Indian oil marketing companies are likely to report normative marketing margins in the next financial year due to the lack of government intervention in the retail price of gasoline and diesel, according to Jefferies Financial Group Inc.

"Though margins have come off in recent times, the government has stayed away from pushing a price reduction, raising our confidence in normative marketing margins," it said in a Feb. 15 note.

Oil prices have been in the $75–85 range since November despite the geopolitical developments in Gaza and the Red Sea turmoil with the latter accounting for 10% of global crude shipments, the research firm said.

A meaningful increase in oil prices seems unlikely in 2024 unless the Organization of the Petroleum Exporting Countries and allies change its stand from voluntary to compulsory adherence to stated production cut targets, according to Jefferies.

Blue-Sky Scenario

In the past, the Union government allowed the OMCs to make integrated margins across refining and marketing within a reasonable range, Jefferies said. "Assuming a break from the past wherein OMCs are allowed to make normative marketing margins in FY25E in addition to benefiting from elevated refining profitability, we see +43%/+18%/0% upside in Bharat Petroleum Corp./Indian Oil Corp./Hindustan Petroleum Corp. respectively from CMP," it said.

The research firm upgraded Bharat Petroleum Corp. to 'buy' as it trades at steepest discount to its past peak. BPCL offers the largest margin of safety when compared to its peak cycle multiple. Its earnings are impacted less by possible marketing losses in diesel till the national elections, it said.

Jefferies has a target price of Rs 890 apiece on the stock, implying a potential upside of 36%.

Marketing Losses In Diesel To Hurt HPCL

Marketing margins on gasoline and diesel have collapsed from Rs 10 and Rs 3.5 per litre respectively in December to Rs 5.5 a litre and Rs 1.3 per litre currently. Diesel crack strength has turned spot marketing margin negative currently, it said.

Recently, the OMC management alluded to marketing loss in diesel. While this will hurt HPCL's Ebitda due to its adverse refining marketing ratio (0.54 times in FY25), BPCL and IOCL will see lower impact in FY25 with ratios of 0.7 times and 0.8 times respectively if the refining strength sustains, Jefferies said.

"Also, OMCs could be allowed to raise retail prices after the elections in May to offset the negative impact," it said.

Peak-Cycle Multiples Leave Room For Upside

The OMCs enjoyed peak multiples over 2014–17 on halving of crude price, hopes of compounded growth in marketing margins as government deregulated diesel price in 2015.

"Assuming OMC multiples go back to this past peak on Goldilocks outlook of comfortable oil price and strong profitability, we see +36%/+13%/-4% upside/(downside) to BPCL, Indian Oil Corp. and HPCL respectively from its current market price," Jefferies said.

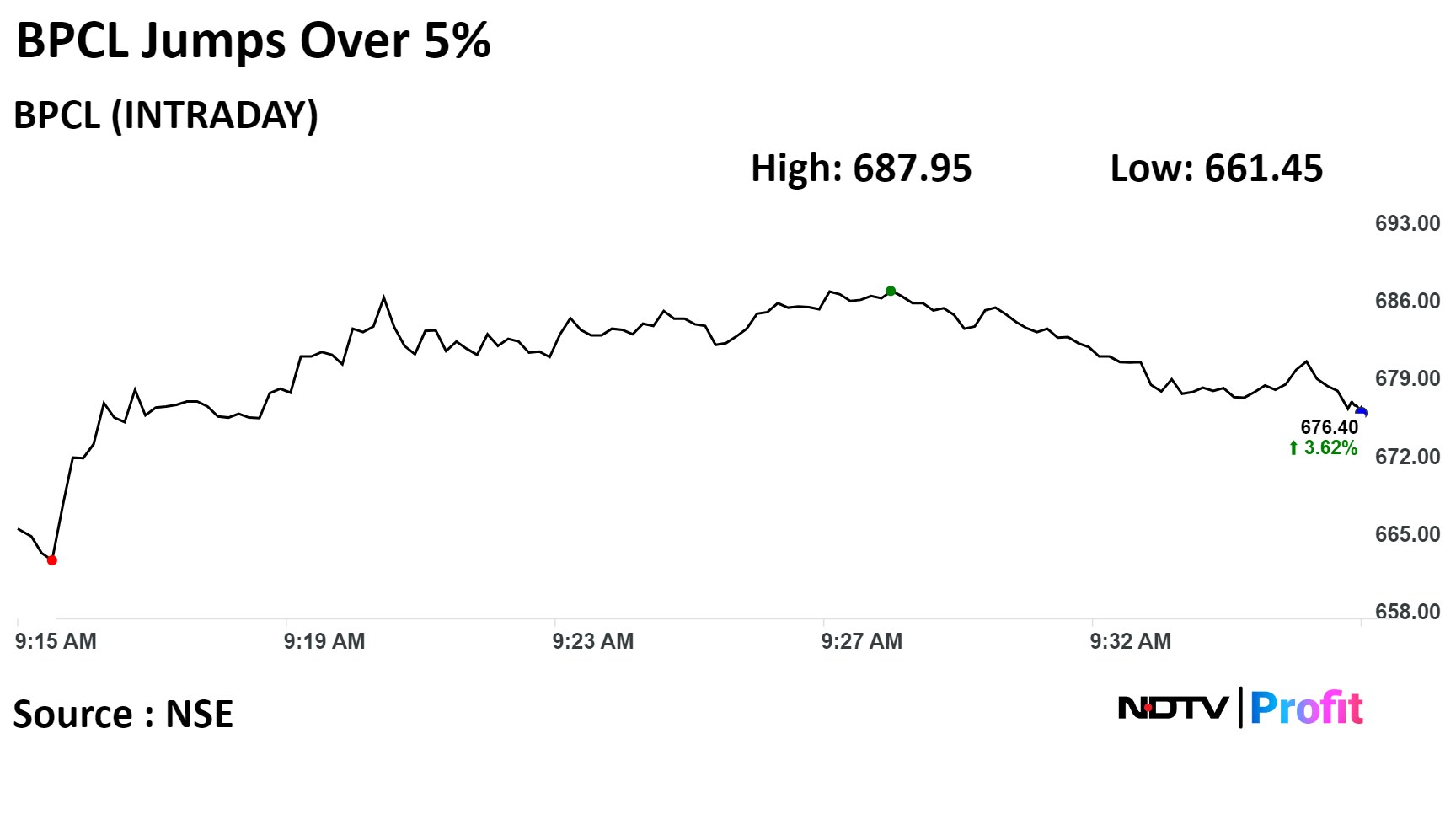

BPCL Jumps Over 5%

BPCL has commenced a pilot project to gain experience in handling hydrogen for the automobile sector. The pilot project is undertaken at an investment of approximately Rs 25 crore, it said in an exchange filing on Thursday.

Shares of BPCL rose as much as 5.39% during the day to Rs 687.95 apiece on the NSE. It was trading 3.54% higher at Rs 675.85 per share, compared to a 0.56% advance in the benchmark Nifty 50 at 10:37 a.m.

Of the 34 analysts tracking the company, 23 have a 'buy' rating on the stock, five recommend 'hold' and six suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 17.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.