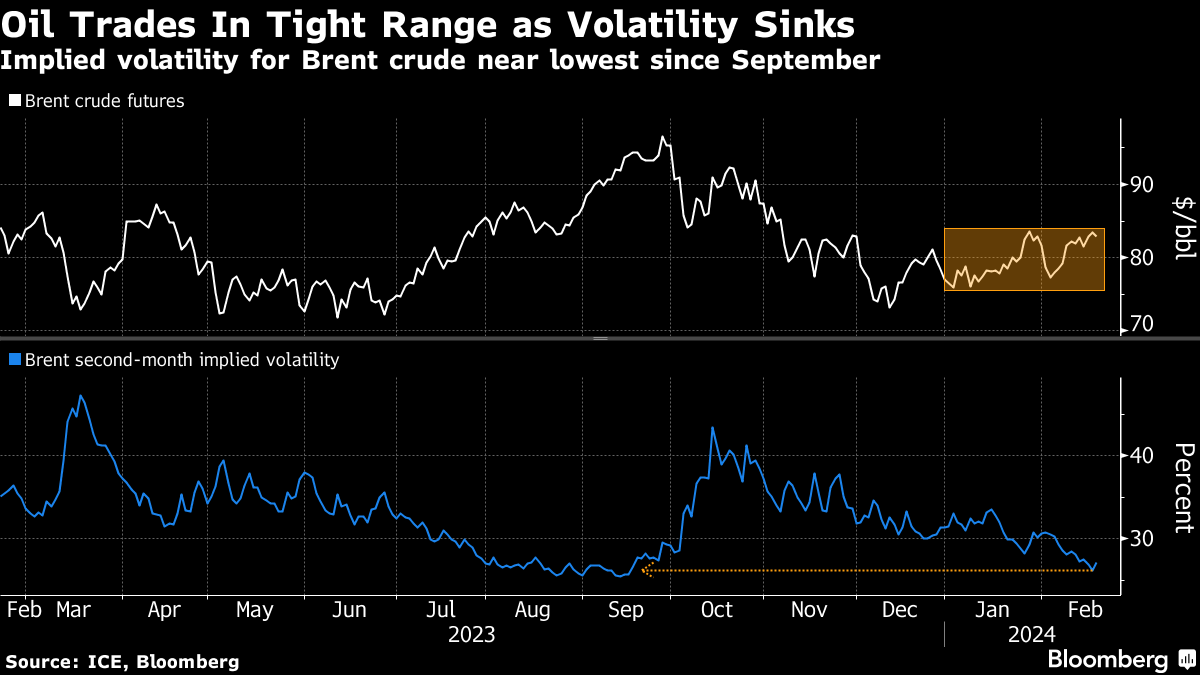

The push and pull of bearish and bullish factors has led to a decline in volatility.

“We expect Brent to trade around the current level in the coming weeks,” Arne Lohmann Rasmussen, head of research at A/S Global Risk Management, said in a note. “Geopolitical risks are upside risks, together with OPEC+ cuts.”

Bullish wagers for global benchmark Brent are at the highest since 2021 after the ratcheting up of geopolitical risks in the Middle East, which accounts for around a third of the world's crude production. Fuel markets, meanwhile, are in focus amid one of the most active trading periods for refined products in several years, as year-to-date price gains outstrip those for crude.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.