(Bloomberg) -- Oil rose as the market weighed in risks from any US retaliation to a deadly attack in Jordan against signs of robust American supply.

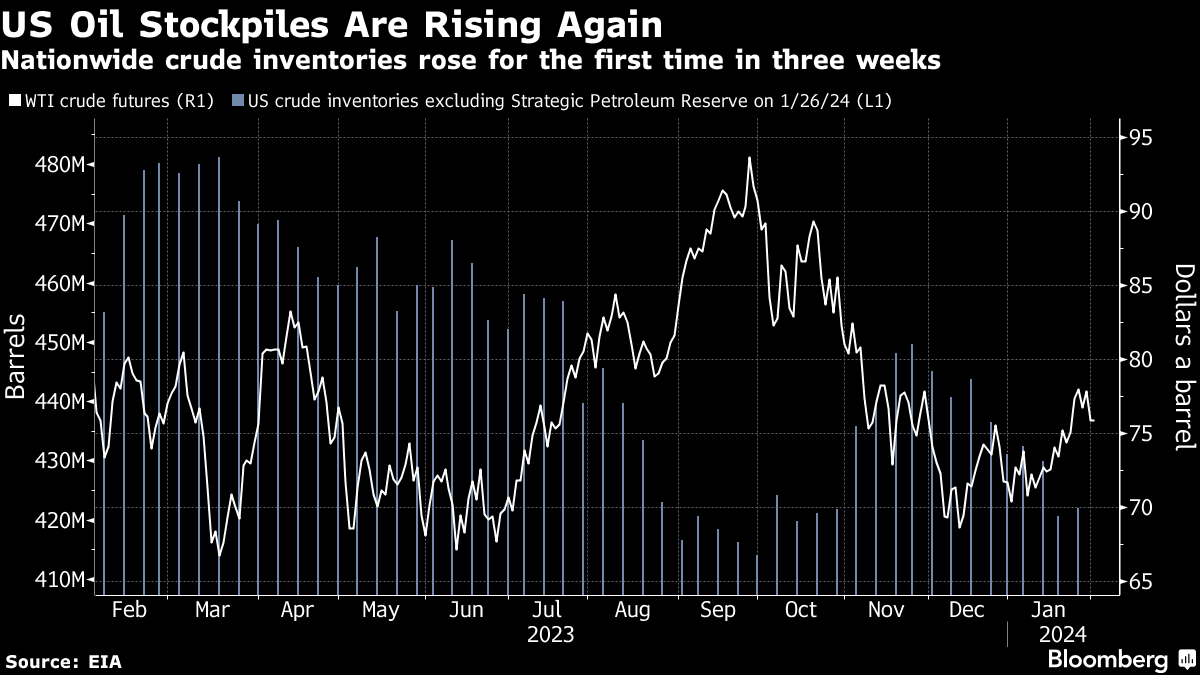

West Texas Intermediate advanced to trade above $76 a barrel after recording its biggest drop since early January in the previous session. Data showing expanding US crude stockpiles and rising oil output put downward pressure on prices on Wednesday. Brent traded near $81 a barrel.

President Joe Biden said earlier this week that he had made a decision on how to respond to the attack over the weekend that killed American troops, without providing details. He said Iran was responsible for providing the weaponry used in the strike, but Tehran has denied involvement and vowed to hit back against any strike on its soil or assets abroad.

Oil capped its first monthly gain in four months in January after an escalation of attacks on commercial shipping in the Red Sea by Yemen-based Houthi rebels. However, concerns around demand in key consumers and strong supply from non-OPEC producers has kept a lid on price gains.

“The market will keep a watch on the Red Sea and the region at large, but we know crude won't factor in supply disruptions until it has a good reason to,” said Vandana Hari, founder of Vanda Insights in Singapore. “The US weekly crude stock-build and its oil production figure took the steam out of prices.”

US oil output rose to 13.3 million barrels a day in November, surpassing a previous record in September, according to the Energy Information Administration. Data also showed weekly production back at 13 million barrels a day, while crude inventories gained for the first time in three weeks.

Investors will be watching for any market commentary from OPEC+ following a meeting of the Joint Ministerial Monitoring Committee later Thursday.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.