Jindal Steel & Power Ltd. and JSW Steel Ltd.'s share prices rose on Thursday after Nomura initiated coverage on these stocks with a 'buy' rating, citing expectations of strong domestic demand, cost-saving measures, and a cyclical recovery.

The brokerage has set a target price of Rs 1,220 apiece for JSW Steel, implying a 22% upside, while Jindal Steel's target price of Rs 1,200 apiece implies 17% upside from the previous close.

Unlike the commodity space, which has entered a downturn largely due to weakened global demand, leading to debates about whether the multiples should de-rate, metals have structural drivers, especially India steel majors, said the brokerage.

These factors include a higher return on equity versus previous downturns, continued deleveraging, increased domestic demand, which reduces exports dependency, improved incremental return on capital employed on brownfield expansion, Nomura said.

Additionally, with China's hot-rolled coil's margins treading at historical trough levels, the brokerage expects the margins to improve, and the recent monetary easing measures announced should aid demand recovery.

Capacity Expansion To Lag Demand Growth

Nomura also noted that, compared to its expectations of India's steel industry adding around 23 million tonne of crude steel capacity over fiscal years 2024-2027, the capacity addition will lag demand growth.

For JSW Steel, the brokerage said that the planned commissioning of 5-million-tonne Dolvi brownfield expansion by Sept. 27 should coincide with the improvement in global pricing and spreads.

This will also aid the company's margins, according to Nomura. "Higher Dolvi volumes, better value-added mix post-expansion, and cost-saving projects should result in higher margins post FY27F," it said.

For Jindal Steel, the acquisition of four coal mines with around 700MT of cumulative reserves will reduce dependence on the merchant market as two of the acquired mines have already started producing at 100% capacity. "We believe JSPL will be able to meet 100% of its thermal coal requirement (~15MT) on increased capacity from these captive mines once they start operating at full capacity," it said.

Cost-Saving Measures

Nomura expects China's export of hot-rolled coils prices to remain range-bound over the next three to six months, resulting in suppressed domestic prices for Indian steel producers. However, Nomura anticipates that under-pressure coking coal prices, stemming from weak steel consumption and declining raw material costs, will partially offset this.

It believes that the margins have hit trough levels and should see a recovery given the uptick in excavator sales, monetary easing measures, and China government's resolve to shore up the property sector, which should support domestic demand and HRC margins.

In terms of costs, the brokerage said that JSW Steel is better placed than integrated players as it acquires most of its iron ore from the merchant market. "Even for captive mines, the premium is calculated based on IBM (Indian Bureau of Mines) prices, which are significantly influenced by the domestic price of iron ore," it noted. "We expect iron ore prices to remain below import parity prices over the next two years, implying lower raw material costs for JSW."

However, for Jindal Steel, Nomura is concerned about the timeline of its multiple margin improvement projects underway. "The slurry pipeline and captive power plants (ACPP-II) are the biggest margin-improvement projects that JSPL has undertaken," it noted. The slurry pipeline would reduce freight cost/t, and the acquired power assets of Monnet Power (unlisted) should lead to around 20% reduction in coal requirement when fully operational, according to Nomura. "However, the company has been revising the timeline for the commissioning of these projects, raising concerns over execution and capex overruns," it said.

This, along with capex cost overruns, lower spreads, and demand disruptions, are some of the key risks to the brokerage's call.

For JSW Steel, it noted, lower spreads, further delays in Dolvi commissioning, and demand disruptions as key downside risks.

Stock Reaction

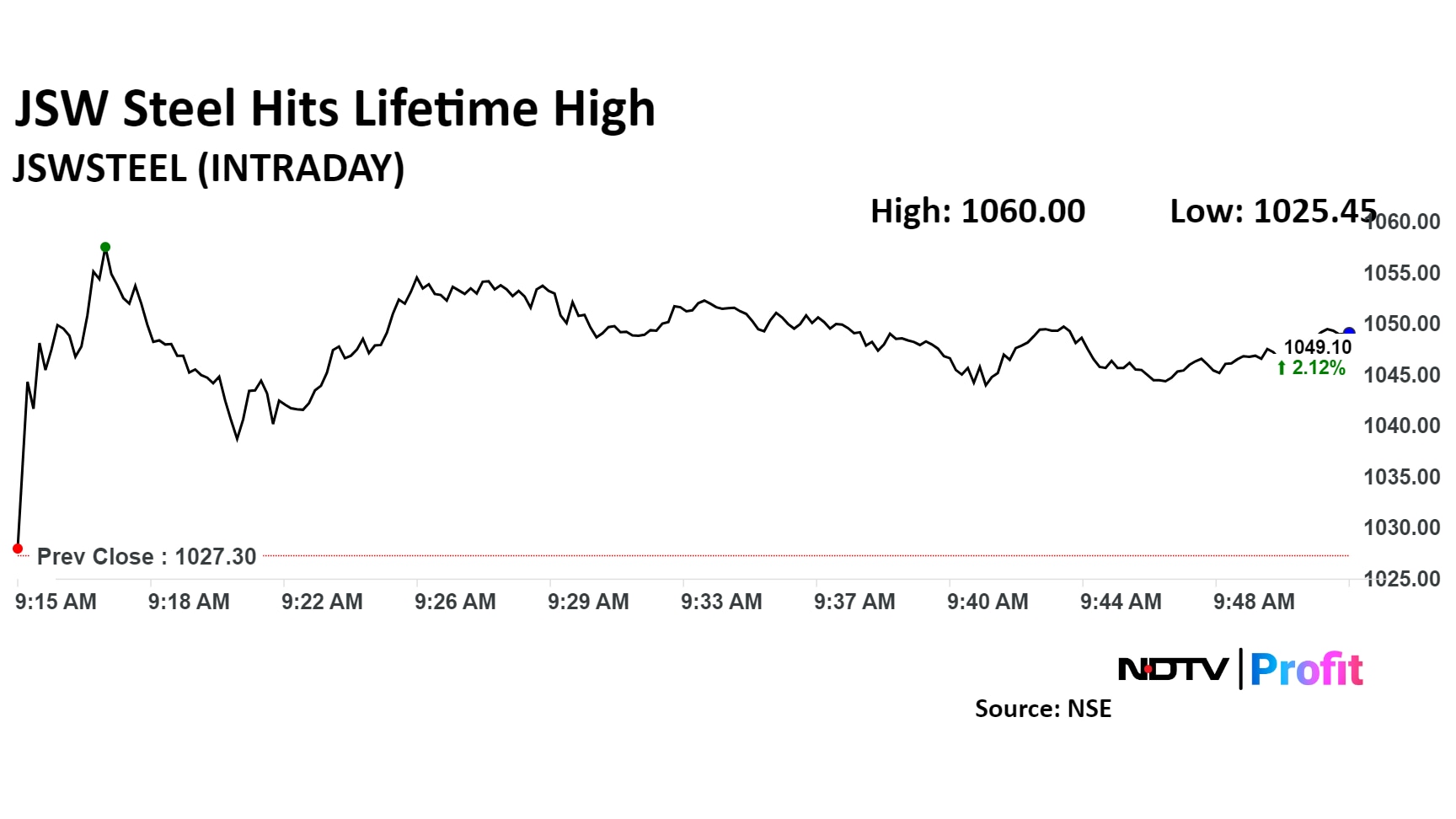

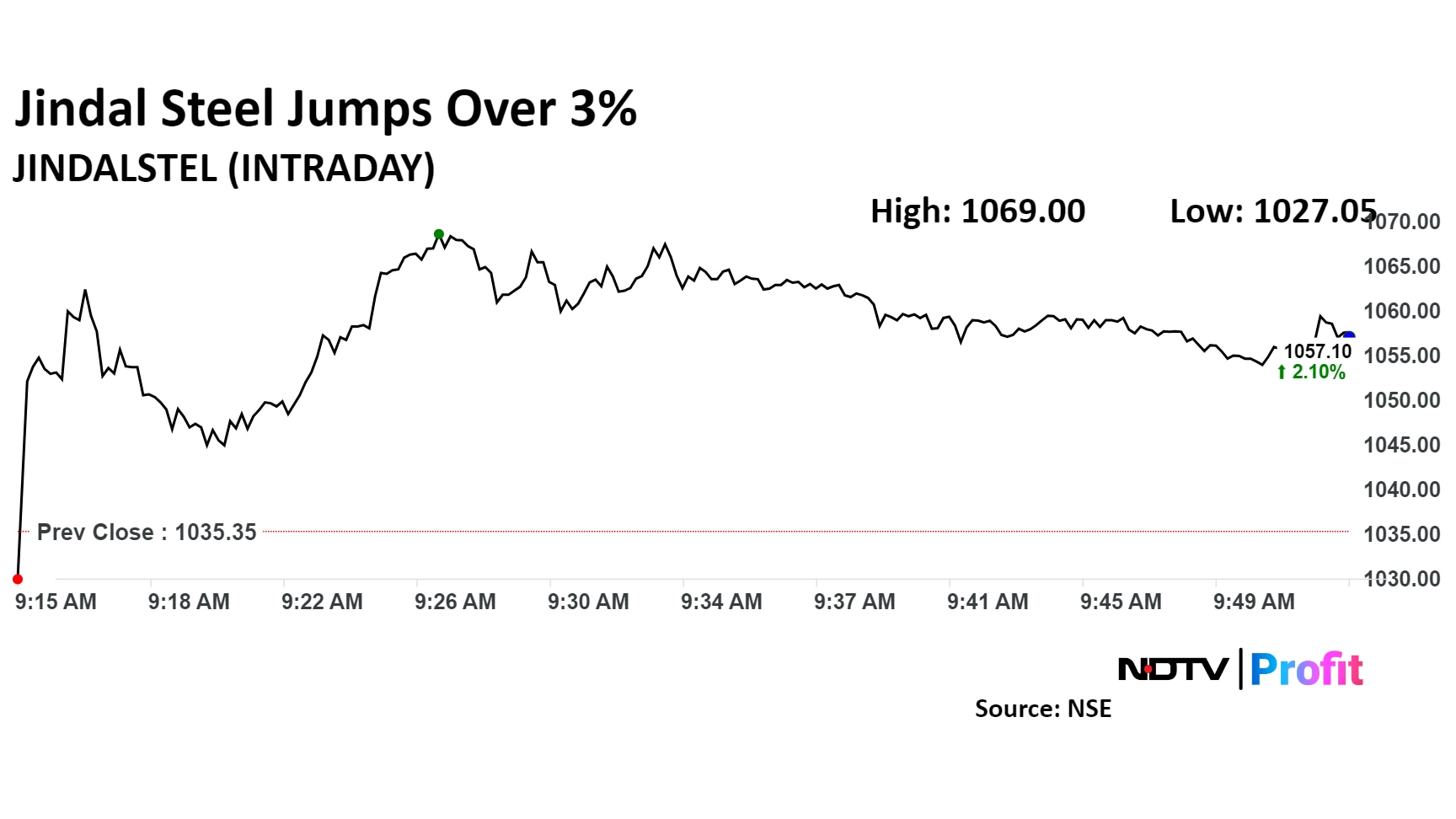

Shares of JSW Steel surged to hit their highest level and those of Jindal Steel & Power pared gains after jumping more than 3%.

JSW Steel's stock rose as much as 3.18% to Rs 1,060 apiece, the highest level. It pared gains to trade 2% higher at Rs 1,047.95 apiece as of 9:57 a.m. This compares to a 0.8% decline in the NSE Nifty 50 Index.

The stock has risen 19.3% on a year-to-date basis and 42.65% in the last 12 months. Total traded volume so far in the day stood at 0.65 times its 30-day average. The relative strength index was at 74.18, indicating that the stock may be overbought.

Out of the 32 analysts tracking the company, 17 maintain a 'buy' rating, seven recommend a 'hold,' and eight suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.8%.

Shares of Jindal Steel & Power rose as much as 3.25% to Rs 1,069 apiece, the highest level since September 17. The stock pared gains to trade 2.2% higher at Rs 1,057.5 apiece as of 10:06 a.m.

It has risen 41.2% on a year-to-date basis and 66.76% in the last 12 months. Total traded volume so far in the day stood at 0.75 times its 30-day average. The relative strength index was at 64.4.

Out of the 27 analysts tracking the company, 17 maintain a 'buy' rating, five recommend a 'hold,' and five suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.