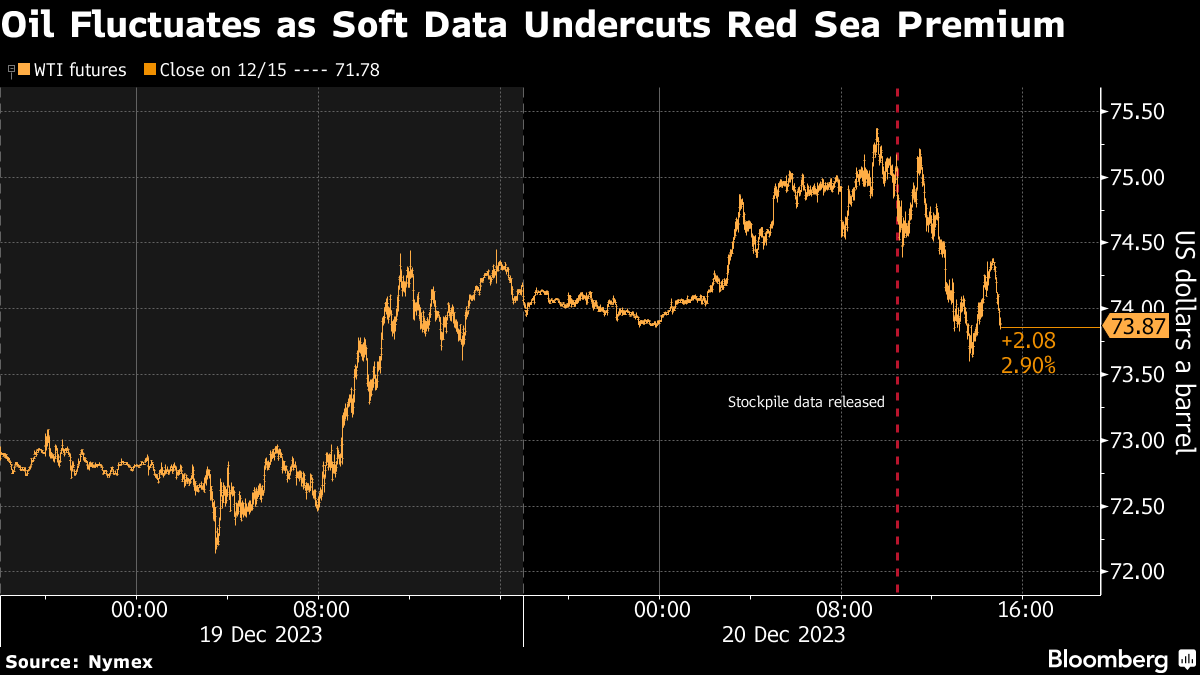

(Bloomberg) -- Oil narrowly held onto a three-day winning streak as the risk of disruptions in the Red Sea overshadowed an increase in US crude stockpiles.

West Texas Intermediate's February contract swung in a roughly $2 range and settled near $74 after government data revealed a large buildup in US stockpiles and record production, adding to persistent concerns about oversupply. Inventories at the key storage hub in Cushing, Oklahoma, remained at the highest since August, pressuring timespreads.

“The market is short and sentiment is poor,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth. “I don't think bears are abandoning their thesis that the market will be in balance to over-supplied next year.”

The market may be volatile heading into the Christmas holiday as trading activity thins. Earlier this week, prices rallied as attacks by Iran-backed Houthi rebels in the Red Sea prompted shippers to divert vessels away from the area. The Red Sea is a vital trade conduit for oil and has gained importance for barrels from Russia en route to Asia after European buyers shunned them because of the invasion of Ukraine.

Further deflating any risk premium was a prisoner swap that involved the US releasing a close ally of Venezuelan president Nicolás Maduro in exchange for 10 Americans, damping the likelihood of reimposed sanctions on the Latin American county.

Read: Russia's War in Ukraine Has Revived Red Sea as a Vital Oil Route

Still, the prevailing sentiment is bearish, with investors still unconvinced that OPEC+ will be able to tighten the market next quarter, given production increases by the US, Guyana and Brazil. The US benchmark is down about 8% for year.

Read More: Shippers Dig In for Long Haul as Red Sea Chaos Worsens

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.