Devyani International Ltd., the operator of KFC and Pizza Hut outlets in India, rose nearly 8% after its subsidiary announced entry into Thailand.

The Indian quick service company's subsidiary, Devyani International DMCC Dubai, acquired controlling stake in Restaurants Development Co., according to its filing. The deal is expected to close before March 31.

Restaurants Development operates 274 KFC outlets across Thailand and employs more than 4,500 people.

Devyani sees a strong opportunity in the Thai market where KFC is the market leader with more than 1,000 stores and four times the next competitor (McDonald's), according a note by Jefferies.

"We however would have liked an India growth effort instead and hope this does not kick-start overseas M&As," Jefferies said. "Deal is subject to minority vote."

According to Dolat Capital, the opportunity for store count addition in India is significantly higher compared to Thailand.

Here's what brokerages say about Devyani International's Thai foray:

Jefferies

The research firm has a 'hold' rating on the stock with a target price of Rs 190, implying an upside of 3%.

KFC has been a strong format for Devyani International from a unit economics perspective. The demand scenario remains muted in the near term on account of weak macro.

Growth at reasonable price seems to be the rationale, evident from 8x trailing EV/Ebitda and 13% store addition CAGR (7Y).

Forward growth multiple could be 5-6x Ebitda even if Jefferies assume modest growth.

Brand contribution margin are in the 14-16% range (vs 20%+ for KFC India). Assuming corporate overheads at around 3-4% of sales, Ebitda margin should be around 11-12%.

This implies an acquisition valuation of 0.9x FY23 EV/sales and 8x FY23 EV/Ebitda — a significant discount to Devyani's own valuations of 7x FY23 EV/sales and 50x EV/Ebitda.

Dolat Capital

Dolat Capital has a 'reduce' rating on the stock with target price of Rs 195.

The opportunity for store count addition in India is significantly higher compared to Thailand.

Other franchises have already established themselves in the market; Dolat Capital believe that store growth would remain a key concern for Devyani International in Thailand.

Restaurants Development acquisition would help Devyani International to augment business revenue growth but managing profitability in the business would remain a key challenge for the company.

Emkay Global

Emkay Global maintains 'reduce' rating with a target price of Rs 165.

The further acquisition of territories, stronger recovery in the tourism space, and better margin delivery remain potential upsides

The brokerages stays conservative as of now given muted demand trends in KFC India, challenges in the pizza category, and macroeconomic issues in Nigeria.

Thailand has 1,009 KFC stores, which is more than 4 times the next QSR peer, McDonald's, having 245 stores. The category remains ahead with natural tailwinds as poultry remains the largest contributor in meat consumption.

A strong management team has resulted in a proven development engine, with the addition of 147 stores across the Northeast, Greater Bangkok, West, and South regions since FY16.

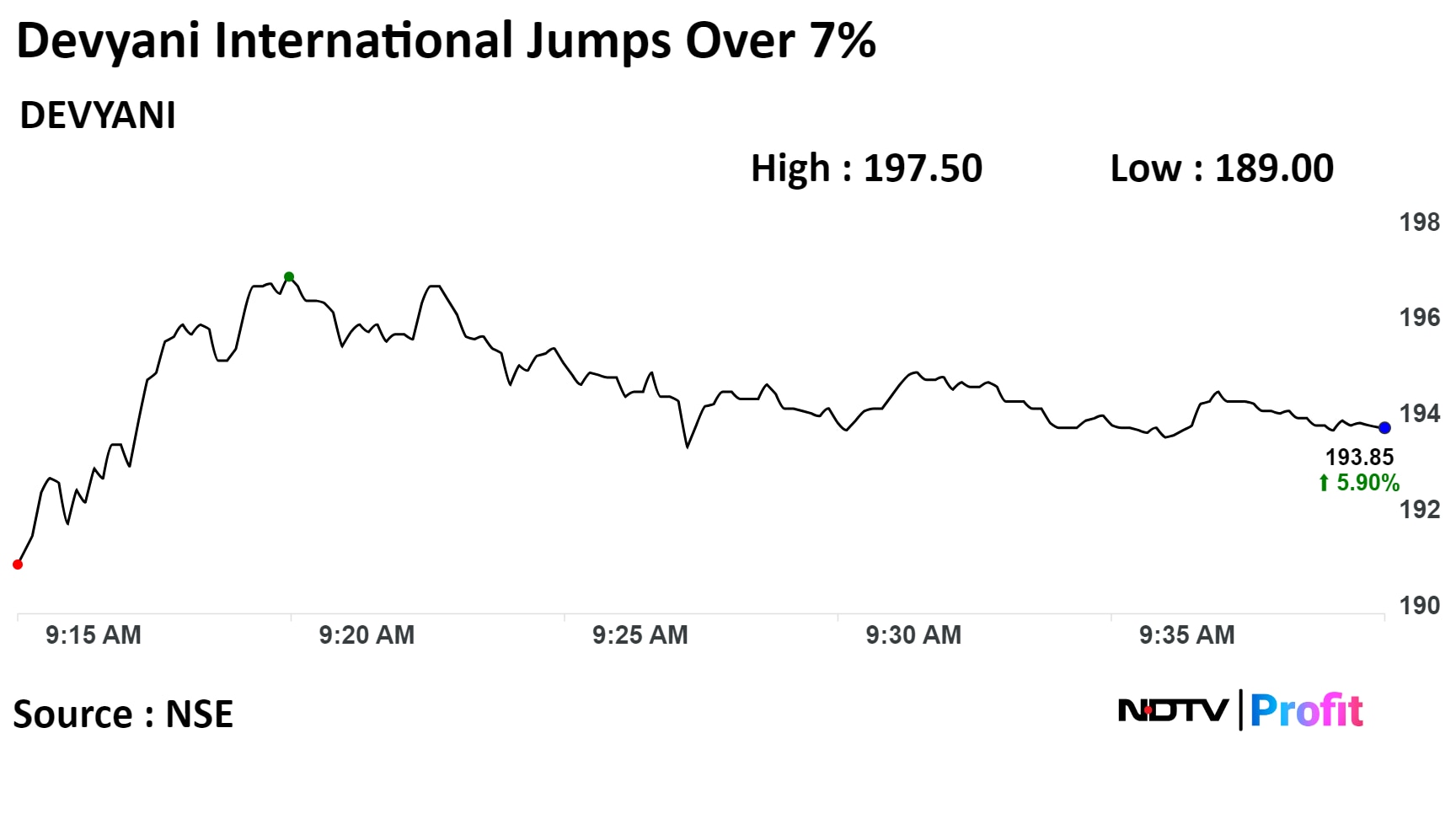

Shares of Devyani International rose as much as 7.89%. The stock was trading 6.17% higher at Rs 194.35 as of 9:39 a.m. compared to a 0.04% decline in the benchmark Nifty 50.

The stock has risen 7.5% year-to-date. The total traded volume so far in the day stood at 33 times its 30-day average.

Of the 21 analysts tracking the company, 15 maintain a 'buy', two recommend a 'hold,' and four suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies an upside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.