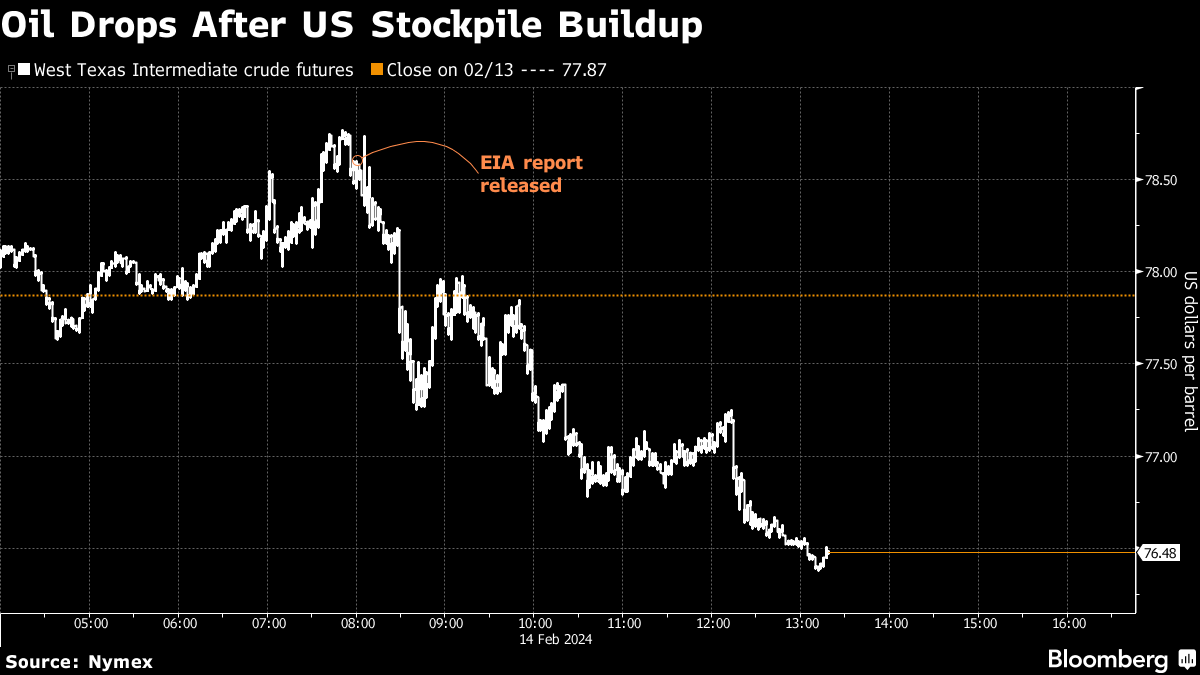

(Bloomberg) -- Oil dropped after the US reported crude inventories rose 12 million barrels last week, the most since November.

West Texas Intermediate fell 1.6% to settle below $77 a barrel, after trading in a roughly $2 range. While the crude buildup surprised investors, falling gasoline stockpiles and surging jet fuel demand capped losses. Jet fuel consumption on a four-week basis rose to a pre-pandemic seasonal high, according to the Energy Information Administration.

Read More: Massive US Crude Build Weighs on WTI Futures: EIA Takeaways

Conflicting market signals have kept oil locked in a $10 range this year. While gauges of market volatility continue to grind lower, fuel margins are steadily improving and key timespreads are rallying, an indication of tighter supplies.

OPEC's top official said Tuesday that global oil demand is set to expand strongly, while a monthly outlook from the group revealed limited compliance with the members' latest round of supply cuts. Separately, the Paris-based International Energy Agency flagged comfortable markets this year, with projected supply growth more than satisfying worldwide consumption.

In related markets, refined products have outperformed crude this year, with benchmark futures for diesel and gasoline both rising almost 10% so far in 2024. Crude is about 7% higher this year.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.