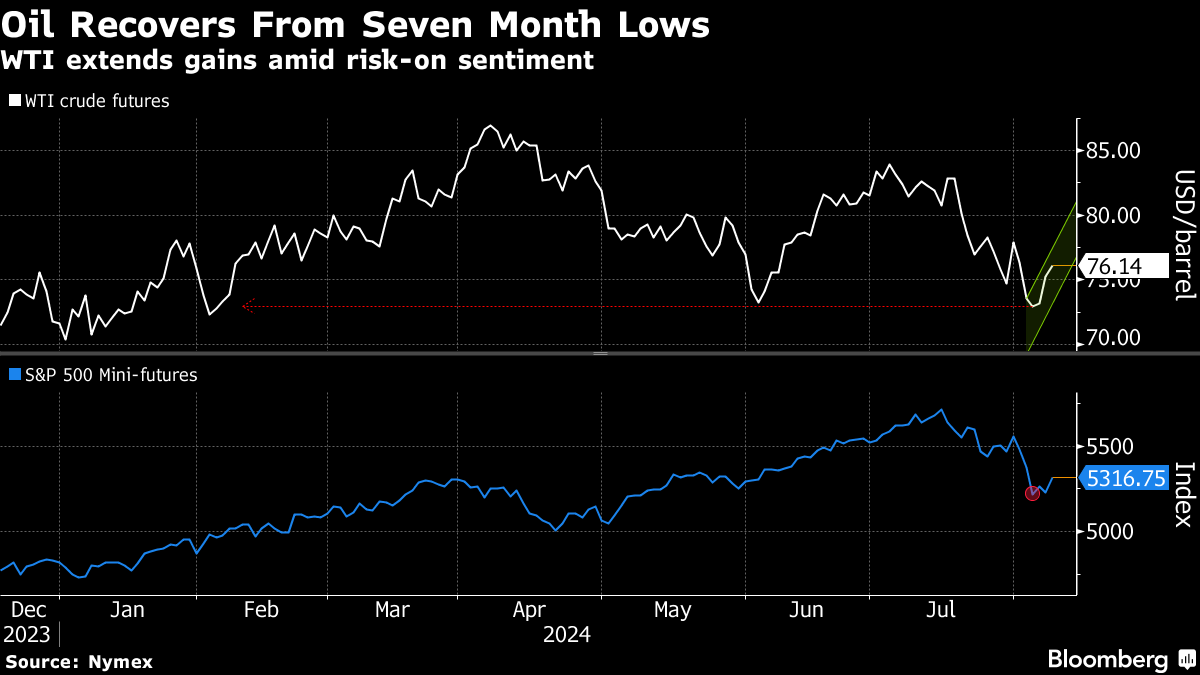

(Bloomberg) -- Oil rose, extending its rebound from a recent plunge, with traders still glued to fluctuations in wider markets and tensions in the Middle East.

West Texas Intermediate advanced 1.3% to settle above $76 a barrel. Israel continues to brace for an attack from Iran, though comments from the Iranian president during a phone call with his French counterpart hinted at a diplomatic path to de-escalation.

Oil has regrouped after slumping to a seven-month low on Monday amid a rout in global equity markets. A halt to crude production from Libya's biggest field has helped underpin the gains, while a rare cross-border attack by Ukrainian troops into Russia added to geopolitical tensions.

“A recovery in the stock market is also easing some recessionary demand fears,” as well as retaliation expectations which have brought back geopolitical fears of tighter supplies, said Dennis Kissler, senior vice president for trading at BOK Financial Securities.

Official data out of the US on Wednesday showed crude stockpiles fell for a sixth week to their lowest since February. That may alleviate some of the concerns about faltering demand in the world's biggest consumer of the commodity, though inventories built up at the key Cushing storage hub and in gasoline.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.