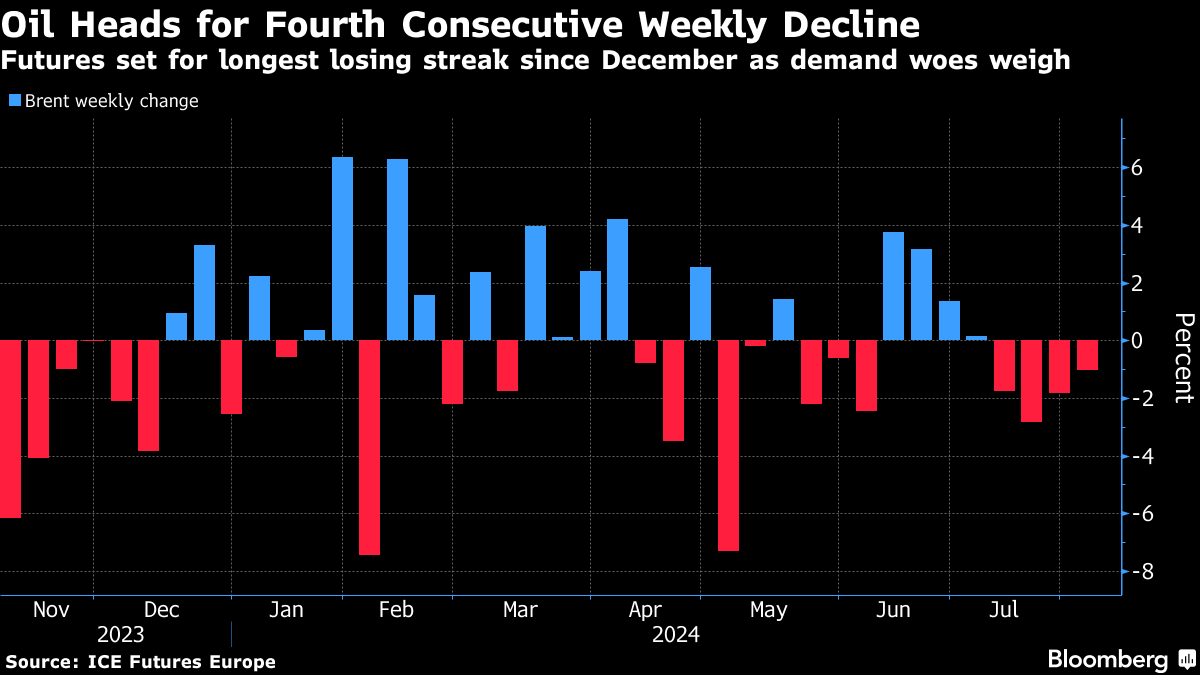

(Bloomberg) -- Oil headed for a fourth weekly drop as demand concerns in the world's two biggest economies overshadowed heightened geopolitical risk.

Brent crude traded above $80 a barrel after dropping by 1.6% on Thursday, while West Texas Intermediate was near $77. Factory gauges in the US and China both showed a contraction on Thursday, indicating signs of weakness in manufacturing. Crude had jumped on Wednesday after the killing of Hamas and Hezbollah leaders led to heightened tensions in the Middle East.

“Demand concerns are shuffling back to the center stage,” said Vandana Hari, founder of Vanda Insights in Singapore. “Any knee-jerk geopolitical risk premium in crude is always susceptible to correction in the cold light of day.”

Oil is set for its longest streak of weekly declines since December, as concerns linger about consumption in No. 1 importer China and as OPEC+ is set to increase production from next quarter — a plan it reiterated at a monitoring meeting on Thursday. Still, futures remain modestly higher this year, helped by expectations that monetary easing in the US will boost consumption, with Federal Reserve Chair Jerome Powell saying an interest rate cut could come as soon as September.

Widely watched market metrics are also signaling less tight conditions. Despite still holding in a bullish, backwardated structure, the gap between Brent's two nearest contracts has narrowed. The spread was last 60 cents a barrel in backwardation, compared with more than $1 two weeks ago.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.