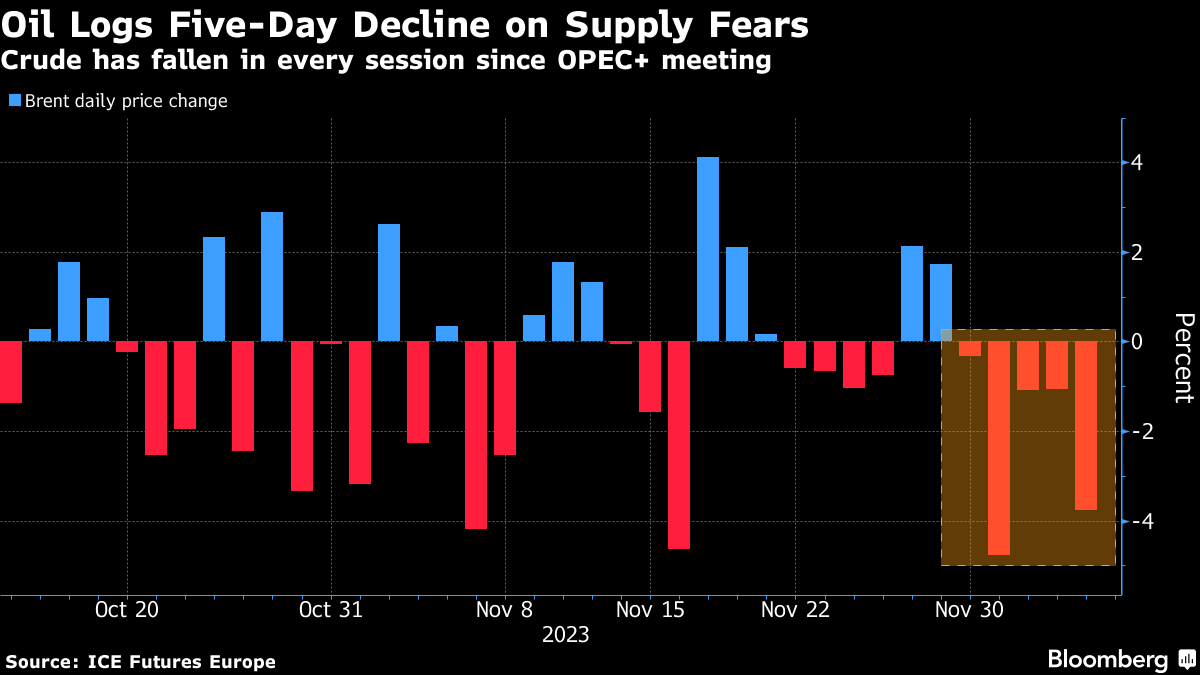

(Bloomberg) -- Oil held the bulk of a five-day run of losses that drove prices to the lowest since June on signs that global supplies are eclipsing demand despite plans by OPEC+ to rein in its production into 2024.

Global benchmark Brent edged higher toward $75 a barrel after slumping by 11% in the longest losing run since February. West Texas Intermediate was below $70. Official US data showed another build in crude inventories at the Cushing hub, while oil output held near a record and gasoline demand softened. Widely watched market timespreads are indicating ample near-term supplies.

Crude's slide — which helped drag an overall commodity gauge to the lowest since 2021 — has come despite a deal forged last week by the Organization of Petroleum Exporting Countries and its allies to deepen output cuts. Futures have dropped by about a quarter from a peak in September on concern that increased production from outside the group will outstrip demand, while there's speculation OPEC+ members themselves may not fully adhere to the curbs.

A procession of the alliance's producers have made the case that their latest agreement will stick and could be extended. Saudi Arabia said earlier this week that cuts can “absolutely” stay past March, with similar remarks from Russia. While Algeria and Kuwait added to the chorus, crude remains under pressure.

“Markets seem to be completely sidelining” the OPEC+ measures, said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte in Singapore. In addition, a downgrade of China's outlook by Moody's Investors Service has added to a weakening outlook in the top crude importer, she said.

The agency cut its outlook for Chinese sovereign bonds to negative in a midweek statement, prompting some pushback from China. Meanwhile, data showed that its imports of crude fell last month to the lowest since April as local refiners grappled with limits on fuel exports and poor margins.

Reflecting the wider market's softness, key metrics have been weakening, with Brent and WTI both in contango, where later-dated contracts trading at premiums to nearer ones, all the way out to the middle of next year. Brent's three-month timespread was 19 cents a barrel in contango; a month ago it was 86 cents in backwardation, the opposite bullish pattern.

Oil's selloff could boost the chances that OPEC+ may call an emergency meeting within the next few weeks, according to Citigroup Inc. The market has been “very disappointed” with the group's latest set of measures, which came against a weakening backdrop, the bank's analysts said in a note.

The weekly supply-and-demand snapshot from the US Energy Information Administration raised some eyebrows among market watchers. The figures showed lower exports, although ship-tracking data has suggested robust if not record flows. In addition, the so-called adjustment factor — akin to a margin of error — was the biggest on record.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.