Jefferies maintains a positive outlook on Reliance Industries Ltd. with a 'buy' rating and a price target of Rs 1,700, representing a 34% upside. Jefferies remains bullish on the stock—upside scenario showing upward potential of 46%—highlighting a balanced risk-reward profile with multiple upside triggers in 2025.

Around 1 million barrels per day of refinery closures are expected globally by 2025—the highest in three years. Combined with China's fiscal stimulus measures and tightening refining capacity additions, global oil demand growth is forecasted to outpace supply, leading to higher refinery operating rates, holds the brokerage.

Reliance Jio's Contribution

Reliance Jio continues to strengthen its leadership in the telecommunications sector. Jefferies notes that Jio's home broadband subscriber additions in financial year 2025 to date are 2.2 times higher than Bharti Airtel's, fuelled by the rollout of fixed wireless access services.

The recently announced merger with Disney India is expected to further enhance Jio's premium content offerings, positioning the company well to monetise its 5G investments—an area of investor concern.

In addition, Jefferies sees the potential for Jio's public listing in 2025 as a significant stock catalyst. A spin-off listing is favored by investors over an IPO, as it could unlock substantial value for shareholders.

Retail: Gradual Recovery Post-Festive Season

RIL's retail segment reported strong sales in October, boosted by festive demand. However, Jefferies believes sustained recovery will take another two quarters, with double-digit growth resuming by mid-fiscal 2026. Despite the current challenges, Jefferies views the market's valuation of RIL's retail arm—at $57 billion—as pessimistic and expects better performance in the medium term.

Valuation Scenarios

Base Case: Rs 1,700 Price Target (+34%)

Jefferies' base case sees RIL share price at Rs 1,700 per share, implying a 34% upside. This assumes a 23% compound annual growth rate of Ebitda in Jio over fiscals 2024 to 2027, driven by 542 million subscribers at an average revenue per user of Rs 224.

Retail is expected to deliver a 15% compound annual growth rate of Ebitda during the same period, supported by recovery in consumer demand. The Oil-to-Chemicals segment is projected to remain stable with a 1% compound annual growth rate of Ebitda, while petrochemicals see an 8% growth.

Upside Scenario: Rs 1,850 Price Target (+46%)

In an upside scenario, RIL could reach a price target of Rs 1,850 per share, offering returns up to 46%, says Jefferies. This assumes a faster-than-expected recovery in refining margins and petrochemicals profitability, driven by higher-than-anticipated demand. Telecom consolidation in India could lead to tariff hikes, improving Jio's ARPU significantly.

Jio's public listing in 2025 could lead to a re-rating of valuation multiples. Growth in retail market share and JioMart's gross merchandise value surpassing expectations would further bolster the stock's performance.

Downside Scenario: Rs 1,250 Price Target (-1%)

In a downside scenario, RIL's stock could drop to Rs 1,250 per share, a 1% downside from current levels. This scenario factors in lower-than-expected growth in Jio's ARPU or subscriber base, leading to a derating of valuation multiples to 8 times, maintains the brokerage.

Refining and petrochemical margins may underperform due to a slower pace of China's reopening. Increased cash burn in the e-commerce business and delayed free cash flow materialisation could also weigh on the stock. Additionally, the New Energy business may fail to contribute to the valuation, further limiting the upside.

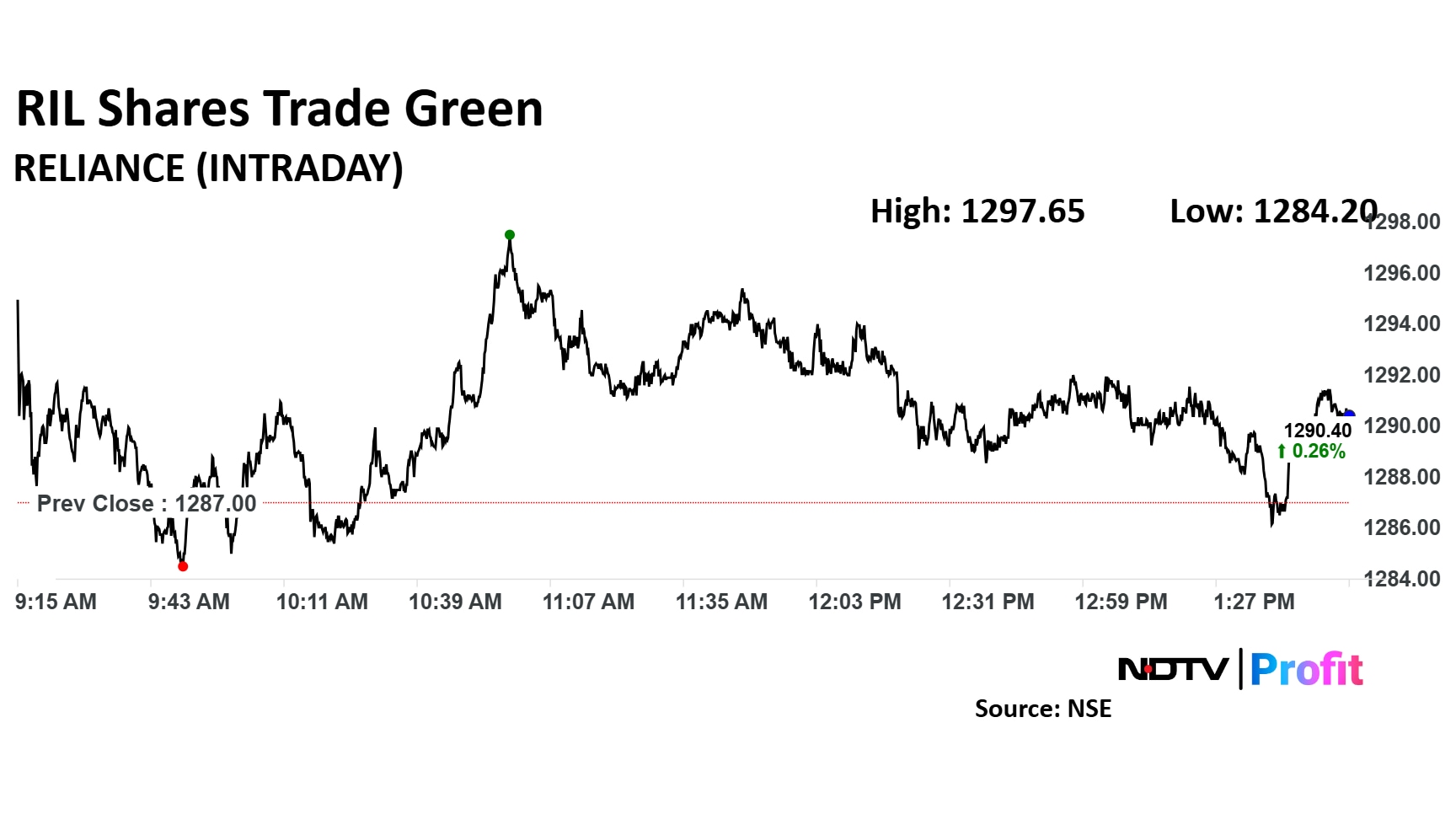

The scrip rose as much as 0.83% to Rs 1,297.65 apiece. It pared gains to trade 0.26% higher at Rs 1,290.40 apiece, as of 01:56 p.m. This compares to a 0.26% decline in the NSE Nifty 50 Index.

It has fallen 0.11% on a year-to-date basis. The relative strength index was at 45.90.

Out of 39 analysts tracking the company, 33 maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.