(Bloomberg) -- Oil held a large advance as a risk-on mood in wider markets and signs OPEC+ members are complying with supply cuts overshadowed a gloomy demand outlook from the IEA.

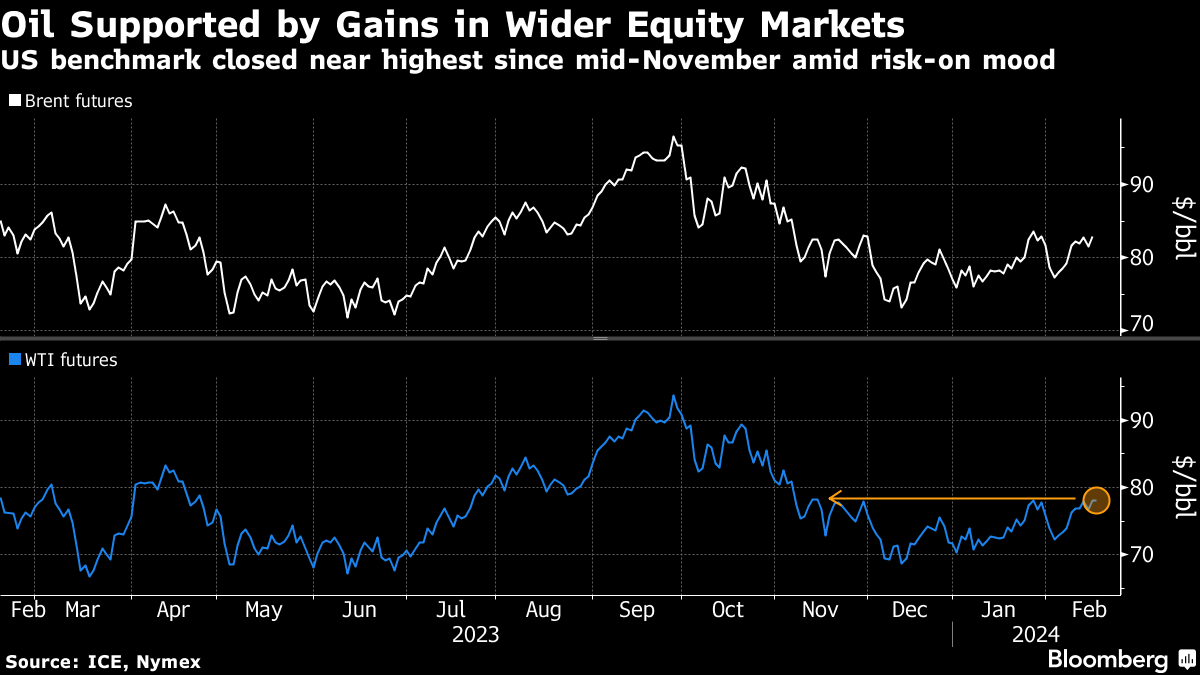

Brent crude traded just below $83 a barrel after rising 1.5% on Thursday, while West Texas Intermediate was near $78, near its highest close since mid-November. Oil's gains came as US equities closed at another record and the dollar eased, making commodities more attractive for overseas buyers.

Crude is trading close to the upper end of the tight range that it's been in this year, with both benchmarks on course for their fourth weekly gains in the past five. Still, there are concerns highlighted by the Paris-based International Energy Agency that oil markets could be in surplus all year as global demand growth loses steam.

OPEC+ has been implementing supply cuts to support prices. Russia has nearly reached its target for voluntary reductions for the first time since making the pledge last year, according to Bloomberg calculations based on official data for January. Elsewhere, Iraq and Kazakhstan have pledged compliance with their targets after failing to fully cut production as promised last month.

In the Middle East, exchanges of fire between Hezbollah and Israel intensified in a further escalation of the week's cross-border fire that's raising alarm of a wider war. In Gaza, Israel arrested dozens of Hamas combatants in Nasser Hospital, with grenades and mortar shells found.

In fuel markets meanwhile, traders are focused on the impact of disruptions in the Red Sea, and refinery outages that have curbed supply. Benchmark diesel and gasoline futures have risen by double-digit percentages since the start of the year, while crude is about 7% higher.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.