Nuvama Insitutional Equities initiated coverage on Jubilant Pharmova Ltd. with a 'buy' rating and estimated the stock price to gain over 30%. The brokerage has a target price of Rs 1,450 per share, implying a 30.40% upside from Friday's closing price.

Jubilant Pharmova is embarking on a new earning cycle with several growth factors at play, said Nuvama Insitutional Equities in a note on Monday. The brokerage expects the company's revenue and operating profit to grow at a CAGR of 11% and 24%, respectively.

Ruby–Fill ramp up, turn around in radio pharmacy and generic businesses, and commissioning of Line–Spokane, and contract research organisation growth will help Jubilant Pharma drive the estimated revenue and Ebitda growth, according to Nuvama. The brokerage sees growth visibility of $350 million beyond financial year 2027 and financial year 2030.

The real booster shot would be balance sheet improvement and is likely to raise net profit 4 times over financial year 2023–24, and 2026–27, the brokerage said in the note. Jubilant Pharmova may generate free cash flow of Rs 1,900 crore between financial year 2025 and 2027, as its improvement of profit and loss statement will help repay debt and raise its return on capital employed to 14% by fiscal 2027.

"Besides potential tailwinds in the wake of the Biosecure Act in the CRO business, product launches in generics may unlock further potential upside to revenue in our estimates," Nuvama said.

Growth Drivers

Nuvama Institutional Equities observed that the commoditised business of Jubilant Pharma have potent growth drivers such as launches, fresh capex coming on stream and industry tailwinds.

Jubilant Pharmova's Radio Pharma business is expected to benefit from Ruby-Fill ramp-up, and I-MIBG launch. While its allergy business will take advantage of ex–US market growth, the brokerage said.

As far as its contract developing and manufacturing organisation is concerned, it will grow on the back of industry normalisation and capex getting completed in fiscal 2027, the brokerage said.

Jubilant Pharmova's generic business will grow due to new launches and compliance reinstatement at Roorkee facility, according to Nuvama.

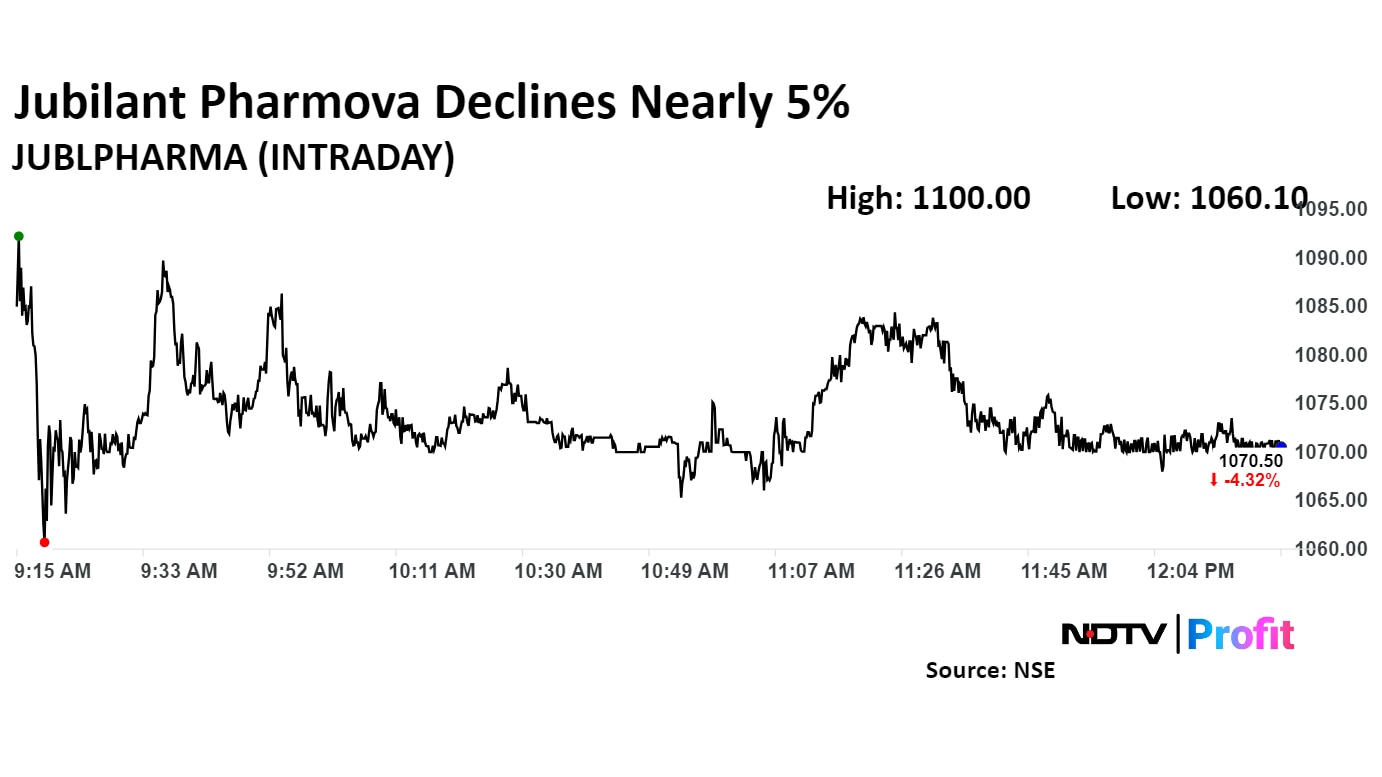

Jubilant Pharmova Share Price

Jubilant Pharmova Ltd.'s share price declined 4.66%, the lowest level since Oct. 4., before paring loss to trade 3.77% lower at Rs 1,070.05 per share as of 12:20 p.m. This compares to 0.45% decline in the NSE Nifty 50.

The stock has risen 150.60% in 12 months, and 96.32% year-to-date. Total traded volume so far in the day stood at 0.06 times its 30-day average. The relative strength index was at 47.31.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 17.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.