Shares of KEC International Ltd. hit a record high on Friday after it secured new contracts worth Rs 1,423 crore for the design, supply, and installation of 380 kV transmission lines in Saudi Arabia.

"These orders in Saudi Arabia, along with the earlier orders in the UAE and Oman, have further reinforced our leadership in the Middle East and substantially enhanced our international T&D order book," said Vimal Kejriwal, managing director and chief executive officer on Thursday.

Following these order, the company's year-to-date order intake stands at over Rs 11,300 crore, a growth of approximately 75% compared to last year, he said.

In August, the company had secured two orders worth Rs 1,171 crore in the Middle East and another order of Rs 1,079 crore.

The company has also set a high bar for its financial year, targeting an order inflow of Rs 25,000 crore. It has already secured orders close to Rs 10,000 crore in fiscal 2025 so far, Kejriwal told NDTV Profit last month.

“As far as the order pipeline is concerned this financial year, we already got orders close to Rs 10,000 crore, and we are L1 in another Rs 7,500 crore. Our stated announcement is that we should be doing Rs 25,000 crore of order intake for this year,” he told NDTV Profit.

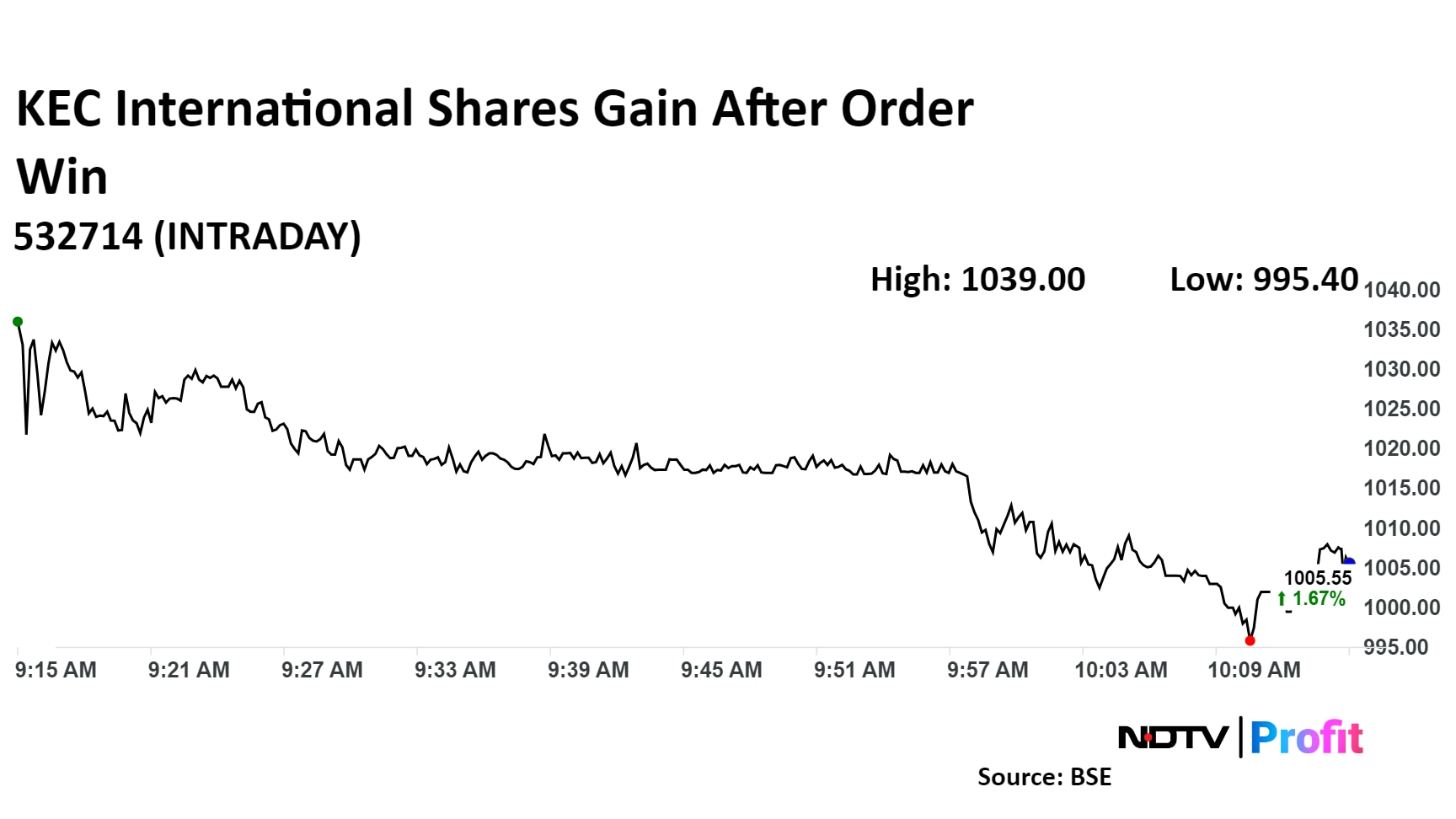

Shares of KEC International advanced 5.3% to hit record high of Rs 1,040 apiece. It was trading 1.7% higher at Rs 1,005.55 as of 10:12 a.m. The benchmark NSE Nifty 50 was trading 0.6% lower.

The stock has risen 48% in the last 12 months and 68% on a year-to-date basis. The total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 75.

Fifteen out of the 24 analysts tracking KEC International have a 'buy' rating on the stock, five recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.