(Bloomberg) -- What started as a nasty drop in Japanese stocks on Thursday turned into a full-blown rout on Friday as the Topix index posted its biggest two-day decline since the 2011 tsunami.

It's a stark turnaround from the record high set in July, when Japanese equities were being celebrated as one of the world's best-performing markets. The Topix sank 6.1% Friday, completing a two-day drop of 9.2% in the wake of Bank of Japan's earlier-than-expected rate hike Wednesday and Governor Kazuo Ueda's hawkish messaging. The Topix joined the Nikkei 225 Stock Average in entering a technical correction.

“I didn't expect stocks to fall this much — it's a disaster,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Asset Management Co. in Tokyo. “This might be temporary, but Japanese stocks are in their worst situation.”

The sharp reversal in Japanese stocks in recent weeks comes as the yen's rally to a four-month high against the dollar hammers exporters including Honda Motor Co., while higher yields drag down real estate firms such as Mitsui Fudosan Co. Just three weeks earlier, Japanese stocks climbed to fresh records, with financials welcoming the prospects of a BOJ rate hike.

Investors took profit on financials, which had been the Topix's best performers on the view that they should benefit from higher interest rates. The equity gauge that tracks the banking sector sank 11%.

“Its looks like heavy forced selling,” said Andrew Jackson, head of Japan equity strategy at Ortus Advisors Pte. “I can imagine many platform-based pod like structure firms are aggressively cutting risk causing blind selling across anything that's even mildly crowded.”

The big concern for the equity market is is the yen, which reached 148.51 against the dollar on Thursday, its highest since mid March. Strategists at Amundi and TD Securities are suggesting that the Japanese currency may advance as far as 140.

“In short, it's mostly the yen,” said Kyle Rodda, a senior market analyst at Capital.Com. “Markets are deepening bets of US rate cuts because of concerns about slowing economic activity at a time when the Bank of Japan is only starting to tighten its policy settings.”

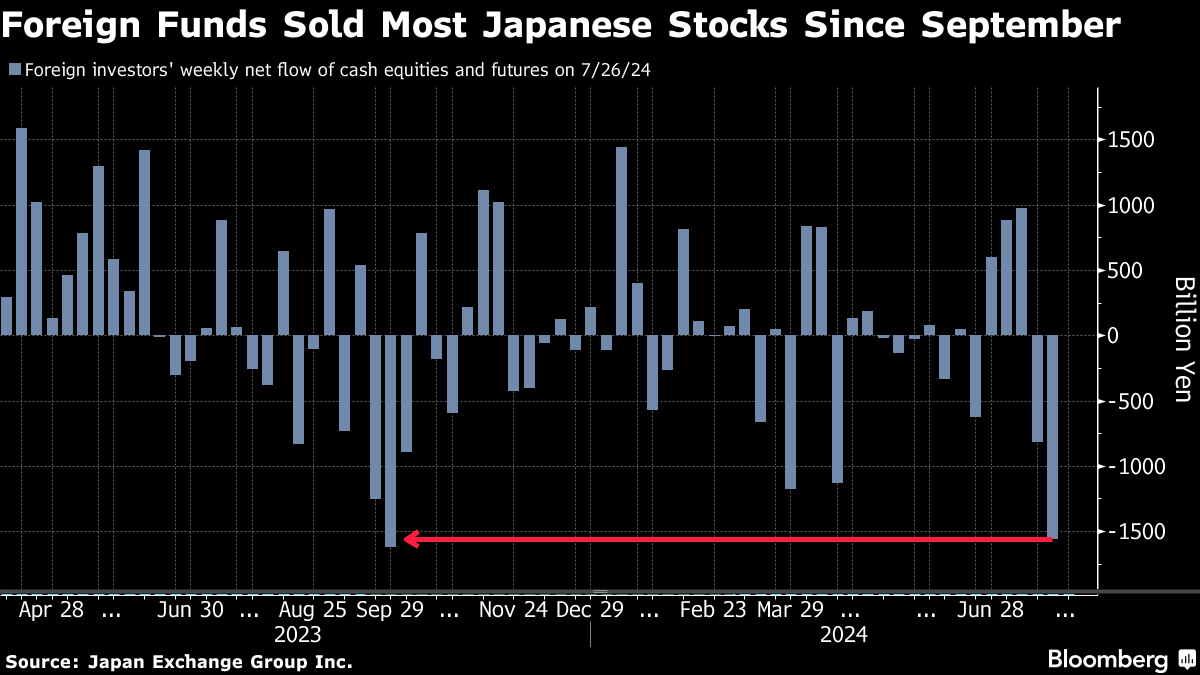

Once the main drivers of the market's ascent, foreign investors sold net ¥1.56 trillion ($10.4 billion) Japanese cash equities and futures combined in the week that ended July 26, according to data from Japan Exchange Group Inc. The Topix tumbled more than 5% during that period, the most in four years.

A rotation out of large tech shares exacerbated the slump as signs of strain in the US economy led traders to reconsider whether Jerome Powell's Federal Reserve is wise to hold off cutting interest rates before September. Data released Thursday showed US unemployment claims hit an almost one-year high while manufacturing shrank.

Tech shares were among the biggest decliners on the Nikkei, with Tokyo Electron Ltd. tumbling 12% and Screen Holdings Ltd. retreating 13%.

“Foreign investors appear to be selling as the outlook for corporate earnings is changing over concerns on the US economic slowdown and a stronger yen,” said Ryuta Otsuka, a strategist at Toyo Securities Co. “The market has clearly turned bearish in the short term, and the mid-term trend of Japanese stocks may be starting to change on concern over US and Chinese economies.”

(Updates prices, adjusts headline)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.