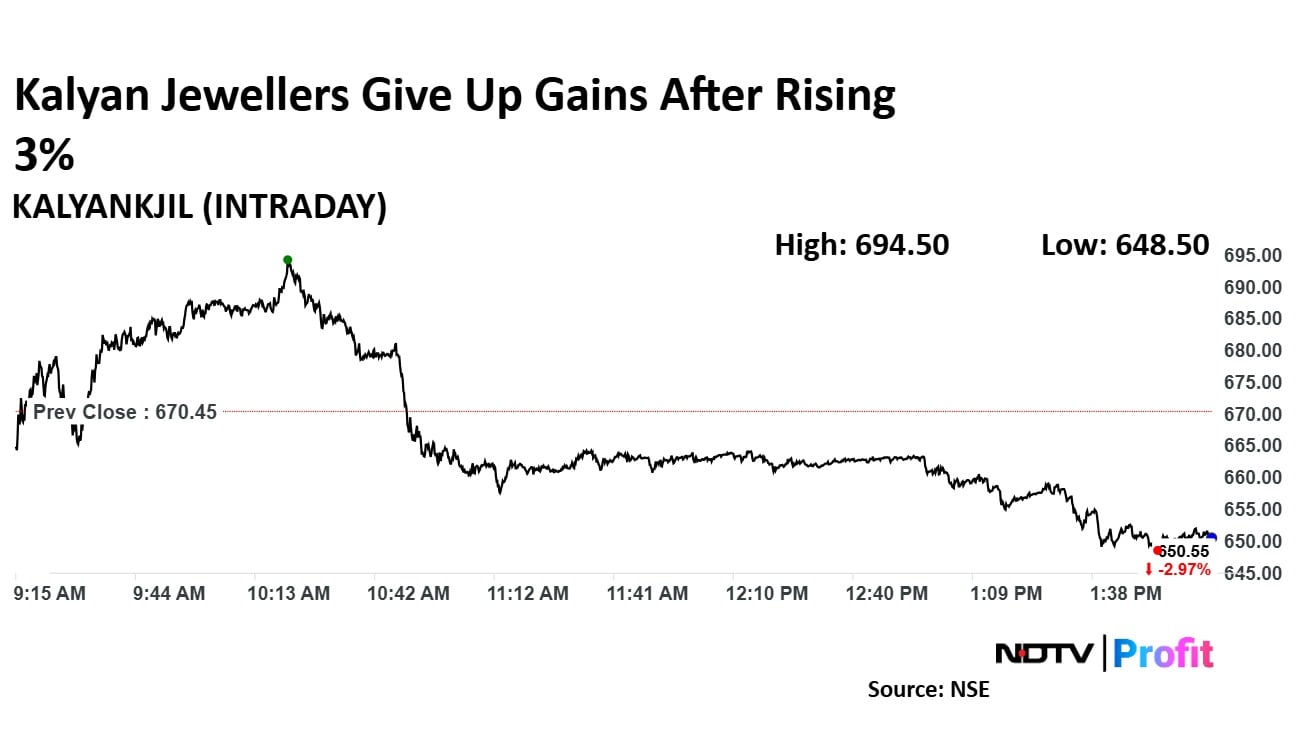

Kalyan Jewellers India Ltd.'s share price rose over 3% on Thursday before erasing gains to trade lower, after the company's second quarter results exceeded analysts' expectations in revenue and Ebitda, despite a slight dip in net profit.

The company reported a net profit of Rs 130 crore, down 3.3% from Rs 135 crore in the same period last year. However, revenue surged 37% to Rs 6,065 crore, beating market estimates of Rs 5,970 crore. Ebitda grew 4% to Rs 327 crore, while the Ebitda margin was recorded at 5.4%, above analysts' forecast of 7%.

Citi On Kalyan Jewellers

Citi maintained a 'buy' rating on Kalyan Jewellers, raising its target price to Rs 810 from Rs 770, implying a 21% upside potential. The brokerage highlighted expectations for Kalyan's Return on Capital Employed to improve to 28% by fiscal 2027, driven by expansion, deleveraging, and enhancements in franchise agreements.

Citi revised its EPS estimates for fiscal 2025 through 2027 by +2% to -6%, reflecting anticipated growth with improved margins.

The brokerage also noted several risk factors, including the potential impact of a downturn in consumer sentiment, increased competition in South India, and possible fluctuations in gold prices. Conversely, the brokerage also noted that consumer demand for Kalyan's offerings and accelerated store openings could lift growth rates above estimates.

Kalyan Jewellers anticipates a strong third quarter, with same-store sales growth aligning with the second quarter, Executive Director Ramesh Kalyanaraman told NDTV Profit. He noted that the Middle East contributes less than 15% of overall revenue, and shared plans to expand internationally, including Kalyan's first US showroom and additional physical stores.

Kalyan Jewellers Share Price Today

Kalyan Jewellers' stock rose as much as 3.59% during the day to Rs 694.50 apiece on the NSE. It was trading 2.98% lower at Rs 650.50 apiece, compared to a 0.09% decline in the benchmark Nifty 50 as of 2:07 p.m.

It has risen 97.47% in the last 12 months and 83.69% on a year-to-date basis. The relative strength index was at 40.44.

Eight analysts tracking the stock have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 17.6%.

Watch The Video Here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.